Durable Power of What?

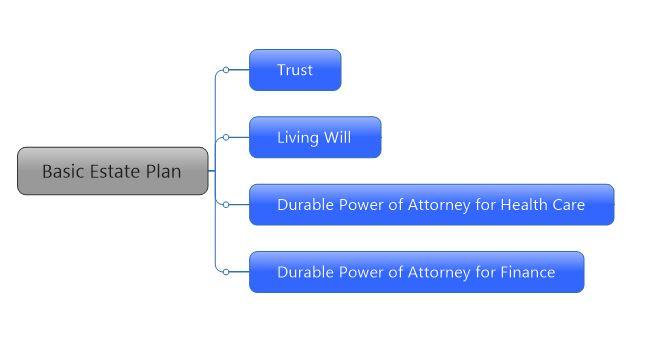

The trust and the living (pour-over) will make up the foundation of an estate plan. No estate plan would be complete without the two separate durable power of attorney, one for financial purposes and one for health care directives. The four listed four documents in the figure below make up a solid, well rounded estate plan for most everyone. This blog will outline the two and attempt to answer the most common questions I get asked about durable powers of attorney.

The Big Four of Estate Plans:

What is a durable power of attorney and more specifically, what does it do? A durable power of attorney sounds a bit scary I believe because of the word power, however, due to the fact that the power is only given under extreme circumstances, it should not be feared, rather it should be a testament to your planning prowess. A Power of attorney is a written authorization for an another person (agent) to “take over” the financial or health care directives of an individual (principal) if that individual becomes Incapacitated, hospitalized or otherwise incapacitated where that person is incapable of making decisions for his or herself. While some powers of attorney are temporary in nature, durable powers of attorney are irrevocable and therefore “durable.” The durable component is why they should be included in an estate plan.

Why would you want a durable power of attorney if you already have a will and a trust? The answer is simple, bad things happen to good people but they don’t always end up in something so finite as passing away. In the case of a principal becoming incapacitated the durable power of attorney for health care will “spring” into place and the agent designated by the durable power of attorney will take over the decision making processes for health care and finances. Also, since there are separate durable powers of attorney for health care and finance, there can be separate agents for dispensing these roles. For example, you might want your brother who is a CPA to handle your finances but your sister who is a doctor to manage your healthcare directives.

If I am married, doesn’t my spouse automatically get to make decisions for me if I am incapacitated? The best answer to that question is yes and no. In many cases if you are in an accident, coma or other incapacitated state, your spouse can make decisions on your behalf, but not all. That is when a durable power of attorney comes in. By making your spouse the agent in your durable power of attorney, you can avoid issues such as selling jointly held property or make sure that your wishes for health care are followed as you directed. While jointly held accounts will be ok, other assets like jointly held property such as real estate is more difficult to dispose of as a signature from the incapacitated principal is required. This can lead to serious financial strains on top of mental strain during such a hardship. Best to be prepared.

If I am married and both of us become incapacitated, what then? Generally, people assign their spouse as their primary agent but they can also assign a contingent agent to handle their affairs if their spouse is incapacitated or has passed on. When selecting this contingent agent, you should be very careful that they are someone you trust. You are after all putting your life and fortune in their hands. Choose wisely with such a big decision. People often think about family members for such an important, trusted role.

When should I set up durable powers of attorney for my estate? While I am not an estate planning attorney, it is best to develop a comprehensive estate plan all at the same time. Create, the trust, pour-over will and the durable power of attorney at the same time. If you already have some but not all of these components together, make sure that they are reviewed by an attorney to make sure that they are up to date and that they work together in synch.

Estate planning is complicated and should only be undertaken through the legal advice of an attorney and most certainly not this blog. The purpose of this blog is to help guide you on the estate planning process and get you to understand the main components of an estate plan. For example, many attorneys put the durable power of attorney for healthcare in the living will. While that is not how I have outlined it here as a separate document, it still is an important component of a solid estate plan. We encourage you to seek legal advice if you want to develop an estate plan and hope what you have read here will help you make smart decisions with your estate.

2024 Disclosures

RHS Financial is an SEC registered Investment Advisory Firm and distributes this presentation for informational purposes only. This presentation ( hitherto referred to as the presentation throughout this disclosure), blog post, infographic, slide deck or whatever form of informational modality the reader wishes to describe this as is provided for informational purposes only and should not be construed as investment advice in any way.

We believe the information, including that obtained from outside sources, to be correct, but we cannot and do not guarantee its accuracy in any way. RHS Financial uses information from outside sources to develop graphs, charts, infographics, etc. to enhance this presentation and while we believe the information from these outside sources, to be correct, we cannot and do not guarantee its accuracy in any way,

Any opinions or forecasts contained herein reflect the subjective judgments and assumptions of the authors who may be employees of but do not necessarily reflect the views of RHS Financial as a company. There can be no guarantee that developments will play out as forecasted. The information in this presentation is subject to change at any time without notice. This presentation contains “forward-looking statements" concerning activities, events or developments that RHS Financial expects or believes may occur in the future. These statements reflect assumptions and analyses made by RHS’s analysts and advisors based on their experience and perception of historical trends, current conditions, expected future developments, and other factors they believe are relevant. Because these forward-looking statements may be subject to risks and uncertainties beyond RHS Financials’ control, they are no guarantees of any future performance. Actual results or developments may differ materially, and readers are cautioned not to place undue reliance on the forward-looking statements. In a nutshell; these are our best guesses and please don’t assume they are fact.

Mentions of specific securities, investment products, investment indices, companies or industries should not be considered a recommendation or solicitation. Data and analysis does not represent the actual or expected future performance of any investment or investment product Index information is used to illustrate general asset class exposure, and not intended to represent performance of any investment product or strategy.

This post may contain references to third party copyrights, indexes, and trademarks, each of which is the property of its respective owner. Such owner is not affiliated with RHS Financial and does not sponsor, endorse or participate in the provision of any RHS’ services, or other financial products. Index information contained herein is derived from third parties and is proffered to you unaltered as we derived it from the third party.

RHS Financial, LLC is a Registered Investment Adviser. Advisory services are only offered to clients or prospective clients where RHS Financial, LLC and its representatives are properly licensed or exempt from licensure. This presentation is solely for informational purposes. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by RHS Financial, LLC unless a client service agreement is in place.

If the client is deemed suitable and agrees, RHS may employ leveraged strategies for these clients. Leverage attained through margin on a client’s account can add additional risk. While RHS tends to seek to improve return with theses strategies by applying leverage to less risky indexes, there is no guarantee that that RHS will lower risk or improve returns.

RHS Financial. 4171 24th St. Suite 101 San Francisco, CA 94114