Should I buy a house now or wait: Navigating personal needs and the market

No matter the state of the housing market, the question of “Should I buy a house now or wait” is on the mind of every homebuyer. However, as of the time of this writing, if you are looking to decide between buying a home, renting, or staying put, your decision is harder than ever.

As a financial planner and a CFP my answer to this question has evolved over the last 10 years. Through the eyes of my clients I have seen what has made them successful as I helped them answered this question for themselves. The real estate landscape is challenging. It is more important then ever to make this decision with intelligence and insight. If you have any questions after reading this please feel free to schedule a free 30 minute wealth building consultation using the link to the right.

According to data from the Federal Reserve, housing listings are at the lowest they have been in five years, with a 60% drop from pre-pandemic inventory. At the same time, the median sales price for a single-family home has increased by 25% from 2019. Renters aren’t fairing all too much better. 46% of American renters spent 30% of their income on housing. All while Americans expect that rents will increase by 10% in 2022.

With statistics like this, it is not surprising home buyers across America are stressed and frustrated. Either way, buyers likely feel like they are rushing into a purchase or waiting for the perfect moment to acquire their home.

If you are in a position to buy a home, despite difficult current housing market conditions, you need to reflect on your personal situation before trying to time the market. If you make a correct evaluation of your reasons to buy a house, the market shouldn’t really matter.

I want to share with you 4 reasons to buy a house, 4 reasons not to buy a house, and finally help you evaluate the decision based on current market conditions. If you still need help evaluating your home purchase decision, after reading this article, feel free to set up a time to chat with us.

Personal Reasons to Buy a House

Family Needs

One of the most powerful desires in life is to do well for yourself and your family. This is especially true if kids are involved. Whether you have children or planning on having them, making sure they are in a good environment is likely at the top of your priorities.

You may want to look for homes that are in a good public school system. Where you are renting, especially in a big city like San Francisco, the public education may not meet your standards. On the other hand, a private school may be far out of budget.

Childcare, such as daycares or nannies in the area, may make a big difference to you. Availability of green space for your kids to play in. Hiking trails and any other regional “amenities” may be the driving cause for you to buy a home in that area. Access to good hospitals and doctors may be crucial.

Need for Space

An extension of needs for your family is a need for space. This need can take a variety of shapes. It could be a need for a home office, need for a backyard for your new dog, space for your hobbies, need for that upcoming child, and much more.

A comparable apartment or a home for rent may not exist that provides you the luxury for space.

Desire to be in a Specific Location

It can be hard to predict how life will unfold. For most individuals where they live is dictated by their jobs or desire to be close to family. Both of these factors can change at any time.

However, if your life appears to be steady and you crave to be in a specific area for the foreseeable future, the desire to plant your roots is understandable. This doesn’t mean you stop traveling and exploring life opportunities, but it does mean you are comfortable with stability. You can see your personal and career growth developing in the area that you choose to buy your home. Several years in the same place doesn’t scare you.

Desire for a Personalized Environment

At some point of time in your life you may develop strong tastes or preferences. A preference for cooking at home may require a large kitchen with nice appliances. A desire to host gatherings will require a large common space. You may want a rainfall shower, marble countertops, hardwood floors or carpet, or some other design in the place you live that makes it feel like home.

This can be close to impossible to achieve in a rental environment. Either because it doesn’t exist or because you can’t do anything about it.

*Before you go and buy a home or a condo and redesign consider that sometimes HOA properties will have rules around what you can do. Also, keep in mind that if you eventually decide to sell your place or rent it that not everybody may have eclectic taste like you. So don’t go too crazy.

Personal Reasons Not to Buy a House

Social Pressure

Your friends, family, and colleagues may give you all the wrong reasons to buy a house. You may see your friends buying a house, your family may tell you it’s time and part of being an adult, and you may see your colleagues buying homes with proceeds of the recent IPO.

Social pressure is a huge factor, whether we like to believe it or not, and whether it is direct or indirect. This social pressure is even more difficult to manage if you can easily qualify for a mortgage and have money for a down payment. Ask yourself “why should I buy a house now?”. If outside influences add up to many of your answers, then maybe you are doing it for the wrong reasons and you should probably wait instead.

You are Worried Prices are Going to Keep Going Up

When will housing prices drop? Will they ever drop? Will they just keep going up? You may feel that you are trying to make a market evaluation. Rising prices stoke two fears. Regret and scarcity. You may feel regret that if you don’t buy now you won’t get nearly the same appreciation. You may feel that you may never be able to buy a house if prices keep going up. These are both legitimate fears.

However, they can pressure you to make a rash decision that are personally and financially irresponsible. You may find yourself paying a mortgage, property taxes, insurance, and other monthly expenses that push your budget to its limit. You may realize that this house isn’t right for you and your family. Worse yet, you realize it at the top of the market and need to eat commission for selling or you have to rent the house out at a monthly loss.

You are Tired of Your Current Apartment

Old appliances, a nasty landlord, same old view, lack of space. The list goes on and on. It is in our nature to take things for granted and find things we want to improve about our current situations. However, an expensive home, with a big mortgage, and a multiyear commitment doesn’t have to be it.

One of the benefits of renting is the flexibility. With remote work seeming to be a permanent trend for many companies, this is a great opportunity to explore different environments. Worse yet is buying a home far away only to realize you need to commute back in to the office.

Feels like you are Wasting Rent

I commonly hear that renting feels like throwing money into the wind. The bottom line is that buying a home isn’t all just appreciation and equity growth with some cheap interest on top. You should wait to buy a house if you haven’t carefully considered all the expenses that go into buying and owning a home.

Here is a non-comprehensive list: property tax, remodeling (at a poor ROI), maintenance, higher utilities, closing costs, insurance, selling early and paying commission.

Get ready to drop a lot of cash and most often at very inconvenient times. No more calling the landlord if the dishwasher floods. Your house is too cold or too hot and your electricity bill is crazy? Guess who is paying thousands for better insulation?

Market Decisions

Being Able to Break Even

Predicting housing markets busts is as challenging as timing the stock market. We may see the writing on the wall. However, it is hard to say when the “bubble” will pop.

You can significantly increase your chances of avoiding a “market timing” mistake by holding on to your property for a long period of time. You need to hold it long enough to make the variety of costs and missed stock market opportunities worth it.

A recent Wall Street Journal article highlighted different geographical markets and how long it approximately takes to break even on buying a home. We have written blogs on it as well and there are great tools such as this NY Times Calculator.

No Similar Size Properties for Rent

Sometimes what you want just doesn’t exist. Waiting to buy a house now or waiting may not be an option if you need a 4 bedroom 3 bath in the suburbs. This is as much of a personal decision as well as a market decision. You may have children that need their own rooms and you could be in need of a home office. Your personal need for a specific layout is going to be impacted by the market supply of homes or condos that meet your criteria.

If there are no new constructions planned in the area for your layout it could be your only option. It could also mean a home that will be in high demand for many years to come.

Sweat Equity

If you look at Zillow or Redfin, I am sure you can find some properties for sale. Some may even come to you as a surprise for how little they are selling for compared to everything else. These properties usually come with a catch: cost to restore or hard work.

If you think you are handy, have time, and commitment then you may be able to find properties that aren’t quite turnkey for a much better value.

Be careful and don’t overestimate your ability. It is one thing to do landscaping or new cabinets it is a whole other thing to fix foundation of a house. Finally, don’t forget about material costs.

Real Estate Crash

When will housing prices drop? After 2008, this has been the number one question on every family’s and professional real estate investors mind. The average house prices at the height of the housing bubble, Q1 of 2007, were $322,000 and at the bottom, Q1 of 2009, they were $257,000. A discount of 20%. If you look even further back in history, you will find that leading up and through the Great Depression houses lost about 50% of their value. Causes were a combination of a lot of new supply and foreclosures.

We all heard stories of someone that got lucky and bought right at the bottom. If you find yourself in the position to buy a home at that very moment you probably should.

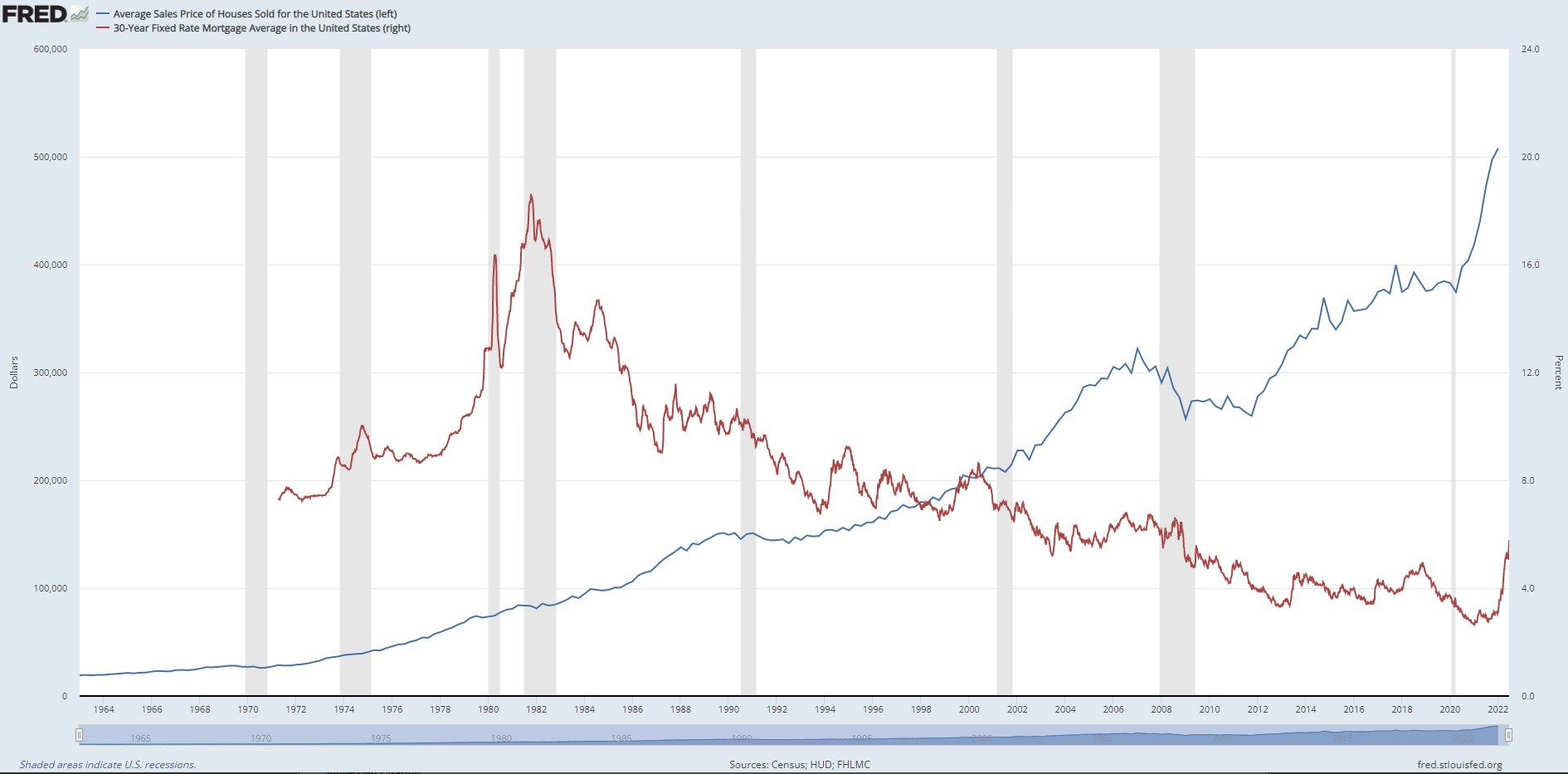

What will the next real estate market pull back look like? It is hard to tell but we can refer to history. Below is a graph showing the average sales prices of houses sold in the United States. It is overlaid with the average 30 year fixed mortgage rate.

There are three takeaways I draw from a graph like this. First, the last significant crash occurred during the Great Recession. In some recessions, designated by shaded areas, like in the 70’s, home prices still increased in value and at best leveled off. Second, even when mortgage rates soared to their 20’s, home prices continued to increase. Finally, for most of the time, home prices increased at a steady rate. Exception include, leading up to 2007 and now leading up to 2022. I will let you draw your own conclusions but it is important to be aware of potential market outcomes.

Keep in mind, that unless you are ready to sit on cash for a while, that next real estate drop is likely to coincide with a stock market drop. You must have personal conviction and be ready to put your down payment into a non productive asset.

It is tempting to predict where real estate prices may go now. Before you get sucked into making forecasts based on gut feelings you need to look inside. Ask yourself why are you trying to buy your home. Reflect on your personal needs before you start thinking about the dollars you stand to gain or to lose. Then once you have conviction that it is the right decision find ways to be financially savvy about your purchase.

If you need help making your home purchase then let us help. Set your FREE CONSULTATION and let us help you navigate this maze of decisions.

2024 Disclosures

RHS Financial is an SEC registered Investment Advisory Firm and distributes this presentation for informational purposes only. This presentation ( hitherto referred to as the presentation throughout this disclosure), blog post, infographic, slide deck or whatever form of informational modality the reader wishes to describe this as is provided for informational purposes only and should not be construed as investment advice in any way.

We believe the information, including that obtained from outside sources, to be correct, but we cannot and do not guarantee its accuracy in any way. RHS Financial uses information from outside sources to develop graphs, charts, infographics, etc. to enhance this presentation and while we believe the information from these outside sources, to be correct, we cannot and do not guarantee its accuracy in any way,

Any opinions or forecasts contained herein reflect the subjective judgments and assumptions of the authors who may be employees of but do not necessarily reflect the views of RHS Financial as a company. There can be no guarantee that developments will play out as forecasted. The information in this presentation is subject to change at any time without notice. This presentation contains “forward-looking statements" concerning activities, events or developments that RHS Financial expects or believes may occur in the future. These statements reflect assumptions and analyses made by RHS’s analysts and advisors based on their experience and perception of historical trends, current conditions, expected future developments, and other factors they believe are relevant. Because these forward-looking statements may be subject to risks and uncertainties beyond RHS Financials’ control, they are no guarantees of any future performance. Actual results or developments may differ materially, and readers are cautioned not to place undue reliance on the forward-looking statements. In a nutshell; these are our best guesses and please don’t assume they are fact.

Mentions of specific securities, investment products, investment indices, companies or industries should not be considered a recommendation or solicitation. Data and analysis does not represent the actual or expected future performance of any investment or investment product Index information is used to illustrate general asset class exposure, and not intended to represent performance of any investment product or strategy.

This post may contain references to third party copyrights, indexes, and trademarks, each of which is the property of its respective owner. Such owner is not affiliated with RHS Financial and does not sponsor, endorse or participate in the provision of any RHS’ services, or other financial products. Index information contained herein is derived from third parties and is proffered to you unaltered as we derived it from the third party.

RHS Financial, LLC is a Registered Investment Adviser. Advisory services are only offered to clients or prospective clients where RHS Financial, LLC and its representatives are properly licensed or exempt from licensure. This presentation is solely for informational purposes. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by RHS Financial, LLC unless a client service agreement is in place.

If the client is deemed suitable and agrees, RHS may employ leveraged strategies for these clients. Leverage attained through margin on a client’s account can add additional risk. While RHS tends to seek to improve return with theses strategies by applying leverage to less risky indexes, there is no guarantee that that RHS will lower risk or improve returns.

RHS Financial. 4171 24th St. Suite 101 San Francisco, CA 94114