A Wealthrepreneur® in every client

Our clients are like micro-entrepreneurs, trying to create their own personal “wealth start-up.” A strategic framework for short-term goals like buying a home to long term goals like philanthropy and retirement.

Wealth Planning that’s Personal

Every financial plan is actionable, simple, and as unique as our clients. We start with a foundational plan that lets you measure your financial improvement in actual dollars. As your life changes and you are faced with challenges, we create stress tests around your special scenario to let you see how your decisions impact your bottom line.

Equity Compensation

Our clients are incredibly bright and work for game changing tech companies. They face critical issues around their equity compensation. We help clients evaluate the investment, financial planning, and tax ramifications around publicly traded and privately held stock.

Retirement

Most people save money so one day they can retire on their terms. We help our clients evaluate their retirement savings strategies taking into consideration employer retirement plans, complicated retirement strategies, and social security. To give our clients deep insight to their future we utilize sophisticated statistical cash flow analytics.

Family Planning

When it comes to planning for your family needs, we understand the complexity of emotions and financial decisions that you need to make. From balancing saving decisions for college to creating a budget to leaving behind a legacy with a trust, we help you evaluate your options and how to successfully execute on it.

Asset Protection

We are serious when it comes to preserving your wealth. We consider your entire life journey and evaluate ways to protect your assets from unexpected events such as untimely death, the ever persistent deterioration of wealth due to taxes, and passing on your wealth in a way that keeps most of it intact.

Solutions for Everyday Needs

We are at the core of our client’s lives. You trust us with your money so that’s why we help you find trusted professionals such as tax advisors, real estate agents, equity compensation attorneys, recruiters, marriage counselors, fitness experts, and more.Find more valuable information

on our Wealth Planning process.

Which is Better: Renting or Buying Your Home?

The conventional wisdom here falls squarely in the “Buy” camp. Buying a house and paying a mortgage is just one of those things, like getting married and having 2.5 kids and paying your taxes, that most people just sort of expect normal, responsible adults do, and is typically one of the foremost financial aspirations of young adults.

Two Wealth Building Tips From William Shakespeare That Are Still True Today

Two quotes from two separate works stick out tome as relevant. Together, they are the very tenants of wealth creation and part of the framework for what I believe leads to financial success. If you implement the two in concert, success is likely assured.

Frequently Asked Questions

Not Ready For A Call Yet?

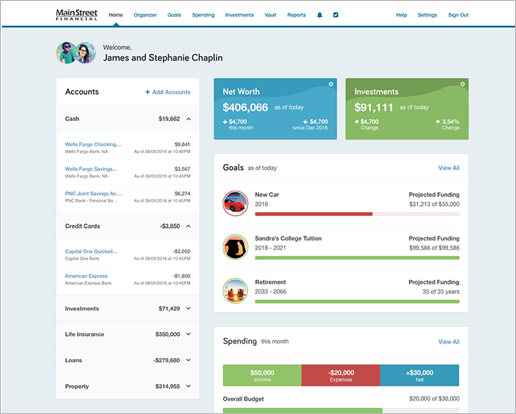

Try our FREE eMoney test to see how much risk is right for you.

Get access to world class planning software utilized by top wealth management firms in the country. Quickly find out how ready you are to retire and reach your goals.