College is now out for summer and I see more interns walking around the financial district than usual at lunchtime. Seeing more of these young folks around made me think back to what I learned in college that I am still using today. Many of my long since forgotten classes no longer resonate with my current reality as a business owner, however, my general education class on Shakespeare left me with several philosophical lessons in life that still help guide me daily.

As a Certified Financial Planner™ I think the bard was very wise. Two quotes from two separate works stick out to me as relevant. Together, they are the very tenants of wealth creation and part of the framework for what I believe leads to financial success. If you implement the two in concert, success is likely assured.

The first piece of advice the bard makes is that you must always be investing. ““Foul-cankering rust the hidden treasure frets, but gold that’s put to use more gold begets.” – Venus and Adonis

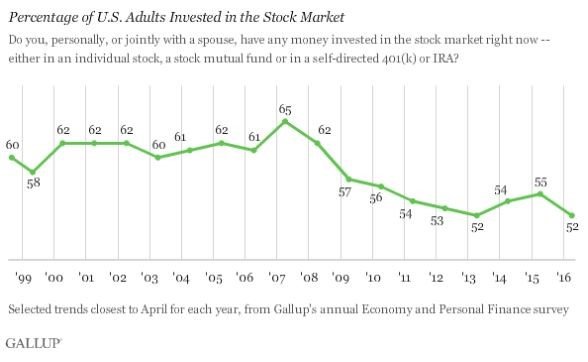

The poem refers to Venus, a goddess who is trying to convince Adonis – a mortal – to be her lover. While it isn’t directly referring to investing, she is saying that you cannot make gains if you don’t take risks. Or as writer Heather Long puts it, “putting money (or gold) under the mattress or burying it in the backyard doesn’t do much.” The simple lesson here is that you should be putting away as much as you can and let compound interest do the rest. Alas, sadly, most Americans don’t see the benefits of owning stocks as this chart below highlights.

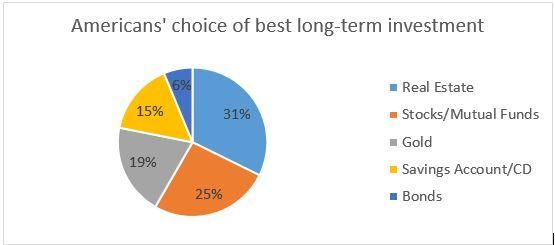

While evidence to the contrary is overwhelming, less than a quarter of Americans believe stocks are the best long-term investment.

Even worse, Americans have more than $11 trillion dollars of cash sitting in bank accounts, more than half the market capitalization of the entire US stock market. That much cash not being invested really shows that many Americans are shoving their cash under the proverbial mattress. Instead they should heed the advice of the bard and take action …but gold that’s put to use more gold begets.”

The second piece of advice the Bard gives is that you must be patient. “How poor are they that have not patience!’ -Iago in Othello

While we all know that patience is a virtue, in this fast-paced, instant gratification oriented modern world it is easy to forget that time, if used wisely, is on your side. At RHS Financial, we believe in value investing which historically over time has proved more profitable than many other strategies. Value investors must employ patience as there will be times that they will underperform but in the long-run, their conviction will pay out in the form of outperformance. During the late 1990’s pundits of growth companies had said that Warren Buffet had lost his touch. Where is Warren Buffet today and, more importantly, where are those pundits today? Take a look at the graph below that shows value stocks in the United States have underperformed their relatively expensive growth oriented peers in recent years.

If you look over the longer term however, you can see in the chart below that value oriented stocks have outperformed growth stocks. Since 1926, the cheapest 30% of stocks as measured by the price to book ratio have outperformed the most expensive 30% of the market by 3.3% a year in the US, resulting in an order-of-magnitude difference in final wealth. After reviewing these kind of results, we see the wisdom in the bard’s words “How poor are they that have not patience!’

History still has much to teach us. Centuries ago Shakespeare at Stratford upon Avon could never guess what Wall Street would mean to the World economy in 2016, he did however understand human behavior. That’s why he was such a good playwright. Most of his plays were based on love, lust, power, fear and greed. Many would say that fear and greed are synonymous with today’s markets . In many of his plays and poems, he encouraged people to focus on what they could control. The Bard’s centuries old advice is still relevant. Plain and simple, let’s make sure that we are always investing and that we have patience in that process.

Disclosures: This post is solely for informational purposes. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by RHS Financial, LLC unless a client service agreement is in place. Please contact us at your earliest convenience with any questions regarding the content of this post. For actual results that are compared to an index, all material facts relevant to the comparison are disclosed herein and reflect the deduction of advisory fees, brokerage and other commissions and any other expenses paid by RHS Financial, LLC’s clients. An index is a hypothetical portfolio of securities representing a particular market or a segment of it used as indicator of the change in the securities market. Indexes are unmanaged, do not incur fees and expenses and cannot be invested in directly.