Institutional White Papers

6 Dec 2023

Financial PlanningInvestingWhite Paper

White Paper: How Much Risk Should You Take? A Better Approach.

When you hire a financial advisor, sign up for a 401(k) at work, or otherwise get started with a new investment plan, one of the...

Read More

21 Sep 2021

EconomicsInvestingWhite Paper

Singularity or Stagnation? Economic Growth in the 21st Century

Economic growth has been kind of weird lately. We’ve just lived through the greatest economic crash followed by the strongest recovery on record. US Real...

Read More

12 Feb 2020

EconomicsInvestingWhite Paper

The Fossil Fuel Industry Will Probably Collapse This Decade

It’s 2020! We’re officially living in the future! And if retro sci-fi stories are any guide, that means abundant, clean, cheap energy for everyone. In...

Read More

Which is Better: Renting or Buying Your Home?

In my last post, I gave my two cents on the old investing debate of whether real estate or the stock market is the better...

Read More

Which is the Better Investment: Stocks or Real Estate?

When we as financial advisors talk with investors about the virtues of diversification, asset allocation, and long-term investing, a question that often comes up is,...

Read More

25 Jul 2017

InvestingPostmodern FinanceWhite Paper

Profiting from the Recklessness of Others

A couple months ago, I wrote about the dangers of levered ETFs, showing how these products designed to juice investor’s returns end up eroding capital...

Read More

20 Jun 2017

InvestingWhite Paper

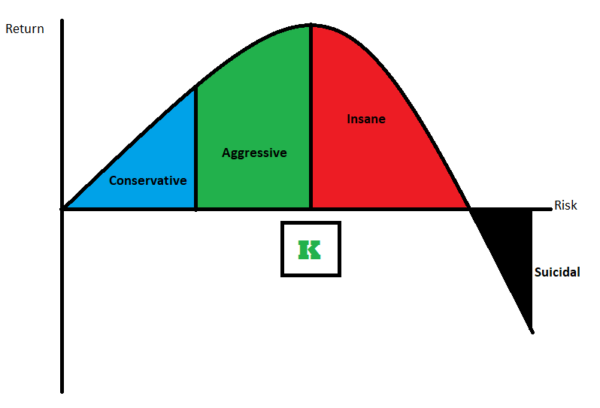

The Line Between Aggressive and Crazy

Suppose I offer you a bet. Flip a coin, heads you lose your entire bet, tails you win it back plus one and a half...

Read More

22 May 2017

InvestingPostmodern FinanceWhite Paper

“Make it a Quadruple”

This month, the financial press has been abuzz with the latest case study in Wall Street’s storied history of feeding speculative frenzies: the quadruple-levered ETF....

Read More

24 Jan 2017

InvestingWhite Paper

Culture, Investor Behavior, and the Market

Investors, being human, are not always perfectly rational, but sometimes make decisions that are influenced by their emotions or cognitive biases, which can effect market...

Read More

19 Dec 2016

InvestingPostmodern FinanceWhite Paper

Postmodern Finance Part 8: Peace, Love, Happiness, and Arbitrage

Imagine an alien race with no concept of money was observing the earth from afar, trying to understand us humans. What might they say about...

Read More

3 Oct 2016

InvestingPostmodern FinanceWhite Paper

Postmodern Finance Part 7: 21st Century Personal Finance

It’s 2016, extreme poverty is on the verge of disappearing from the earth, private companies are planning manned flights to Mars, you’re probably reading this...

Read More

9 Aug 2016

InvestingPostmodern FinanceWhite Paper

Postmodern Finance Part 6: Don’t Bet Your Life On It

In this series, I have been arguing that differences between investors – such as the differences in their willingness to use leverage, their susceptibility to...

Read More