Aspire to be greater than just your finances

Leave the mindset of scarcity behind. Instead, build your aspirational financial plan® and the kind of wealth that is the envy of your peers, establish a legacy that will outlive you and meaningfully alter the lives of your family and the world around you.

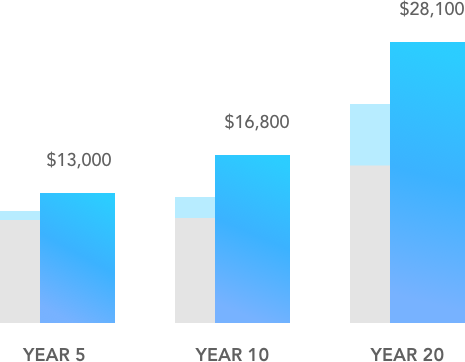

Simulated Growth Of $10,000

Over 20 Years*

- With Advisor

- Behavioral Gap

- Without Advisor

Working with a financial advisor can increase your annual returns by 3%.

The biggest part of this return is behavioral coaching that can add up to 1.5% per year.

Four Part Framework

Invest With Purpose®

Our Invest With Purpose® process has been developed because wealth isn’t just about money; it’s about your family, your passions, your challenges, your values and your desire to give back to the community. With this knowledge we create a mind map that is the guiding document and how success will be measured for you.

Rightfolio®

Financial success is at the crossroads of financial rationality and emotional satisfaction. As our relationships with our clients develop, we can really analyze the fuzzy math of what makes someone tick and we help craft a financial plan and investment strategy that truly feels unique.

Engineered to Do Better®

Many investors fail to tune out the noise and make decisions using their gut and intuition. We use rigorously vetted quantitative rules to engineer your portfolio in order to manage risk while seeking to maximize after-tax returns.

Framework for Financial Success®

With your goals, values, dreams, aligned with your finances we help you automate your wealth building process by creating a framework that simplifies your life and let’s you focus on what you love doing most.

Find more valuable information

on our Aspirational Planning

The Alternative Path to Good Financial Habits Through A Good Decisions Fund

Unless you make a living writing a financial frugality blog, it is rare that someone truly enjoys the process of budgeting. Through my journey to financial habits self-discovery, I may have finally found something that truly works for me called the Good Decisions Fund.

Three Behavioral Hacks for Business Owners to Take Back Their Lives and Eliminate Retirement Worries

How familiar does this scenario sound? You started your business because you had a vision of helping others while helping yourself succeed financially in the process. Along the way however, you got lost in the business and now the business started running you!

Frequently Asked Questions

Not Ready For A Call Yet?

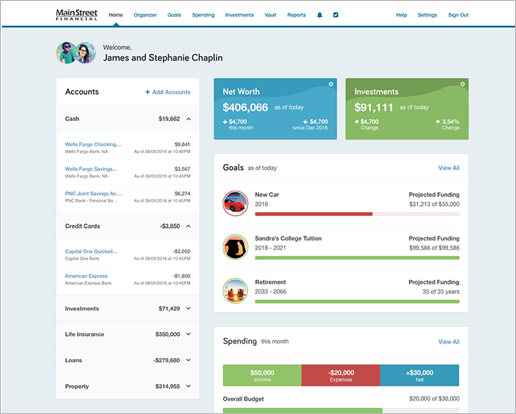

Try our FREE eMoney financial planning software.

Get access to world class planning software utilized by top wealth management firms in the country. Quickly find out how ready you are to retire and reach your goals.