Tax-Loss Harvesting: Beyond the Basics Tax Minimization Strategy

Tax-loss harvesting is a tax minimization strategy that is often used to offset some capital gains at the end of the year. In a more professional portfolio, it is used to take the sting out of taxes generated from rebalancing.

Many people believe they are properly tax-loss harvesting, but in reality, they are just selling bad investments. This tax minimization strategy is not intended for you to lose money and leave you disappointed in your investment decisions. It is intended to grow your portfolio faster through one of the best tax-efficient investing strategies.

Sadly, there are not a lot of options for avoiding capital gains tax. Aside from dying, giving your assets away, making no income, or investing in a new option called opportunity zones. With such a limited and not-so-appealing lineup of options, it is critical that you learn how to use this tax reduction strategy like a pro.

What is Tax Loss Harvesting

To understand this tax minimization strategy is it is important to understand capital gains. In essence, proper tax-loss harvesting is a way to avoid capital gains by recognizing losses on parts of your portfolio and using these losses to offset the gains. So it’s also just as important to understand capital losses.

Capital Gains Tax

There are two types of capital gains. Short term and long term. Short-term capital gains are taxed at your ordinary-income tax bracket.

Long-term capital gains have tax brackets that are separate from the tax brackets you use for ordinary income such as from wages or interest in your savings account. There are three tax brackets for long-term capital gains 0%, 15%, and 20%. In addition, there is a 3.8% net investment income tax for income above $200,000 (single filers) or $250,000 (joint tax filers).

Using Losses

An important part of tax-loss harvesting to understand is that capital losses can be used to offset capital gains. First, long-term capital losses offset long-term capital gains, then short-term capital losses offset short-term capital gains. Then the leftover difference between short-term and long-term capital losses and gains offset one another. Furthermore, every year you can use up to $3,000 of your capital losses to offset your ordinary income such as from your wages.

Furthermore, capital gain losses can be carried on forever! That means if you recognize a loss this year you could use it to offset gains 10 years in the future.

Capital gain taxes are only recognized in your taxable accounts. Your IRA’s and 401k’s grow tax-deferred and tax loss harvesting is not applicable in those accounts.

Now that you understand capital gains, it is time to learn how to avoid capital gains tax on stocks and how to tax loss harvest.

How to Tax-Loss Harvest

To tax loss harvest you need to sell an investment at a loss. To maintain your overall portfolio strategy, you will want to buy the investment back after recognizing the loss.

You can buy the same investment back but you must be aware of the wash sale rule. The wash sale rule prevents you from buying back the same investment 30 days before or after the sale. Being out of the market for 30 days is not acceptable to most investors. That is why another option is to buy a similar, but different investment.

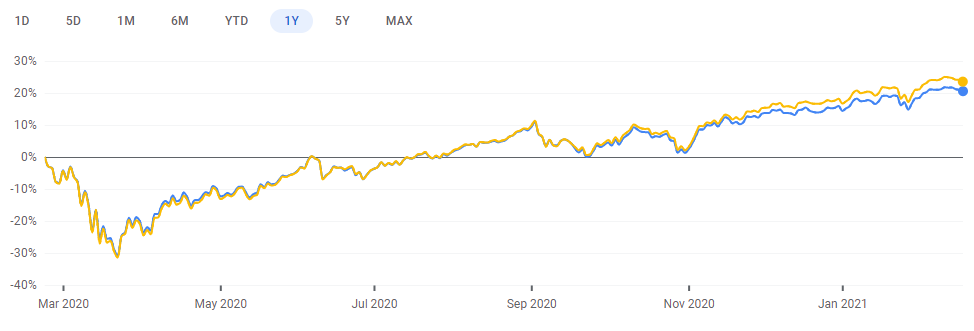

Here is a tax-loss harvesting example. Let us say you have a loss on the S&P 500 ETF. You would sell the S&P 500 ETF and instead of buying the S&500 ETF again, you would buy a US Large-Cap ETF. While the two ETF’s are not the same, the behavior will be similar in up and down markets. Here is an example of the performance between a fund that represents the S&P 500 and one that represents the Russel 1000.

You can now use this loss to offset capital gains or up to $3,000 of ordinary income.

Tax-loss harvesting does not make taxes disappear. While you sold something at a loss you bought something else, which was a similar investment at a much lower price. When you go to sell the new investment, you will end up paying tax on these additional gains. So, what’s the point of tax-loss harvesting?

Why would you tax-loss harvest?

There are four primary reasons why you would use tax-loss harvesting.

Taking a deduction from your ordinary income can save you thousands of dollars over your lifetime. At the top federal tax bracket of 37%, you will save $1,100 of Federal taxes a year. ($3,000 * 37% = $1,100)

Any money you can put to work now will allow your wealth to compound faster. Instead of paying a tax bill this year you can use that same money and invest it. Even though you will eventually pay taxes on it when you sell it, by then it will have done its job of growing your money faster.

You can use a long-term capital loss to offset short-term capital gains. Because short-term capital gains are taxed at a higher rate than long-term capital gains this can be especially valuable for say, reducing holdings in appreciated employer stock you haven’t held for more than a year.

If you have a highly appreciated investment you can use tax-loss harvesting to sell down your appreciated investment position while recognizing minimal tax. Many of our clients who have work in tech have accumulated large holdings in their current or past employer’s stock. For any one of these individuals to diversify this risky, yet highly successful investment can cost hundreds of thousands in taxes if not millions. Tax-loss harvesting in complementary parts of their portfolio can help them reduce this risk and tax burden at the same time.

With every sale at a loss, you will use this to sell some of your highly appreciated investment, you will then use these proceeds to reinvest in the remainder of your portfolio. This process is repeated until you have slowly diversified away from the large holding while minimizing the tax burden along the way.

Example of Tax-Loss Harvesting Helping to Diversify

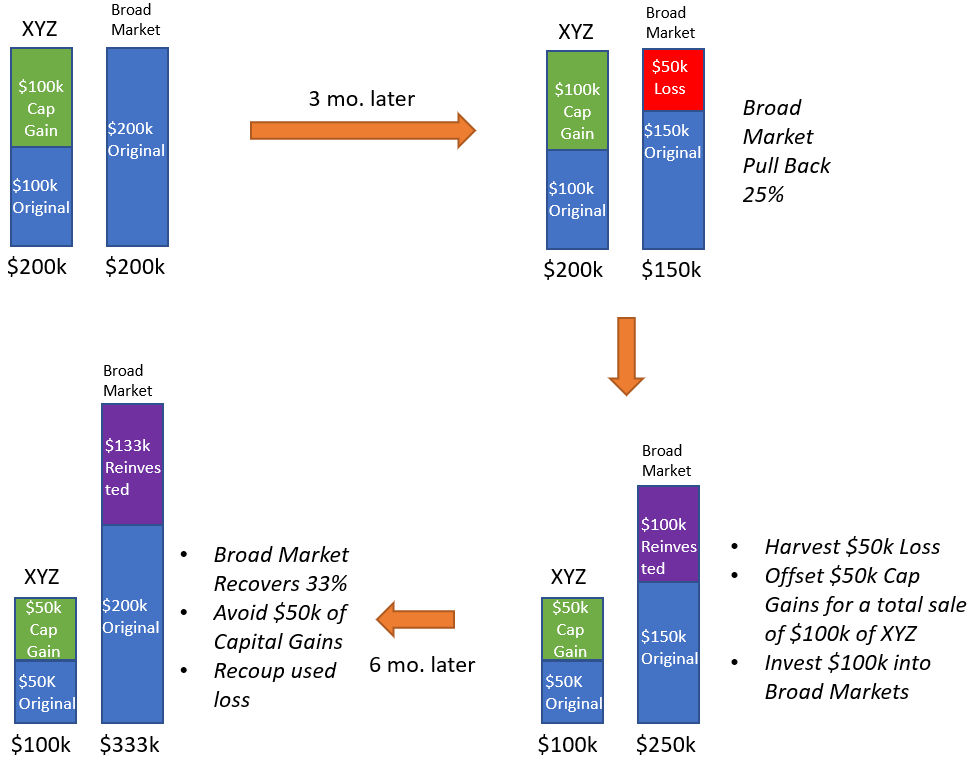

Let’s say you have worked at Tech Company ZXY (a fictional company) for the last 5 years. You have accumulated a large holding worth $200,000. Over the last 5 years, ZXY has increased 100%. This means that $100,000 of your ZXY stock is all capital gains.

To help you reduce this position through tax-loss harvesting you would invest in complementary investments. Let’s say another $200,000 for a total portfolio value of $400,000. This could be other stocks, funds representing a variety of markets, and bonds.

A few months later some of these complementary investments have lost $50,000. The first step is to sell those investments and replace them with similar investments. This maintains your investment strategy intact. You would then pair the loss of $50,000 with $50,000 worth of gains in your ZXY shares. $50,000 worth of gains in ZXY would free up $100,000 dollars of new cash. This cash can then be used to invest in new stocks, funds, bonds, etc that will give you the opportunity to tax loss harvest.

This strategy requires a lot of close attention. It requires you to understand how to maintain your strategy while swapping investments. This is a part of what we do at RHS Financial and we can help you figure it out.

Tips to enhance your tax-loss harvesting

Tax-loss harvesting is an ongoing strategy that benefits from careful thought and attention. Over the years that we have been doing this for our clients, we have developed the following strategies that can be helpful in reducing taxes.

Don’t automatically reinvest dividends

It is common that you will have the option to reinvest dividends automatically from your investments. This makes sense if you are trying to find a simplified way to accumulate your existing position. However, if you are looking to find ways to continue diversifying your portfolio and finding new opportunities for tax-loss harvesting we would encourage you to let your dividends accumulate to cash first. You can then decide how to invest that cash to complement your existing investments. This new purchase will also give you the opportunity for future market swings to provide you with new tax-loss harvesting opportunities. A new investment bought at a higher price is a lot more likely to lose value in a market swing.

Recognize gains early in the year

This technique is counterintuitive to how most individuals execute tax-loss harvesting. Most investors will compare their losses at the end of the year to their gains and then place the trades that offset one from another. However, if you are already planning on selling an investment at a gain, doing so at the beginning of the year will free up cash to invest in new positions that can then be used for the rest of the year for tax-loss harvesting opportunities.

Sell the lots that are at the highest cost basis first

For many investors, a highly appreciated investment has been acquired over several purchases. These purchases will vary in price, some higher and some lower. When you place a trade on just a part of your investment the brokerage firm will decide which shares to sell based on what is called tax lot accounting.

For most firms, it is automatically set to what is called FIFO or first in first out. Usually, the first position you bought would be the most appreciated one in an increasing market.

As you slowly sell down on your highly appreciated investment you want to sell the one that has appreciated the least. Why? So you still end up with the same amount of investment ownership but pay the least amount of taxes in the process.

Therefore, if you can, you should set your tax lot accounting to HIFO, or highest in first out. Not all brokerage firms can accommodate for this so you may have to choose the specific lots you sell and choose the ones that have the least appreciation.

Spread capital gains over the years

When dealing with a highly concentrated and appreciated investment you should consider recognizing a portion of gains every year rather than all at once. This provides two benefits if you are comfortable with the risk of loss.

It requires less tax-loss harvesting over the year to create an offset. It also might prevent you from going into higher capital gains tax brackets.

You should evaluate if additional sales would recognize you an additional 3.8% net investment income tax. The same goes for if you are about to cross into the top marginal tax bracket. At the top marginal tax bracket, your long-term capital gains increase from 15% to 20%.

Conclusion

Tax-loss harvesting is one of the few tools that investors can use to sell investments and rebalance without paying taxes. Do not let a large tax bill stand between you and a smart decision to diversify. We briefly touched on using tax-loss harvesting to reduce capital gains tax on highly appreciated stock. Part of this strategy requires the use of a completion portfolio which we will talk about in future posts. We will also cover how you can use shorting and margin to enhance this tax minimization strategy.

Keep an eye out if you want to take your tax-efficient investing to the next level!

If you want to get started now, but do not know how, let’s talk.

Click the link HERE to get a free consultation where we will answer your questions about tax avoidance and tax mitigation.

2024 Disclosures

RHS Financial is an SEC registered Investment Advisory Firm and distributes this presentation for informational purposes only. This presentation ( hitherto referred to as the presentation throughout this disclosure), blog post, infographic, slide deck or whatever form of informational modality the reader wishes to describe this as is provided for informational purposes only and should not be construed as investment advice in any way.

We believe the information, including that obtained from outside sources, to be correct, but we cannot and do not guarantee its accuracy in any way. RHS Financial uses information from outside sources to develop graphs, charts, infographics, etc. to enhance this presentation and while we believe the information from these outside sources, to be correct, we cannot and do not guarantee its accuracy in any way,

Any opinions or forecasts contained herein reflect the subjective judgments and assumptions of the authors who may be employees of but do not necessarily reflect the views of RHS Financial as a company. There can be no guarantee that developments will play out as forecasted. The information in this presentation is subject to change at any time without notice. This presentation contains “forward-looking statements" concerning activities, events or developments that RHS Financial expects or believes may occur in the future. These statements reflect assumptions and analyses made by RHS’s analysts and advisors based on their experience and perception of historical trends, current conditions, expected future developments, and other factors they believe are relevant. Because these forward-looking statements may be subject to risks and uncertainties beyond RHS Financials’ control, they are no guarantees of any future performance. Actual results or developments may differ materially, and readers are cautioned not to place undue reliance on the forward-looking statements. In a nutshell; these are our best guesses and please don’t assume they are fact.

Mentions of specific securities, investment products, investment indices, companies or industries should not be considered a recommendation or solicitation. Data and analysis does not represent the actual or expected future performance of any investment or investment product Index information is used to illustrate general asset class exposure, and not intended to represent performance of any investment product or strategy.

This post may contain references to third party copyrights, indexes, and trademarks, each of which is the property of its respective owner. Such owner is not affiliated with RHS Financial and does not sponsor, endorse or participate in the provision of any RHS’ services, or other financial products. Index information contained herein is derived from third parties and is proffered to you unaltered as we derived it from the third party.

RHS Financial, LLC is a Registered Investment Adviser. Advisory services are only offered to clients or prospective clients where RHS Financial, LLC and its representatives are properly licensed or exempt from licensure. This presentation is solely for informational purposes. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by RHS Financial, LLC unless a client service agreement is in place.

If the client is deemed suitable and agrees, RHS may employ leveraged strategies for these clients. Leverage attained through margin on a client’s account can add additional risk. While RHS tends to seek to improve return with theses strategies by applying leverage to less risky indexes, there is no guarantee that that RHS will lower risk or improve returns.

RHS Financial. 4171 24th St. Suite 101 San Francisco, CA 94114