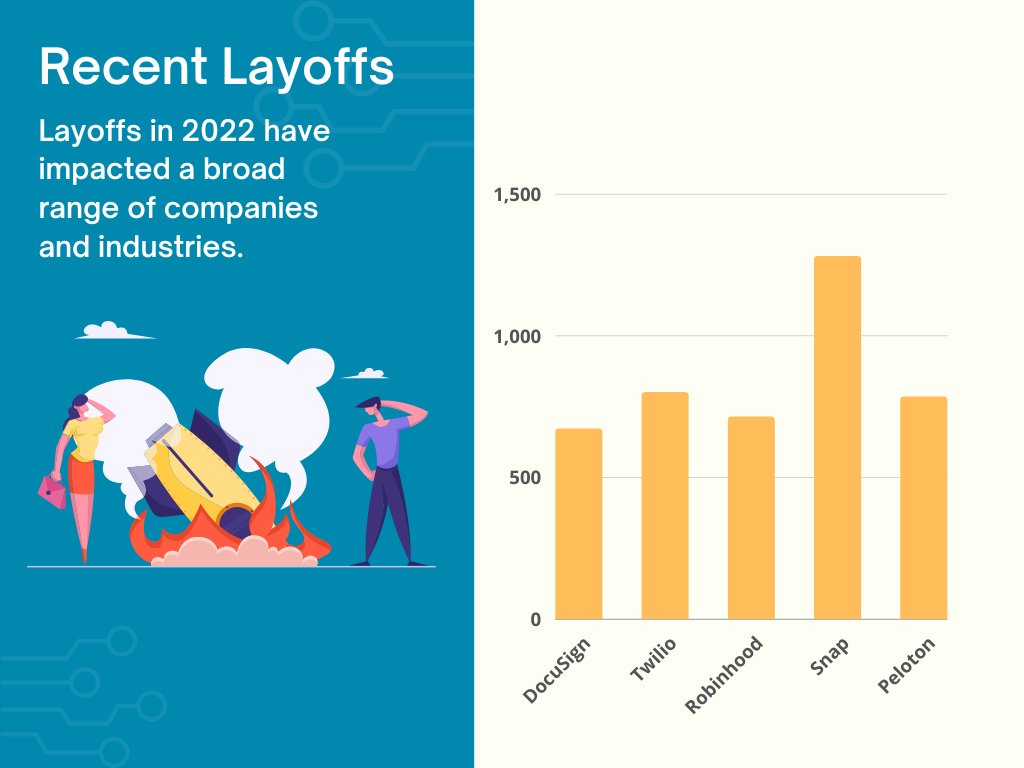

As of January 10th, more than 172,000 tech employees in the U.S. have been laid off, according to Layoffs.fyi. The tech industry has experienced broad damage this year. From Twilio, to Netflix, to Patreon, to San Francisco, Silicon Valley, and the greater Bay Area, no one is immune.

Have you been recently laid off from work or are concerned about potentially being laid off? Well, I am here to help you learn exactly what to do when you’ve been laid off. There is opportunity in this challenging time and ways of surviving layoffs that can keep your finances intact.

Many of our Silicon Valley clients provide us with a unique perspective on this experience. Whether they leave voluntarily or not, my job is to help them evaluate several important areas.

- What to do with their equity compensation?

- Which options make the most sense for their 401k?

- How to make the most of their severance?

- What to do about health insurance?

- How to navigate taxes and potential tax opportunities?

As a CFP, it is important to look through the lens of personal finances, the economic environment, and taxes. If you are going through this experience we are here to HELP.

What to do with your equity compensation when you’ve been laid off?

Equity compensation has been at the core of the massive wealth generation in Silicon Valley. If you are being laid off from work it is critical you understand what you can and need to do. You need to be familiar with the stock grant agreement and what type of equity you have.

1. Stock Grant Agreement and Clawbacks

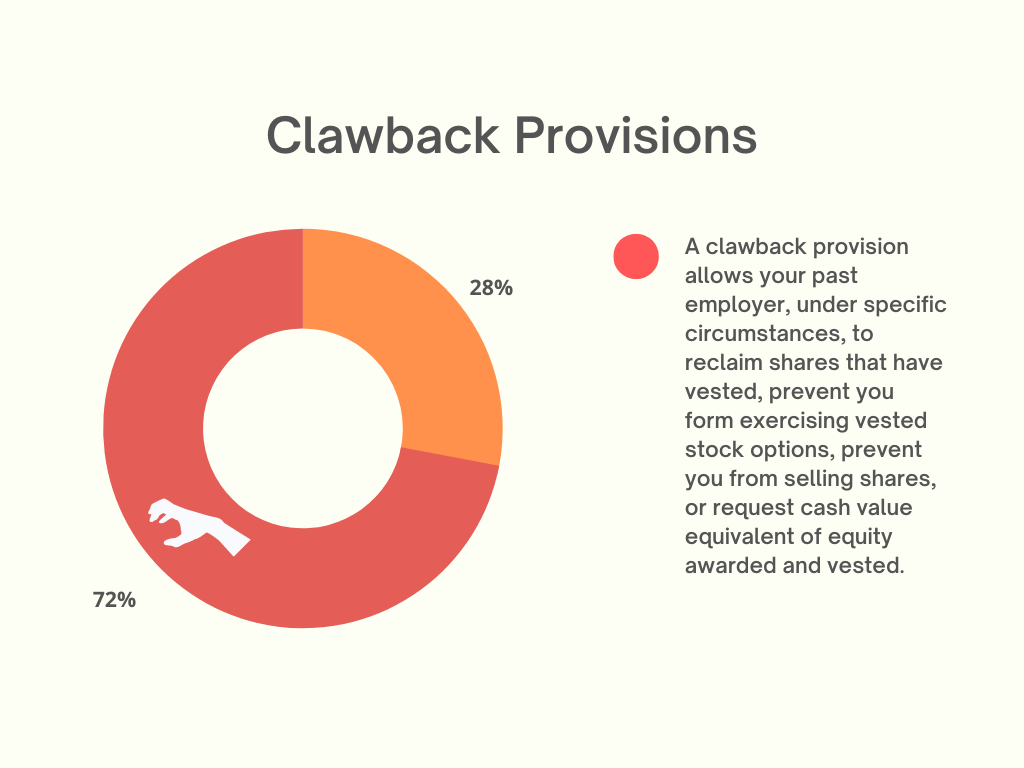

The stock grant agreement, or equity award letter, is the legal document you received that states everything from what kind of equity type you received to how many shares to vesting and termination criteria. Within the stock grant agreement, you need to be familiar with non-compete rules and clawback rules. A 2019 Deloitte study shows that about 72% of companies surveyed have clawback provisions.

Non-compete rules and clawback rules stipulate who you can and can’t work for and under what circumstances can your past employer take back vested shares/options or the dollar equivalent.

You will be faced with several decisions depending on the type of equity compensation you have.

2. Incentive Stock Options

If you have Incentive Stock Options (ISOs) then you will likely have 90 days to exercise the options or lose them forever. But before you go and blindly exercise you need to be mindful of triggering the Alternative Minimum Tax.

If your company allows you to hold the ISOs beyond the 90-day period after you have been laid off from work, be aware that they will be transformed into Non-Qualified Stock Options (NQSOs). You will lose the tax benefits that come with ISOs.

3. Non-Qualified Stock Options

If you have NQSOs you will need to keep close track of the expiration date, which is 10 years from the date of the grant. They don’t last forever, and you will need to make a decision on them at some point in time.

4. Equity Stock Purchase Plan

If you have an ESPP plan then you will receive the money back that you elected to save for the next purchase period.

5. Restricted Stock Units

Finally, with RSUs if you don’t make the next vesting event you will only have the previously accumulated shares. With the accumulated shares you can now sell at any time since you are no longer an insider. You may need to double-check with your HR to make sure you don’t possess any insider information.

What to do with your 401k when you’ve been laid off?

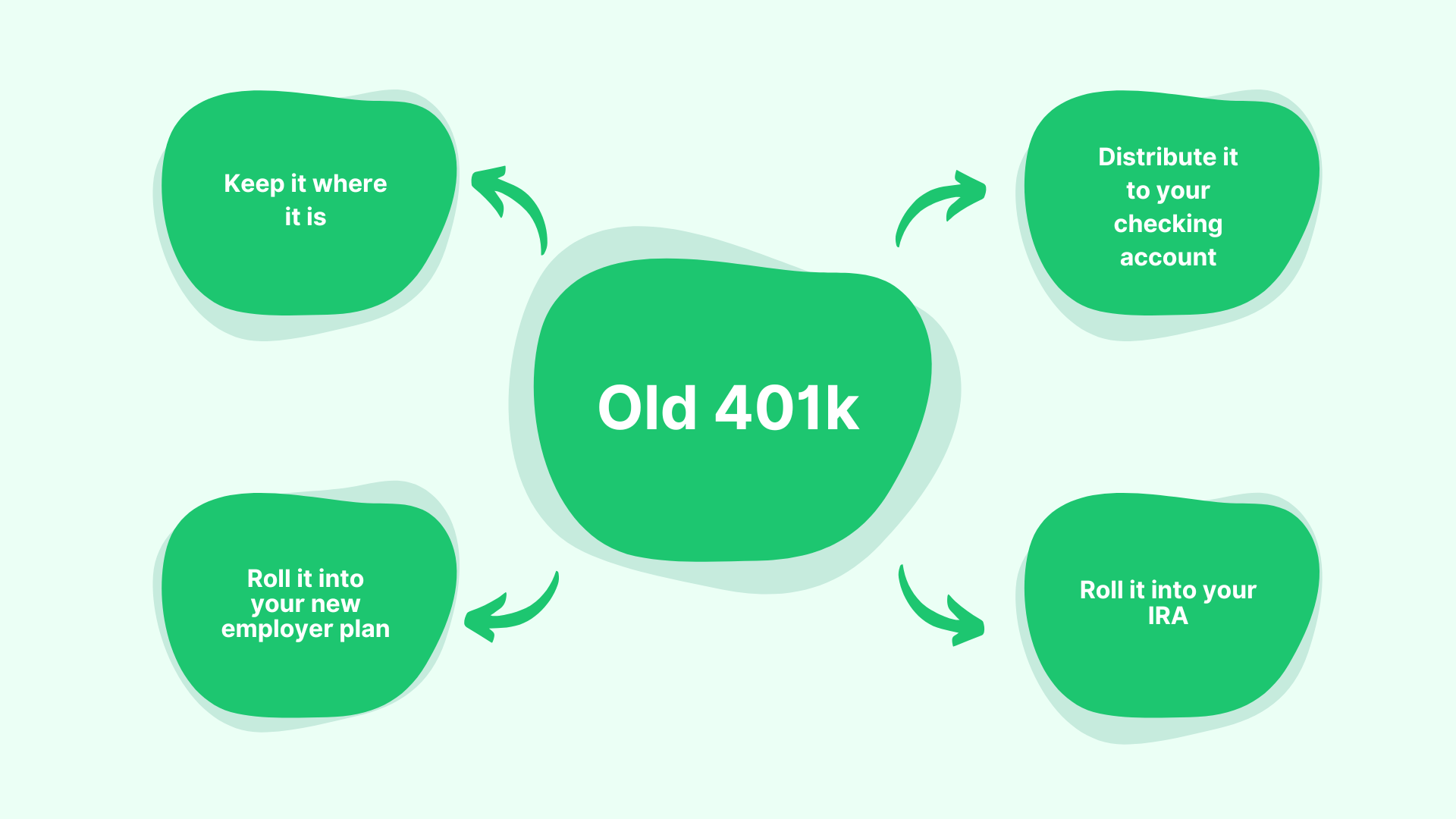

Second to equity compensation, your 401k is probably the largest wealth accumulation vehicle you will have. It is full of tax benefits and usually comes with a lucrative employer match. If you have been laid off from work you have a few options with your 401k.

6. Keep your 401k where it is

You can keep it at your past employer. This would make a lot of sense if your past employer had some proprietary investments you absolutely love. These could be funds with subsidized expense ratios, providing you close to costless investing. It could be funds that are only available to that plan.

Usually, unless you have forgotten or are lazy, it makes sense to keep your accounts organized. Your other two options include rolling it over into your new 401k or rolling it over into an IRA.

7. Roll it Into your new 401k

Your current 401k may also have exclusive funds. They may provide investment management at a steep discount. Furthermore, there are additional benefits to rolling it into your 401k beyond just investments. This includes being able to take a loan on your balance, additional creditor protection, and more flexible distribution rules.

8. Roll it into your IRA

Finally, you can move your funds into an IRA. This gives you the greatest investment flexibility and access to a broader range of advice and guidance services. On some occasions, with smaller companies, the 401k can be a more expensive option than an IRA. The option I am not covering is distributing your 401k into cash. This is tax suicide and will certainly set you back financially.

Severance and Surviving Layoffs

It is much easier to survive layoffs when you have a generous severance package. A severance package will provide you with income for a predetermined amount of time. It may also provide you with other benefits, such as helping you find work, accelerated equity vesting, and other pre-negotiated benefits. Each severance package is unique to the company. So it is important you take the time to understand what your severance package entails.

9. Negotiate your next severance

At the beginning of your employment, you can and should negotiate your severance package. While it is probably too late now that you are reading this blog, you may consider this for your next job opportunity.

10. Understand the rules of your severance package

Another key to the severance package is the benefit to your past employer. Most employers use severance packages as a way to protect themselves from lawsuits from departing employees. However, it can also mean that you are not allowed to share company secrets or work for specific competitors.

The different terms of the severance package is why it is so important for you to review yours closely. If you need help reviewing yours we can help or introduce you to an attorney who could.

Health Insurance

If you are being laid off there is a chance that there will be some period of time before you find another job with another healthcare provider. You have two options. You can stick with your current health provider through COBRA. Alternatively, you can look at private insurance provided through organizations like Covered California or through national providers like HeatlhCare.gov.

11. Using COBRA

If you like your current health provider (for example, you may have a physician you are working with) you may decide to utilize COBRA. You may also use COBRA if you had recent health problems and want continuation in treatment. COBRA can be expensive. It will require you to pay for the entire amount previously covered by your employer. For most, COBRA only lasts 18 months and on rare occasions can be extended another 18 months.

12. Using public marketplaces

You can also look at various marketplaces. In California, we have Covered California and nationally you can look at Healthcare.gov. In both cases, you can shop for long-term plans based on your income, health, and family situation. You can choose the plans based on the amount of coverage and cost. COBRA may be a good option for temporary unemployment and in unique cases. However, if you are going to be unemployed for an extended period of time and are looking to save money, marketplaces make more sense.

Taxes and tax opportunities

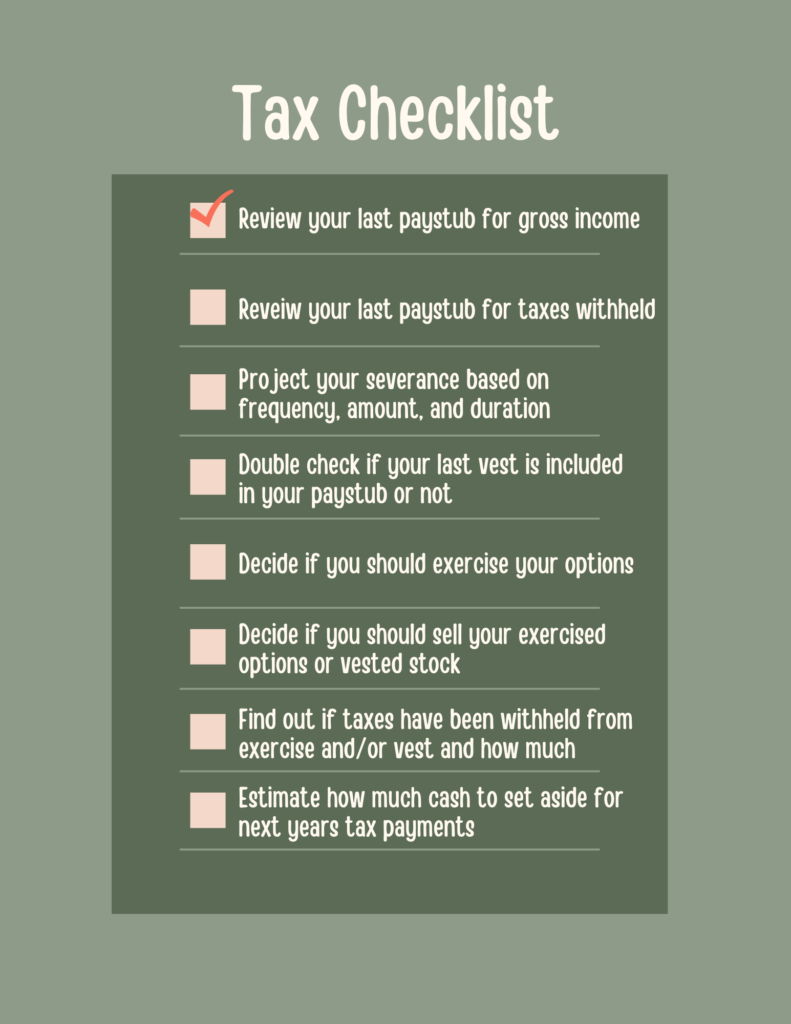

Your all-in income for the year is going to take into consideration all your pay for the year, the amount and duration of your severance, and all the equity that was vested, exercised, and or sold. This will impact your tax bracket. Your tax bracket and the amount of taxes withheld will guide your tax strategy.

13. Evaluate your taxable income for the year

Your severance will be taxed as any other W2 income you received from your employer for the year. It may end before the year is over or it may last through to the next year. Some equity that vests immediately get taxed, like your RSUs. Other equity requires you to make a decision to exercise and sell like ISOs and NQSOs. Some equity compensation has mandatory withholding for taxes and some do not. Your last paystub will also let you know what your gross income was and how much was withheld for taxes.

To make a confident tax decision you will need to know how much w2/severance income you have received, how your equity compensation was taxed for the year, and what was withheld from all sources of income.

14. Set aside cash for next year’s tax bill

You will want to set aside enough for next year’s tax bill. Because your job prospects are not yet certain it is important to have a reliable source of cash on the sideline. This means using your severance pay to put aside cash if need be and selling your equity as it vests or as you exercise it. Having an accurate tax projection here becomes important especially if you are trying to balance spending on your current lifestyle and being confident that you won’t be short on future tax payments. Your financial or tax advisor should be able to help you calculate an estimate.

15. Convert IRA to a Roth

If you get laid off early in the year or you decide to take a sabbatical the following year, or even a portion of the year, then it is likely you will enter one of the lowest tax brackets you will be in for the rest of your life (yes, even lower than retirement). This presents you with an opportunity to convert any regular IRAs or 401ks to your Roth IRA.

At some point in your life, you will be forced by the IRS to distribute your regular 401ks and IRA’s. This distribution is a set percentage that increases every year as you age. With a large enough IRA, that distribution, counted as ordinary income, can create a very large tax bill. This is why people like to pay the taxes upfront on a Roth IRA so they can distribute tax-free.

If your income is sufficiently low in the year you get laid off or take a sabbatical you can use that to your advantage by distributing your IRA/401k to your Roth and paying taxes on the distribution at a lower rate.

Calculating exactly how much you should convert requires some estimates of where you fall on the tax brackets now and where you will potentially end up in the future. This can be done through financial planning software or with some Excel spreadsheet magic.

16. Harvest Capital Gains

If you decide that a Roth conversion is not the right decision for you then depending on your tax bracket you may consider harvesting capital gains. If you are single, you will owe no federal capital gains tax if your total income (including capital gains) is less than $40,400 for the year ($80,800 for married filing jointly). This applies only to long-term capital gains. This situation is likely to unfold itself if you got laid off early in the year and decide to take a sabbatical through the rest of the year. Harvesting capital gains is very useful if you have been sitting on a highly concentrated and highly appreciated stock. Usually common if you have been accumulating RSUs or have exercised some stock options.

17. Contribute to your IRAs

Finally, if you don’t quite fall into a low enough tax bracket to harvest some capital gains then you should see if you can make a deductible contribution to a regular IRA or a non-deductible contribution to a Roth IRA. The income limitations depend on what kind of IRA you want to contribute to, if you are married, and if you were covered by a 401k throughout the year. You can read all the IRS rules HERE.

Everybody’s experience when getting laid off from work is going to be different. That is why the question of “What to do when you’ve been laid off?” is going to start by taking a long look at your finances, your employer documents, and your personal goals. If you need help surviving layoffs we are HERE to help!