Profiting from the Recklessness of Others

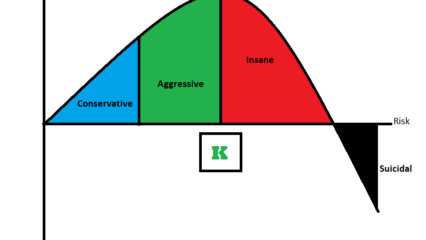

A couple months ago, I wrote about the dangers of levered ETFs, showing how these products designed to juice investor's returns end up eroding capital due to the subtle mathematical logic of compounding. In my last post, I followed up on the topic by describing the Kelly Criterion, a mathematical [...]