A Guide to the Stimulus Package for COVID-19 Impacted Individuals and Families

The stimulus package for COVID-19 was signed into law by President Trump on Friday, March 27th, 2020. The act is extremely broad and impacts everyone from individuals to airlines. To get a better grip on the CARES Act we decided to write up a guide for individuals and families.

This blog post is going to cover the items below so feel free to skip around.

- Stimulus Check

- Using the Retirement Account to Supplement Cash Flow

- Change to Required Minimum Distribution

- Charitable Contribution Changes

- Unemployment Benefits

- Changes to Federal Student Loans

- Health Care Benefits

Stimulus Check

One of the most discussed and complex benefits of the CARES Act is the stimulus check.

The stimulus check benefit can be received in one of two ways.

Either through a check or via a tax credit that will offset your 2020 taxes.

How do I qualify for the stimulus check?

- The check is not based on what you will make in 2020!

- The stimulus check amount will be based on the income of your most recent tax filing adjusted gross income(AGI). You can find your AGI on line 8b of your Form 1040 from your most recent filed taxes.

- If you were an early filer in 2019 then the amount of the check you qualify for will be based on your 2019 AGI. Alternatively, if your last filing date was 2018 then your 2018 AGI will be used.

- Planning Tip: If your AGI in 2018 is below the phase-out limits but your 2019 AGI is above the phase-out limits, hold off on filing. Alternatively, if your 2019 AGI is below the phase-out limits but your 2018 AGI is above the phase-out limits you want to file ASAP. As part of the coronavirus relief efforts, the filing and the paying deadline have been extended until June 15th.

- If your AGI in 2018 and 2019 was above the phase-out limits you will receive a smaller amount of the check or none at all.

- If your income was too high based on your last tax filing, you lose your job during 2020, and your income for 2020 falls below the phase-out limits you will receive a tax credit. This is probably one of the worst features of this stimulus package for COVID-19 as it is going to be a little too late to matter.

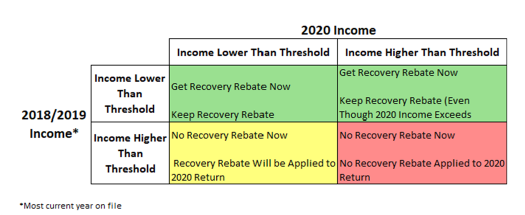

- If you make more in 2020 than in 2018/2019 and you receive the check you don’t have to pay it back.

Source: Michael Kitces

How much will I get?

- A single person will get up to $1,200 and a married couple will get up to $2,400. You will also get up to $500 per child under the age of 17.

- The stimulus check is phased out by $5 for every $100 that you make above a certain amount.

- $75,000 of AGI for a Single Person

- $150,000 of AGI for Married Filing Jointly

- $112,500 of AGI for Head of Household

- Below is a graph with an example of how much you would get at different income levels.

- The formula to figure out the amount you will receive is:

- Full Stimulus Check per Your Filing Status – {[(your AGI – Phase-Out Limit)/$100]*$5}

When and how will I get the stimulus check?

During the 2008 Great Recession, the US government sent a stimulus check with the same expected timeline. As of right now, the guidelines for the COVID-19 stimulus package is to send the check as soon as possible. However, back in 2008, the stimulus check did not reach people until a couple of months after the legislation was passed. If past experience is any indication of how this will play out you should not expect to receive the check until around May.

There are a variety of ways someone can receive the check:

- Social Security recipients will get their check where they get their Social Security checks deposited

- Those that filed in 2018/2019 will get it in the bank account where they had a direct deposit/withdraw done during the last tax filing

- Otherwise sent to the last known address

Planning Tip: Since you last filed your address or bank information may have changed. To update this information you have one of two options.

- You can fill out and submit form 8822 to change your address, that you can find here. An example of this form is below.

- You can change your bank account information on file by calling the IRS at this number: 800-829-1040

Retirement Account Changes

The CARES Act is implementing provisions to make it easier to use your retirement account as a last form of defense.

Drawing money out of your retirement account during a downturn is highly inadvisable. In 2008 a lot of individuals lost money as a result of a need to draw money out of their IRAs. This required them to sell their retirement assets at severely depressed values. They had no other choice or have done it out of sheer panic. When the markets recovered they never got back in or just didn’t participate as much.

However, if you have no choice, the COVID-19 stimulus package is taking steps to make the experience less painful.

Qualified Early Individual Retirement Account(IRA) Distributions

If you are under the age of 59.5 there are a few reasons you can take money out of your IRA without paying the 10% IRS penalty. Those include first-time house buying needs, education needs, and more.

In addition to the existing rules, during 2020, you will be allowed to withdraw up to $100,000 due to COVID-19-related adverse financial experiences. This withdrawal will have several benefits.

- No 10% IRS penalty

- If it comes out of your employer retirement plan they are not required to withhold money for taxes

- You have an opportunity to roll that money back over 3 years

- You can choose to spread the income over 3 years or claim it all in 2020

- Planning Tip: If you lose your primary source of income this year and expect to go back to work next year you may want to accelerate this income recognition. If by chance you keep your job and you still need the funds you should spread the income over 3 years.

Borrowing from your 401k

Traditionally you can only borrow up to $50,000 from your 401k plan or a maximum of 25% of your vested balance.

For the period of 2020, this is changing to $100,000 or up to 100% of your vested balance.

You will also not need to start making payments until a year later.

Required Minimum Distribution(RMD) Suspension

All RMDs from retirement accounts for 2020 are being suspended.

These RMDs can be from a regular retirement account, employer plans such as 401(k)s/403(b)s, or inherited IRAs.

If you turned age 70.5 last year you are also eligible to suspend your first RMD payment from 2019 as well as the one for 2020.

For inherited IRA’s both the stretch provision RMD’s and those under the 5-year distribution plan are suspended. For those under the 5-year distribution plan, 2020 will not count for a year.

If you have already made a distribution for 2020 you have two options.

- You can roll-back your RMD if you made the distribution less than 60 days ago and you have not had a rollover in the last 12 months.

- Anyone that this does not apply to may be able to roll it back as part of the COVID-19 related $100,000 distribution.

- In order to do this, you must speak to your brokerage firm and ask them to re-categorize the RMD as a COVID-19 financial burden related distribution.

If you have set up automatic RMD distributions you need to contact your brokerage firm and cancel the payments temporarily.

Charitable Donation Changes

There are two changes to charitable donation rules that the more fortunate can take advantage of if they want to help out in the fight against COVID-19.

In order for these rules to apply, you must use the standard deduction and donate cash directly to the charity that is a 501(c)(3) organization.

- You can donate up to $300 to a charity and have it be deducted directly from your income without the need to itemize.

- With the recent tax act, most individuals and families have been using the standard deduction. To take advantage of charitable contributions through itemizing you would need to have a variety of other itemizable items or need to have given a significant amount to charity.

- You can donate cash and exclude up to 100% of your AGI instead of 60%. If you donate an excess of 100% the extra amount will be carried forward for 5 years.

Unemployment Benefits

If you happen to lose your job during 2020 the CARES Act unemployment benefits have been expanded significantly to help you out.

Help for those that don’t qualify for traditional unemployment

Traditionally if you are self-employed you are not eligible to receive unemployment benefits. This is changing through what the CARES Act is calling the Pandemic Unemployment Assistance. This will benefit individuals such as independent contractors, those looking for part-time work, and those that don’t have a long enough employment history to benefit from traditional forms of unemployment benefits.

Extension of Benefits

In addition to those eligible for traditional unemployment, the federal government will fund an additional $600/week of unemployment benefits for up to 4 months. The unemployment benefits will also start immediately, avoiding the traditional one week waiting period that is there to encourage people to find another job. Finally, traditional unemployment benefits will be stretched an additional 13 weeks.

Student Loan Changes

If you have federal student loans the CARES Act is providing some very tangible benefits that you should take advantage of ASAP. With the stimulus package for COVID-19 federal student loan benefits includes:

- No payments until September 30th of 2020

- No interest on canceled payments

- They will still count for federal loan forgiveness programs

To take advantage of this, you must call your loan service provider and ask them to cancel the payments as part of the stimulus package. They don’t automatically stop.

For those of you that have private student loans, your lender may have additional benefits for COVID-19 related forbearance. This will depend on the service provider and is not part of the CARES Act.

Health Care Changes

Finally, the COVID-19 stimulus package creates some additional flexibility for medical benefits.

First, you can use your HSA, MSA, or FSA for over-the-counter medication. The stimulus package details the inclusion of feminine products as a qualified medical expense from your plan.

Those that are on Medicare will also receive a no-cost COVID-19 vaccine when it is released.

The CARES Act will also allow for a 90 day supply of prescription medication for anybody covered by Medicare Part-D.

Stay safe everyone and if you need help understanding how this applies to you don’t hesitate to reach out.

2024 Disclosures

RHS Financial is an SEC registered Investment Advisory Firm and distributes this presentation for informational purposes only. This presentation ( hitherto referred to as the presentation throughout this disclosure), blog post, infographic, slide deck or whatever form of informational modality the reader wishes to describe this as is provided for informational purposes only and should not be construed as investment advice in any way.

We believe the information, including that obtained from outside sources, to be correct, but we cannot and do not guarantee its accuracy in any way. RHS Financial uses information from outside sources to develop graphs, charts, infographics, etc. to enhance this presentation and while we believe the information from these outside sources, to be correct, we cannot and do not guarantee its accuracy in any way,

Any opinions or forecasts contained herein reflect the subjective judgments and assumptions of the authors who may be employees of but do not necessarily reflect the views of RHS Financial as a company. There can be no guarantee that developments will play out as forecasted. The information in this presentation is subject to change at any time without notice. This presentation contains “forward-looking statements" concerning activities, events or developments that RHS Financial expects or believes may occur in the future. These statements reflect assumptions and analyses made by RHS’s analysts and advisors based on their experience and perception of historical trends, current conditions, expected future developments, and other factors they believe are relevant. Because these forward-looking statements may be subject to risks and uncertainties beyond RHS Financials’ control, they are no guarantees of any future performance. Actual results or developments may differ materially, and readers are cautioned not to place undue reliance on the forward-looking statements. In a nutshell; these are our best guesses and please don’t assume they are fact.

Mentions of specific securities, investment products, investment indices, companies or industries should not be considered a recommendation or solicitation. Data and analysis does not represent the actual or expected future performance of any investment or investment product Index information is used to illustrate general asset class exposure, and not intended to represent performance of any investment product or strategy.

This post may contain references to third party copyrights, indexes, and trademarks, each of which is the property of its respective owner. Such owner is not affiliated with RHS Financial and does not sponsor, endorse or participate in the provision of any RHS’ services, or other financial products. Index information contained herein is derived from third parties and is proffered to you unaltered as we derived it from the third party.

RHS Financial, LLC is a Registered Investment Adviser. Advisory services are only offered to clients or prospective clients where RHS Financial, LLC and its representatives are properly licensed or exempt from licensure. This presentation is solely for informational purposes. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by RHS Financial, LLC unless a client service agreement is in place.

If the client is deemed suitable and agrees, RHS may employ leveraged strategies for these clients. Leverage attained through margin on a client’s account can add additional risk. While RHS tends to seek to improve return with theses strategies by applying leverage to less risky indexes, there is no guarantee that that RHS will lower risk or improve returns.

RHS Financial. 4171 24th St. Suite 101 San Francisco, CA 94114