Postmodern Finance is the underlying thesis of our investment process and all topics that enhance our ability to invest. This is an evolution of modern portfolio theory and takes a new perspective on investment management.

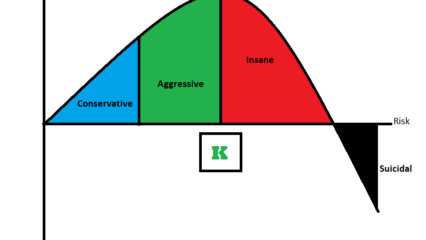

Testosterone is not an Investment Performance Enhancer

Finance, especially investment management, has traditionally been a male-dominated industry, often noted for its swashbuckling machismo, aggressive competitiveness, and otherwise male-high-school-jock-stereotype nature as in popular movies like Wall Street and The Wolf of Wall Street. In Michael Lewis's debut book Liar's Poker, about the time he spent working at a major investment bank, the top [...]