State Street recently published a survey of the return expectations and strategies being used by institutional investors around the world (h/t Flirting with Models). The respondents were a sample of over 400 money managers representing pension funds, insurance companies, foundations, endowments, and other major pools of institutional wealth. Though the survey doesn’t say directly how much money the respondents represented in total, 63% of them reported having $5 billion or more in assets under management, so we can infer that at the very minimum the survey speaks on behalf of $1.3 trillion of Other People’s Money, with the true figure probably being five or ten times that amount. Which is disconcerting, because the answers given convey a profoundly naive understanding of investing principles.

Don’t Hold Your Breath

Right off the bat, the most striking thing about the survey is the extremely optimistic return assumptions of the respondents.

Yikes! The investors polled said that they expect stocks to deliver 10% returns over the long run and 5.5% returns from bonds. While these figures are right in line with the historical returns on these assets, it’s extremely unlikely that they will do so well going forward. Why not? Because both stocks and bonds today are much more expensive today than they have been historically and offer much more meager cash flows. Let’s look at bonds first:

As is well known by now, interest rates have been falling for 30+ years. The chart below depicts the yield on 10 year Treasury bonds since 1980. Beginning the period at double-digit rates, long term government bonds now pay less than 2% interest.

Bonds not only payed more in the past, but the recent era of falling yields brought windfall profits, as falling yields equals rising prices. Much of the returns on a bond portfolio over the last few decades has been the result of this price appreciation, something that can’t possibly continue unless bond yields are to continue to fall to negative 10 percent!

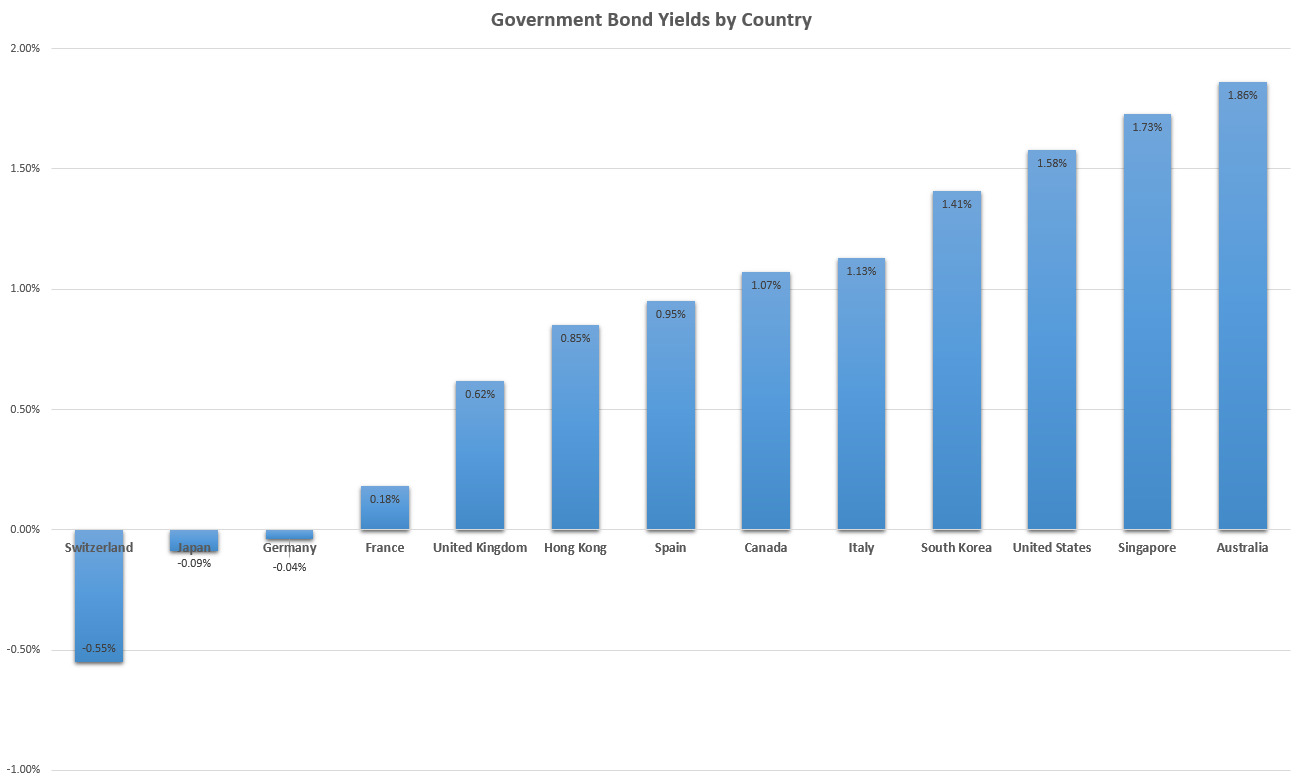

And US treasuries are among the few government bonds still paying something. Take a look at the yields on bonds elsewhere around the world:

Source: Bloomberg

Nowhere in the developed world can you buy a 10-year government bond paying more than two percent, and in some countries they’re now negative! Now, you can, of course, choose to take more risk and hope to get more return. Nearly insolvent Brazil, for example, is currently paying over 11% interest on its sovereign debt. Or you can look for junk-rated corporate bonds of companies in financial distress and find some high single-digit deals (that is, if they pay you back), but you should hope that a large pension fund isn’t doing that with the majority of their “bond” allocation. Such high-yielding bonds are, of course, extremely risky, and act more like stocks. Speaking of which…

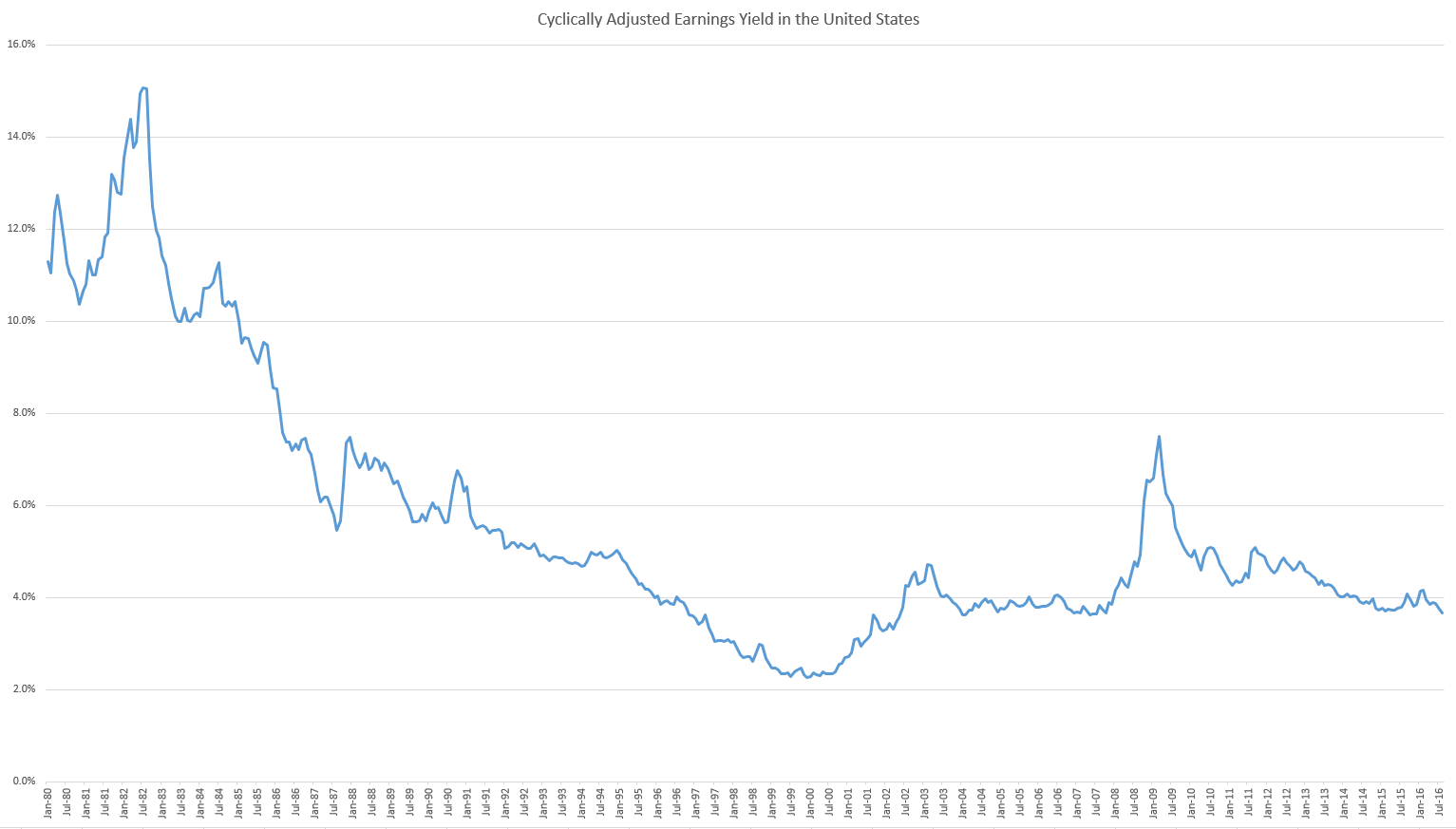

Equities, at least in the US, have also become more expensive over this same period. Though stock market returns are more erratic and harder to predict than for bonds, earnings yields provide reasonable approximations of what to expect on average over a period of a decade or so. Below I show the evolution of the cyclically-adjusted earnings yield (the inverse of the Shiller P/E) in the US since 1980.

Source: Robert Shiller

In the early 80s you could buy a dollar of stock and get 10 cents or more of earnings, making 10% real returns possible. Plus, as was the case with bonds, prices were bid up over the next two decades, culminating in the dot-com bubble, in which the earnings yield on stocks reached its lowest point in American history. What followed was a “lost decade” in which US stocks made no money for over ten years. Today, one dollar invested in the S&P 500 buys you less than 4 cents of earnings, meaning real returns over the next decade will likely be in the neighborhood of 4%. Add in an expected inflation rate of 2% for a nominal 6% return, well shy of the 10% expected by our survey participants.

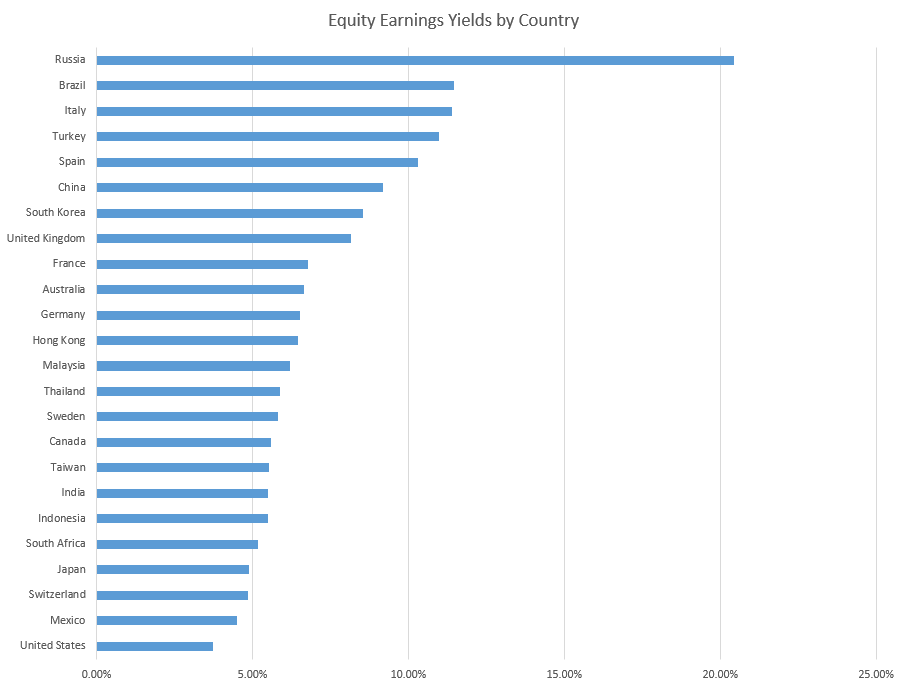

In equities, in contrast to bonds, the US is actually the most expensive market currently, and there are some deals to be had if you wish to venture overseas. Below I plot the earnings yields of several international stock markets:

Source: Research Affiliates

Still, looking at earnings yields, only the post-Brexit UK, perennially beleaguered Spain, and a handful of emerging market countries offer prospective returns north of the 8% real/10% nominal target our institutional investors have set for themselves.

Get Smart

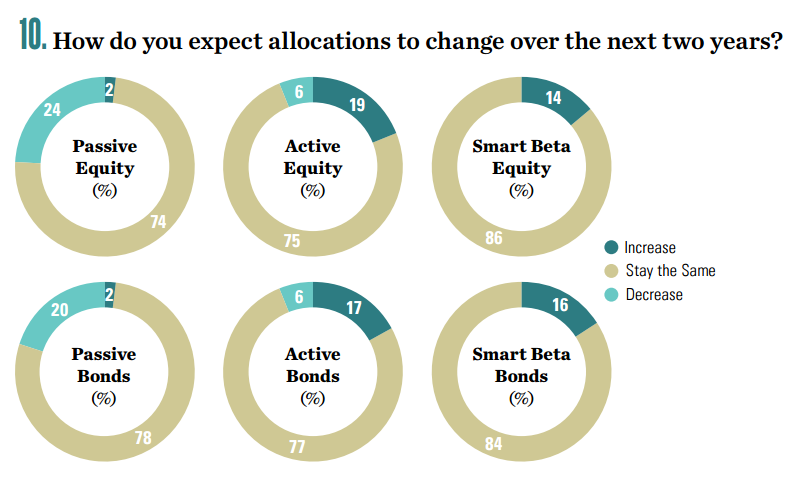

On top of these unrealistic expectations for stock and bond returns, the survey participants indicated they expect their portfolios to deliver a whopping 10.9% annualized return, presumably reflecting their conviction that they can select securities that outperform the overall stock or bond markets they belong to. On this front, I was surprised to see that these institutional investors are actually in the midst of increasing their allocation to active management. Unlike individual investors, who have been flocking to index funds in recent years, institutional investors seem to be steering in the opposite direction, and are in fact decreasing their passive/index exposure.

This move away from indexing includes new allocations to so-called “Smart Beta” strategies. Smart Beta, in case you haven’t heard, is a marketing term invented by the money management industry in recent years to refer to rules-based investment products that pick securities based on qualities, such as value or momentum, which have historically been predictive of performance. I have written about smart beta strategies (without using that rather obnoxious label) here, here, and here.

This raises a bit of a conundrum for evidence-based investors. The outperformance of smart beta strategies is predicated on taking advantage of the mistakes of other investors. Value investing, for example, seeks to buy cheap stocks that other investors are unreasonably pessimistic about. So what happens when every investor is trying to buy what everyone else doesn’t like? As I wrote about in a previous post, the increasing allocation of investment to index funds is likely to make the market more efficient, as it disproportionately removes investors who are prone to make mistakes and distort prices, making it more difficult for active investors to beat the market. If the remaining active managers are now increasingly allocating to strategies specifically engineered to correct the mistakes of more naive investors, what chances does one have of beating the market using strategies that worked in the past?

Fortunately (or unfortunately, depending on your perspective), this concern is likely to remain hypothetical, as the survey respondents quickly make it clear they think of smart beta more as a fashion trend than a scientific framework.

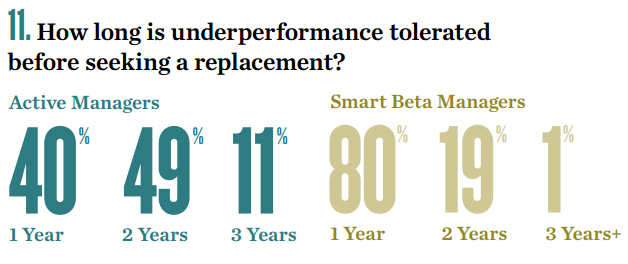

Sigh… 80% of respondents said they would drop their smart beta strategy if it underperformed for one year, and fully 99% would give up within 2 years. No doubt this is coming from people who would call themselves “long term investors.” This is almost too depressing to react to, so I’ll let Warren Buffett speak for me:

The stock market is a device for transferring money from the impatient to the patient.

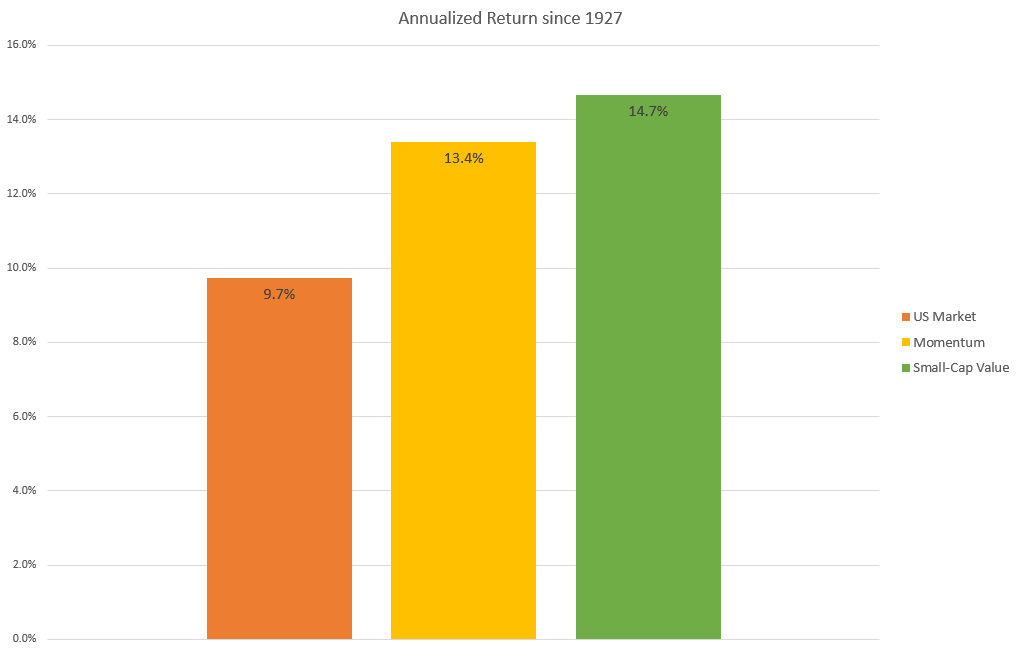

As a refresher, since 1927 momentum stocks and small-cap value stocks have outperformed the broad US stock market by 3.7% and 5% per year, respectively.

Source: Ken French’s Data Library

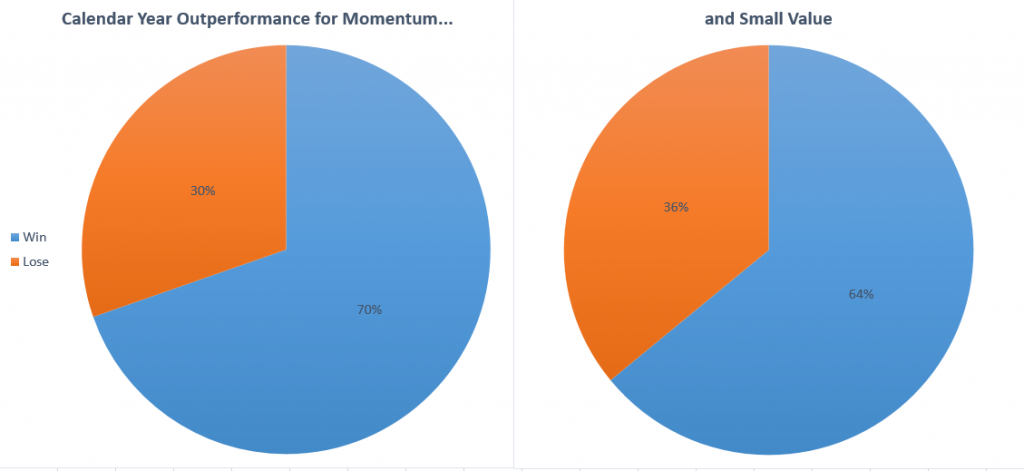

But the number of years these strategies have outperformed the market is only about two out of three.

Source: Ken French’s Data Library

Anything that “works” in finance only works slightly more often than it fails. Smart beta strategies like value and momentum, like the market itself, can lose money for many years on end before succeeding. These institutional investors who plan to give up on any strategy that doesn’t keep up for a year or two are likely to consistently buy high, sell low, and underperform as a result. Indeed, research has shown that institutional investors tend to do more harm than good when they switch investment strategies. According to the State Street survey, it seems they have not yet learned their lesson.

So, to sum up, if you buy life insurance or an annuity, receive or will receive pension benefits from your employer, or live in a country with a sovereign wealth fund, that money being held in trust for you is most likely being managed by people who:

- Have economically unreasonable expectations of the returns their investments will earn;

- Have publicly stated they will give up and change course if their expectations are not quickly met; and

- Have been shown to make things worse every time they change anything.

I say good luck with that!

Disclosures: This post is solely for informational purposes. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by RHS Financial, LLC unless a client service agreement is in place. Please contact us at your earliest convenience with any questions regarding the content of this post. For actual results that are compared to an index, all material facts relevant to the comparison are disclosed herein and reflect the deduction of advisory fees, brokerage and other commissions and any other expenses paid by RHS Financial, LLC’s clients. An index is a hypothetical portfolio of securities representing a particular market or a segment of it used as indicator of the change in the securities market. Indexes are unmanaged, do not incur fees and expenses and cannot be invested in directly.