Money Mindset: From Scarcity to Abundance

This is the second in a three-part blog series on do you have the right money mindset for financial success. As your CFP it is my job not only to help you grow your wealth in the most efficient way it’s also to help you understand why mindset around money is one of the greatest assets we have in our arsenal.

In the last post, we discussed why it was important to develop a positive financial mindset. In this post, we will look at how we as humans in society tend to develop a scarcity mindset that tends to limit our ability to grow the kind of wealth we know we deserve. I will outline where the scarcity mindset comes from, how to identify it, and offer some quick hacks to help you get past the scarcity mindset. Furthermore, I will outline how a scarcity mindset can affect your wealth and present a framework for financial success that I developed several years ago to help you identify where you are and how to move upwards in a positive manner.

Scarcity Money Mindset: It is Real

What is the scarcity mindset? Years ago, Stephen Covey author of the 7 Habits of Highly Effective People coined the term the scarcity mentality. He postulated that people with a scarcity mentality view the world as a finite pie. If someone takes from that pie, there is less for everyone else. This scarcity mentality is thoroughly conditioned in us as humans, especially in the corporate world; making promotions, raises, and advancement a rare thing. Similarly, with building wealth, most people think of money as a rare commodity and hard to get. It is a scarce resource in their minds and therefore all thoughts towards getting more money tend to be difficult ones. A quick word of advice, do not let your small bank or brokerage account put limits on your thinking about your ultimate wealth. In other words, instead of having a scarcity mindset that is limiting, you need to develop a money mindset of abundance that is limitless. It is far more likely that you will achieve your financial goals if you develop a positive money mindset because you look at the world as an ever-expanding pie rather than a finite pie.

Abundance Money Mindset: Also, Real But Much Rarer

Stephen Covey also coined the term Abundance Mentality. A person with an Abundance Mentality believes that there is plenty out there for everybody. Have you ever met or worked with someone with an abundance mentality? If you have, you will know that they are some of the most memorable people ever and a joy to work with. They are nice, supportive, they share information gladly and genuinely want to help because they know it helps them in turn. These people are few and far between, but they are always memorable. They view the world as full of opportunity, tend not to get frustrated when they do not get the job they want today or promoted right away because they know there are more opportunities out there. They do not feel rushed because they know if they miss an opportunity today, there will always be other opportunities tomorrow.

Where Does the Scarcity Mindset Come From and Some of its Negative Effects?

In my last post, we discussed Stanford Psychologist Carol Dweck’s research into a fixed mindset and how fixed mindsets can limit one’s ability to grow wealth. A scarcity mindset is an attitude which limits creativity and confines people to thinking small about their personal finances. This fixed scarcity mindset will make you believe that you do not have enough, you will never have enough and there is very little you can do about it. Over the course of time, this fixed mindset builds fear and low self-esteem and prevents people with this problem from learning and trying new things. Even worse, it can lead to jealousy and even resentment towards others who are successful in life. This forces people with this mindset to draw comparisons with others including friends and family. If one ends up in competition with these other people, they may very well end up having nothing that they want and everything the others wanted. The result is a hollow outcome and serves no one.

How Can I Identify if I Have a Scarcity Mindset?

There are a precious few of us who truly have an abundance mindset, so in all likelihood, you have at least some form of a scarcity mindset. The National Science Foundation states that the average human has between 12-60,000 thoughts a day of which, 80% are negative. With your mind working in such a negative way, it is hard to not have a scarcity mindset that is fixed and limits growth. Ask yourself the following questions to see if you have a scarcity mindset and remember, in order to grow, you need to be honest with yourself:

- Do I take financial or personal risks when I really want something?

- Do I give up when I do not get something I want and then lie to myself that I didn’t really want it in the first place?

- Do I feel there is never enough success to go around?

- Do I hoard information or feel reluctant to contribute because by giving, I may lose something?

- Do I compare my success to others and find myself lacking?

Abundance Mindset Hacks You Can Start Using Today

In all likelihood, you exhibit some degree of scarcity mindset. The good news is with only a little more effort you can overcome the attitudes that may be holding you back.

- Stop being envious of other’s success, rather, be curious as to how they got to be successful.

- Stop thinking that only you have issues that you can understand. Many people have had similar issues and have overcome them.

- When things do not go your way, flip the experience on its head and learn from it. For example, if you did not get the job, tell yourself it was not a great fit and start searching for a better one.

- Stop rushing, focus on what you want and develop a plan to get there.

- Finally, set goals, big goals, ones that if achieved, the outcome will change your life so much that they are worth sacrificing for.

Other Quick Hacks to Make You Think with More Abundance Immediately:

- Lower your consumption of media.

- Focus on what matters to you, stop worrying about competing with others (mentally declutter)

- Share information and ask others to share with you

- Discover gratitude daily, be thankful for what you have, and don’t worry about what you do not have (yet)

- Try to create win-win situations more often in business and life.

In What Ways Can a Scarcity Mindset Affect the Growth of Wealth?

Now let’s turn to how a money mindset of scarcity can limit your ability to build the kind of wealth you know you deserve. From a wealth-building perspective, a scarcity mindset can have a dramatic negative effect.

- If you are living paycheck to paycheck, it can make it seem impossible to save anything at all.

- It can cause people to take on debt in order to avoid missing out on something they want today.

- It can make people be unwilling to share in rewards and in a team setting, this can be devastating to one’s ability to be promoted.

- They can become jealous of what others have and covet the wrong things which is the exact opposite of building wealth.

- It tends to make people create small goals that are uninspiring, and we all know uninspiring goals are seldom achieved because there is no challenge that inspires drive.

How Can a Money Mindset of Abundance Help Me Grow My Wealth?

- Look for positives in failure. When you fail, learn from it.

- Creating win-win scenarios will get more people on board with your plans and ideas.

- When you focus on what you have and what you want, you will not waste time or money chasing after things you don’t want or need.

- You will create goals worthy of your time and effort that will change your life in a positive way.

- It reduces the fear of missing out because you realize there are always other opportunities out there for you.

Introducing the Framework for Financial Success®

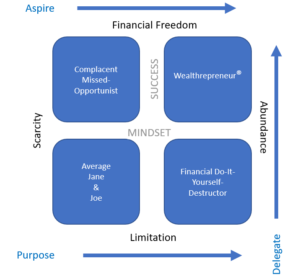

Several years ago, I worked out the Framework for Financial Success. It is a simple visual guide that outlines the Scarcity vs. Abundance mindset in relation to building wealth. I will briefly introduce the model here in this post and in my next post, I will walk through the model in more detail.

In the middle of the quadrant chart, on the X-axis, we see Mindset is displayed and on the y Axis, we see Success is displayed. On the left side of the grid we see Scarcity and on the right, we see Abundance. At the bottom of the chart, we see Limitation and at the top of the chart, we find Financial Freedom.

There are four distinct boxes in this quadrant chart. The objective of this chart is to become a Wealthrepreneur which is in the Northeast quadrant. A Wealthrepreneur has a money mindset of abundance and has achieved financial freedom if you read this chart as intended. Many people stay in the Northwest quadrant their entire lives as Complacent Missed Opportunists frustrated that they knew they were not building the kind of wealth they know they deserve.

The good news is moving from the Complacent Missed Opportunist to the Wealthrepreneur does not require much more effort on one’s part but more of a mindset shift. In my next blog post, I will go through this model in more detail and show you how it can be a framework for your financial success as well.

2024 Disclosures

RHS Financial is an SEC registered Investment Advisory Firm and distributes this presentation for informational purposes only. This presentation ( hitherto referred to as the presentation throughout this disclosure), blog post, infographic, slide deck or whatever form of informational modality the reader wishes to describe this as is provided for informational purposes only and should not be construed as investment advice in any way.

We believe the information, including that obtained from outside sources, to be correct, but we cannot and do not guarantee its accuracy in any way. RHS Financial uses information from outside sources to develop graphs, charts, infographics, etc. to enhance this presentation and while we believe the information from these outside sources, to be correct, we cannot and do not guarantee its accuracy in any way,

Any opinions or forecasts contained herein reflect the subjective judgments and assumptions of the authors who may be employees of but do not necessarily reflect the views of RHS Financial as a company. There can be no guarantee that developments will play out as forecasted. The information in this presentation is subject to change at any time without notice. This presentation contains “forward-looking statements" concerning activities, events or developments that RHS Financial expects or believes may occur in the future. These statements reflect assumptions and analyses made by RHS’s analysts and advisors based on their experience and perception of historical trends, current conditions, expected future developments, and other factors they believe are relevant. Because these forward-looking statements may be subject to risks and uncertainties beyond RHS Financials’ control, they are no guarantees of any future performance. Actual results or developments may differ materially, and readers are cautioned not to place undue reliance on the forward-looking statements. In a nutshell; these are our best guesses and please don’t assume they are fact.

Mentions of specific securities, investment products, investment indices, companies or industries should not be considered a recommendation or solicitation. Data and analysis does not represent the actual or expected future performance of any investment or investment product Index information is used to illustrate general asset class exposure, and not intended to represent performance of any investment product or strategy.

This post may contain references to third party copyrights, indexes, and trademarks, each of which is the property of its respective owner. Such owner is not affiliated with RHS Financial and does not sponsor, endorse or participate in the provision of any RHS’ services, or other financial products. Index information contained herein is derived from third parties and is proffered to you unaltered as we derived it from the third party.

RHS Financial, LLC is a Registered Investment Adviser. Advisory services are only offered to clients or prospective clients where RHS Financial, LLC and its representatives are properly licensed or exempt from licensure. This presentation is solely for informational purposes. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by RHS Financial, LLC unless a client service agreement is in place.

If the client is deemed suitable and agrees, RHS may employ leveraged strategies for these clients. Leverage attained through margin on a client’s account can add additional risk. While RHS tends to seek to improve return with theses strategies by applying leverage to less risky indexes, there is no guarantee that that RHS will lower risk or improve returns.

RHS Financial. 4171 24th St. Suite 101 San Francisco, CA 94114