Alright, bring on the hate mail! As I promised in my last post, today I give you more than you ever wanted to know on why Bitcoin is an investment you should probably avoid.

I have resisted the temptation to write about Bitcoin on here for a while, partly because I am sure there is nothing I can say that will change the minds of the True Believers that this little-asset-that-could tends to attract, and it’s been obscure enough to outsiders that I didn’t think it worth going over in detail for them. But with the price of Bitcoin now at $6,000 and other crypto-currencies popping up by the hundreds I now feel it is almost my moral obligation to warn against anybody who will listen from jumping on board this cliff-bound bandwagon.

I have also been reluctant to make my bear case against Bitcoin because there’s a small chance that I will be absolutely, spectacularly wrong. I certainly have been for the last six years. I was skeptical of Bitcoin before it was cool, and have witnessed it increase in value more than four orders of magnitude despite my protestations. I’ve seen friends make small fortunes off a bet I’d told them only a sucker would make. And if they’re actually right, and Bitcoin does go on to “go mainstream” as a serious financial instrument, we might still have another few orders of magnitude left to go. But I wouldn’t bet on it, and I don’t think you should either.

Bitcoin is a Crappy Currency

I won’t spend much time here discussing what exactly Bitcoin is. For those who are unfamiliar (as well as for those who are), I highly recommend this recently published open letter to Jamie Dimon by Adam Ludwin (JPMorgan CEO Jamie Dimon has recently made several high-profile remarks ridiculing Bitcoin). I’ve found it to be the most sane analysis of the technical and economic dynamics of the crypto-market, and I will be excerpting from it throughout the rest of this post. But basically, Bitcoin is a medium that combines decentralized computing and cryptography to allow users to send payments to one another without relying on a trusted intermediary such as a bank or credit card company. This is the central innovation of Bitcoin, and whatever the ultimate destiny of Bitcoin itself, from a purely technological perspective it’s an extremely clever one. Any transaction that takes place in our economy that does not involve the immediate physical transfer of cash has always relied on financial intermediaries, especially banks. Checks, wire transfers, all of e-commerce, indeed the vast majority of economic activity thus involves one or more middlemen, each of which takes a cut, and each of which in today’s world is highly regulated, if not outright controlled by, the central government. And of course even cash transactions rely on fiat money issued and controlled by the government. Bitcoin, however, relies on none of this, but is the world’s first cash-like asset that can be quickly and securely sent to anyone in the world without relying on any centralized institutions such as banks or governments (again, for a description of how it accomplishes this read the letter linked to above or any of the other many summaries available online).

Bitcoin was started by the pseudonymous Satoshi Nakamoto in the depths of the 2008-09 financial crisis and from the beginning was fostered by a community of radical libertarians, anarchists, and others who were deeply suspicious of the government and modern banking system in a post-bailout world. Because of its computational sophistication, Bitcoin also gained early adoption from hackers, cypherpunks, futurists, and other techno-enthusiasts, making it the most fashionable investment trend among the Bay Area’s tech and alternative scenes. In many ways, bitcoin-enthusiasts are the 21st century version of gold-bugs, both generally viewing the modern system of fiat money and central banking as illegitimate, inefficient, incompetent, or otherwise prone to disruption and collapse. If you peruse Bitcoin forums you will quickly run into exactly the sort of thinking you would expect of a movement like this: conspiracy theories, crackpot economics, and predictions that the major fiat currencies of the world are on the brink of hyperinflation (nevermind the fact that since the end of the financial crisis and the beginning of Bitcoin inflation around the developed world has been close to zero). And just as gold bugs have been arguing, for the better part of 100 years, that the inherent inferiority of fiat money would soon become self-evident, forcing a return to the gold standard and a soaring price of gold as a result, so too do the most enthusiastic Bitcoin supporters believe that decentralized digital currencies will eventually become the primary, maybe even the only payment system people use anymore, replacing fiat currencies and forever wresting control away from the nefarious bankers secretly controlling the world. Power to the people! or something like that.

It would take an entire book (or better yet a class in monetary economics) to go over all the many, many reasons this line of thinking is deeply flawed, but the basic upshot is that for certain types of systems, especially monetary systems, centralization is, as a matter of fact, just inherently more efficient and generally better in most every dimension, making cryptocurrencies fundamentally flawed insofar as people want to use them as… currencies. In his letter Ludwin recognizes this fact explicitly (one of the only pro-crypto writers I’ve seen do so) and even prefers to call them “crypto assets” for this reason, a notation I will adopt throughout the rest of this post. From his article:

It’s not at all clear yet that decentralized applications are actually useful to most people relative to traditional software.

Simply put, you cannot argue that for everyone Bitcoin is better than PayPal or Chase. Or that for everyone Filecoin is better than Dropbox or iCloud. Or that for everyone Ethereum is better than Amazon EC2 or Azure.

In fact, on almost every dimension, decentralized services are worse than their centralized counterparts:

- They are slower

- They are more expensive

- They are less scalable

- They have worse user experiences

- They have volatile and uncertain governance

Ludwin goes on to argue that these are mostly inherent and not contingent inferiorities of decentralized services. In order to maintain the decentralization and cryptographic security that is the raison d’etre of these systems they must use a Rube Goldberg-esque set of protocols that consumes a large amount of computation and electricity and is necessarily more complex and expensive than centralized systems. Current use cases crypto-enthusiasts point to as examples where Bitcoin is potentially cheaper to use than mainstream payments systems – such as the international remittances market – do not demonstrate that Bitcoin is more efficient (it isn’t), but merely that current industry players (like Western Union) are benefiting from monopoly profits. The emergence of Bitcoin startups may make these markets more contestable and thus drive down the price of conventional services, but the notion that the world should adopt a slower and more expensive technology to drive out an imperfect but quicker and cheaper one is a bit like burning the house down and rebuilding it to avoid washing the dishes. The only real way in which crypto assets are superior to centralized payments systems is that they have what the community refers to as censorship resistance.

Censorship resistance means that access to decentralized applications is open and unfettered. Transactions on these services are unstoppable.

More concretely, nothing can stop me from sending Bitcoin to anyone I please. Nothing can stop me from executing code on Ethereum. Nothing can stop me from storing files on Filecoin. As long as I have an internet connection and pay the network’s transaction fee, denominated in its crypto asset, I am free to do what I want.

So using Bitcoin or other crypto assets is generally slower, more expensive, and just all-around suckier than using mainstream financial intermediaries, but is essentially inscrutable to the authorities. What does that make this technology good for?

The black market.

Though most activity in the crypto asset market is probably speculative in nature right now, it’s no secret that much of the usage as an actual medium of exchange is to facilitate transactions in drugs and other illegal contraband. The infamous Silk Road emerged in 2011, merely two years after Bitcoin even began, and was the largest Bitcoin-denominated marketplace in its two years of operations before being shut down by the FBI, selling over $1 billion USD worth of drugs, weapons, and other black market goods and services. And like Napster before it, the shuttering of the Silk Road merely saw myriad imitators on the dark web spring up to replace it. So while Bitcoin has struggled to catch on among traditional e-commerce retailers (Ludwin states that Bitcoin “has fewer mainstream merchants accepting it as a payment option in the U.S. today than in 2014.”) it has emerged as the preferred payment method at your friendly neighborhood cocaine and Uzi internet retailer.

Okay, so with all this in mind let’s return to the original question at hand: What is Bitcoin really worth, and is it currently overvalued? Lots of traders and analysts have been struggling to wrap their heads around the valuation of Bitcoin and other crypto assets. Bitcoin has no yield like with stocks or bonds or any other obvious valuation metric associated with it. Even the concept of purchasing power parity, often used to compare currencies against each other, won’t work as Bitcoin is not associated with a geographic region but is a purely digital, global medium. Instead, in order to get a handle on Bitcoin we need to get down to real economic basics and invoke the quantity theory of money. Those of you who ever took an intro macroeconomics course may remember what is probably economics’ most famous formula, the equation of exchange:

Where M is the money supply, V is the velocity of money (basically the amount of turnover in the money supply), P is the price level, and Q is the level of real expenditures. In words, the equation of exchange tells us that the total nominal size of the economy is equal to the value of money in circulation times the average number of times a unit of money is spent in a given time. This formula is an accounting identity: it’s true by definition, so given three known inputs we can easily find the forth, like the size of the Bitcoin economy, for example. The supply of Bitcoins, M, is currently about 16.6 million (this number will slowly increase for the next 123 years until it reaches its maximum value of 21 million). The annual velocity of Bitcoin is, perhaps surprisingly, rather close to the velocity of the US dollar M2 money supply at about 10. As I write this the USD to Bitcoin exchange rate is bouncing around a level of $6,000. This means that the total nominal size of the “Bitcoin economy” expressed in US dollar terms is approximately $998 billion ($99.8 Billion supply times a velocity of 10).

Okay, and what is the size we should expect, given Bitcoin’s use in the economy? There’s obviously little in the way of official statistics on this, but this site collects information from various sources to piece together the size of the world’s black markets. They estimate that the total global black market is worth $1.8 trillion. This is approximately 2% of the world’s economy, going towards things like (to take the top five goods on the list) counterfeit drugs, prostitution, counterfeit electronics, marijuana, and illegal gambling. This is the world Bitcoin aspires to inherit.

So if Bitcoin were to become the “official” currency of the global black market, then plugging the $1.8 trillion figure in for (P * Q) and dividing by the product of the current number of Bitcoins and their velocity, we arrive at an equilibrium exchange rate of about $10,900 per Bitcoin. That means Bitcoin is currently 45% undervalued. BUY!

Wait.

First of all, though Bitcoin was the original crypto asset and still the most widely adopted, it is far from the only one. Adding up the value of the hundreds of other “alt-coins” on the market, the total money supply of all crypto assets currently in circulation right now is about $172 billion. There’s a lot of debate among crypto-enthusiasts right now about whether Bitcoin’s first-mover advantage will allow it to remain the preeminent crypto asset of the future or if the supposedly superior technical features of any of the other alt-coins will give them the upper hand. You could debate further whether this will be a winner-take-all market with one crypto asset dominating all activity versus one where several assets exist alongside one another on relatively equal footing. Somebody who wanted to bet on the continued rise of the crypto asset market without favoring any particular coin might in principle want to follow an “index fund” strategy and buy a diversified portfolio of coins in relative proportion to their total market value. The point being, if we take the total $172 billion value of the entire crypto market as our baseline and plug in the same math as above, the overall crypto asset market is now currently priced to accommodate the total transactional volume of the global black market.

Secondly, read that last line again: the overall crypto asset market is now currently priced to accommodate the total transactional volume of the global black market. In other words, if all the markets around the world in cocaine, heroin, pirated software, smuggled cigarettes, human trafficking, child pornography, AK-47s, and so on go on to become denominated exclusively in crypto assets, then crypto assets are already fairly valued. How much of today’s black market business is currently done in Bitcoin? It’s impossible to get any good measure of this, but the figure is probably in the low billions of dollars at most. That’s enough uppers, downers, screamers, and laughers to bring Hunter S. Thompson back from the dead, but it’s a rounding error compared to the size of the respective markets in consideration. Black market transactions seem to account for a tiny minority of the Bitcoin economy (which seems to be mostly dominated by speculative activity) and Bitcoin transactions seem to account for a tiny minority of the black market economy (which still mostly does business in good old fashioned US dollars). This intersection of massive speculation around a price level that assumes a totally transformed future is a hallmark of bubbles, as in the dot-com era when people day-traded web-based companies that barely had a business model but were priced as though they would soon account for all the world’s consumer purchases.

Proponents have pointed out that Bitcoin has great uses for facilitating the “grey market” as well, especially in countries experiencing severe financial distress. Much has been made of the fact that many Venezuelans, in the face of their country’s current hyperinflation and economic collapse, have turned to mining Bitcoin to fund basic living expenses. Nonetheless, reports of these sorts of activities remain anecdotal and the degree to which Bitcoin has penetrated global gray markets is surely a tiny fraction of a percent. Thus, even granting that crypto assets may be useful as an auxiliary currency in failed states around the world on top of its black market usage, the market is currently priced such that it is implicitly forecasting a truly massive, orders-of-magnitude level increase in adoption of these assets as media of exchange. Euphoric optimism on this scale is usually a bad omen in finance.

Third, supposing Bitcoin or other crypto assets do go on to become a major force in global black and grey markets, governments of the world are almost certain to start clamping down on the crypto market. In this way Bitcoin’s success could actually be its own undoing. Governments really don’t like black markets, and have shown their willingness to spend huge sums of money and human lives in order to suppress them. Already governments (and the banking system by extension) are generally extremely wary of Bitcoin, even though the asset’s role in the black market so far has been a drop in the bucket. A few more high-profile Silk Road-like criminal cases could easily trigger a major backlash by the nations of the world. Crypto-enthusiasts often retort to this concern that there really is little the governments of the world can do to stop Bitcoin, a position that belies their naivete in my opinion. True, it would be practically impossible to enforce a ban on private citizens sending Bitcoin to one another, short of banning the internet. But it would be fairly straightforward to prohibit banks and other financial institutions from owning Bitcoin, transacting with parties known to be Bitcoin dealers, or allowing customers to transmit their deposits to or from Bitcoin exchanges. Keep in mind that for many decades the United States effectively banned its citizens from owning gold, so such a move would hardly be unprecedented. If the US and just a few other major countries issued such restrictions on crypto assets, banks in virtually every country on earth would likely follow suit, crippling the market. Though enthusiasts may imagine a self-contained economy, in reality currencies depend on being readily exchangeable for their value. When national currencies are sanctioned by the rest of the world, the next thing you see is devaluation and hyperinflation, and Bitcoin is likely to be no different.

Bitcoin is a Crappy Store of Value

Okay, so maybe Bitcoin won’t go on to become a major world currency, but what about its usefulness as a store of value? This is a phrase you hear a lot in crypto circles, and sometimes stated as boldly as claims about its imminent adoption as a global currency (e.g. “Bitcoin is the Most Stable Store of Value in History“). What makes Bitcoin unique, proponents argue, is that the total supply of Bitcoins that will ever exist is known with certainty; there will never be more than 21 million of them, and this makes it immune to supply shocks that other commodities or traditional stores of value are susceptible to (such as the widespread inflation that swept across Europe during the Renaissance as a result of the influx of conquistador silver and gold), and hence more attractive as a store of value.

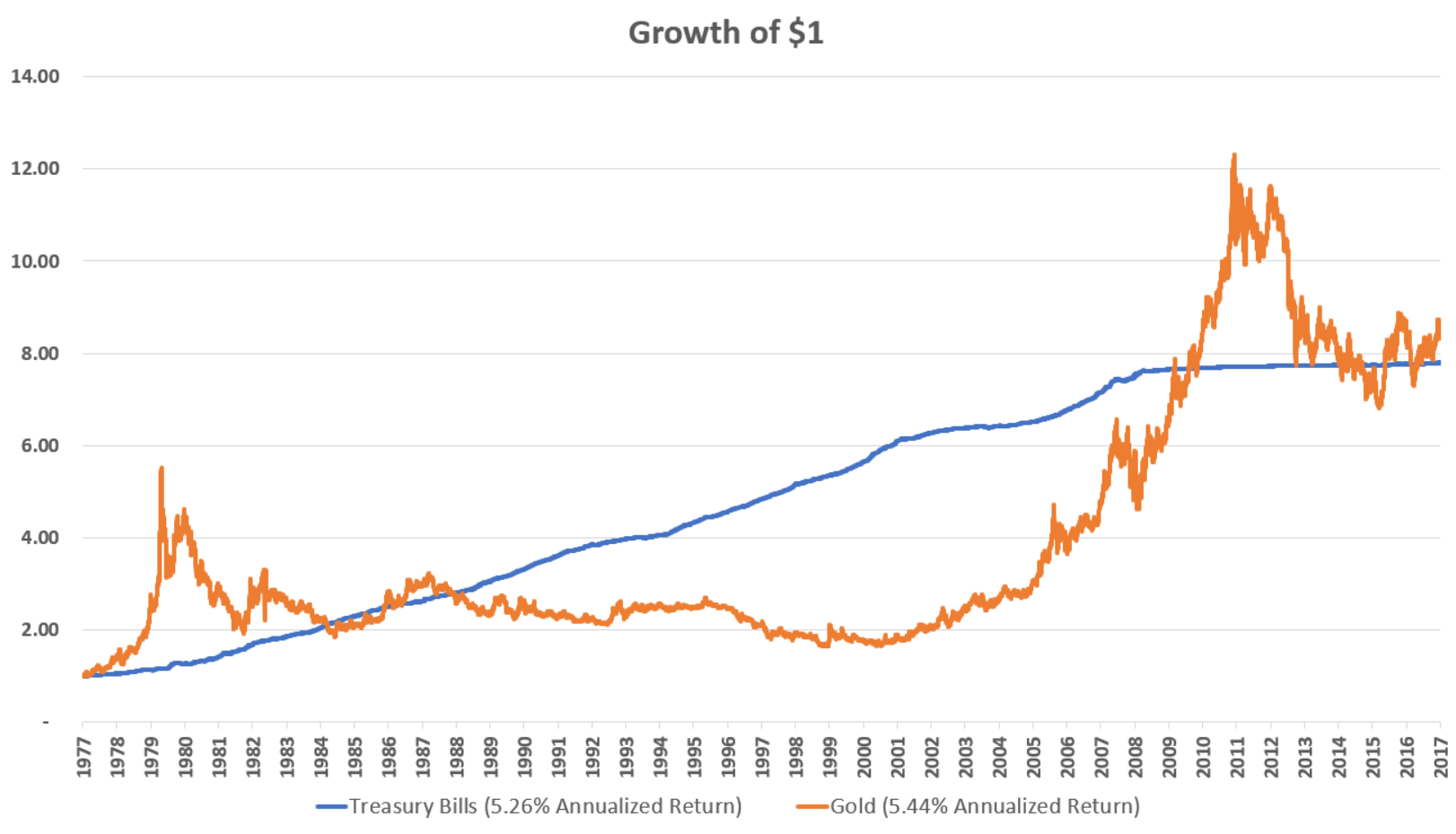

To this I respond: there really isn’t anything all that special about something having finite supply. I’ve noticed, for example, that Colby Davis paintings from his late high school period are in extremely short supply, fitting entirely in the back of my closet, and even though my mom says they’re nice, they don’t seem to command much in the way of a market premium. For something to be a store of value it has to be anchored by its demand for utilitarian purposes, so we’re back to evaluating Bitcoin as black market currency. But let’s set that aside for the sake of argument for now and take the store of value argument seriously. The thing is, stores of value really aren’t anything to get excited about. Economic theory tells us that a commodity with inelastic supply, steady real demand, and no significant correlation with other risky assets should appreciate at about the “risk-free rate”, i.e. the interest rate on short-term government bonds. Gold mostly satisfies these criteria, how has it done against this prediction over the long run? Below I plot the performance of gold against 1 year treasury bills over the last 40 years.

Gold has delivered almost exactly the same return over this 4 decade period as treasury bills, albeit with a tremendous amount more risk, spending years oscillating between over- and under-performance. This is the ironically hilarious thing about gold bugs and the gold market: the admonishments you hear to buy gold usually come in the same breath as dire warnings about skyrocketing government debt, but in the two generations since the end of the gold standard in the United States, gold has done almost exactly as well as… government debt. And so we should expect much the same from Bitcoin over the long run assuming its niche role in the economy gravitates towards some long-run equilibrium. In theory, the fact that Bitcoin’s supply is even less elastic than gold’s changes nothing about its long run expected return, but merely serves to make its price fluctuations more volatile[note]This is a simple consequence of price dynamics under varying supply elasticities, an econ 101 concept. Given a change in demand for a good, the more elastic its supply the more the quantity supplied will change to accommodate the demand shift, diminishing the price impact. For a good with perfectly inelastic supply such as Bitcoin, a shift in demand results in the maximum possible change in price, as price (instead of quantity) is the only variable available to equilibrate the market.[/note] detracting from its usefulness as a store of value.

Now, I don’t mean to sound too harsh on gold. Even if we only expect modest returns around the risk-free rate (currently about 1.4%) from the yellow metal, its low correlation to stocks and bonds means it’s potentially useful in small amounts for reducing the overall volatility of a portfolio as part of a strategic asset allocation. That’s all fine and good, but when I talk to people who are excited about Bitcoin, or when I see ads like this…

…it’s pretty clear to me that these people are not excited about using small allocations to Bitcoin to slightly reduce their portfolio volatility while earning modest positive returns on their capital, true to the “store of value” argument, they’re expecting to get rich quick.

Even if we do look at Bitcoin through a portfolio lens its extreme volatility makes it all but worthless as a diversifying asset and a store of value. Looking at the last year’s worth of daily returns the annualized standard deviation on the S&P 500 has been about 7.5%. This means that for this level of volatility, we would expect 95% of the observations to fall within 15 percentage points plus or minus it’s expected average return. So if the expected return on the S&P 500 is about 5% right now, that means there’s about a 95% chance the return over the next year will be between -10% and +20%.[note]Stock market volatility has been remarkably low over the last year. The long run average annualized standard deviation on the US stock market is closer to 15%.[/note] Gold is a bit more volatile with a standard deviation of 12.8% over the last year. But Bitcoin is more than ten times as volatile as the stock market with an annualized standard deviation of 78%! Even though Bitcoin has thus far shown no correlation with the stock market, at this level of volatility the amount of Bitcoin an equity investor looking to reduce portfolio risk should hold is zero. Even a 1% allocation only increases risk; this is in stark contrast to gold, to which a 30% allocation would have minimized portfolio risk for an S&P 500 index investor over the last year.

To give a better sense of what this kind of volatility means, assuming the expected return on Bitcoin is equal to the risk-free rate, then there’s about a 10% probability that the realized return on Bitcoin over the next year will be -100% or lower! Yes, I know, you can’t have a return that’s less than -100%. These sort of statistics break down at such extreme values, but I think this gives us a good ballpark estimate of how likely Bitcoin is to become completely worthless in the near term, and it’s easy to see how the psychology would match up with the statistics. Bitcoin has pretty much only gone up over this last year, but in finance anything that goes up can (and eventually will) go down by a roughly equivalent amount. A one standard deviation move down[note]15% probability[/note] on Bitcoin at this point would mean a fall in the price of a few thousand dollars, putting all the recent speculative buyers deeply in the red. The most likely response is for them to panic and sell out, pushing the price down further and putting earlier and earlier investors into the red, setting off a chain reaction downward. But because Bitcoin has no intrinsic value like stocks or real assets, there is no obvious floor beneath which value investors will step in and defend the price. Bitcoin, like Tinkerbell, only has power because we believe in it. That belief has been strongly reinforced recently as the believers have been handsomely rewarded, but that chain of logic can just as easily be unwound the other direction.

So, to summarize:

- The long-run equilibrium expected return on Bitcoin and other crypto assets is approximately equal to the risk-free rate, currently less than 2%.

- Bitcoin is currently priced in anticipation of an equilibrium in which it achieves widespread adoption orders of magnitude greater than it already has.

- There is little evidence that non-speculative use of Bitcoin has dramatically increased recently, and good reason to suspect it’s unlikely to.

- If Bitcoin remains a niche asset at roughly its current level of non-speculative use, then it’s probably massively overvalued and a correction of 50-80% seems reasonable, a figure corroborated by volatility statistics.

- Given a sufficiently large devaluation, it’s plausible that investors could lose confidence in crypto assets in a chain reaction that completely destroys the market and drives the price to zero.

Still interested?

Bitcoin is a Lottery Ticket

I mentioned at the beginning that I could be wrong about Bitcoin. Is it conceivable that Bitcoin and/or other crypto assets might become major forces in global commerce, legitimate or otherwise? Is it conceivable that Bitcoin might supplant gold as the internationally recognized safe-haven commodity? I suppose stranger things have happened. If Bitcoin’s most enthusiastic supporters are right, we still have a long way to go. While Bitcoin’s current $100 billion valuation strikes skeptics as preposterous, it’s still a far cry from the estimated $7.7 trillion the world’s gold reserves are worth, to say nothing of the value of US dollar money markets.

And even if Bitcoin never grows beyond its currently tiny niche uses and it is in a bubble, there’s really no telling how big this bubble can get. The last two bubbles in this country, the housing and dot-com bubbles, each involved trillions of dollars and widespread participation by the American public. Crypto assets, on the other hand, are still relatively unknown outside of their diehard following, and they remain relatively difficult for investors to access, especially at large scale. This could soon change as a Bitcoin ETF seems likely to be around the corner, after years in the making. This would mean that any investor with a brokerage account could instantly and easily buy Bitcoin to their heart’s content. It’s easy to see how opening the floodgates like that could give way to a tidal wave of newfound speculation driving the price higher still. Like in past bubbles, there are plenty of buyers out there who don’t necessarily believe in the long term fundamentals of Bitcoin, but think the bubble will continue to inflate and that they will be able to sell at a higher price to a greater fool. I don’t have a strong sense of how rational such a strategy may or may not be, only that it’s a fairly risky game to play.

This is all to say that Bitcoin looks a lot like a lottery ticket right now, probably most likely to lose money, but with a small chance of winning big, at least for a little while. Financial markets often offer lottery-ticket-like assets, and usually they’re a pretty bad deal, but they can be a lot of fun, which is certainly true of Bitcoin.

So, if you’ve been thinking about buying Bitcoin (or already have and are wondering whether now is the time to cash in) this is how you should think about it: as a fun lottery ticket. Not as part of your asset allocation or long term investment strategy, but as a reasonable alternative to a weekend in Vegas. Don’t invest any more in it than you’re comfortable losing entirely, probably less than 1% of your net worth (full disclosure: I own a small amount (less than $1,000 worth) of Bitcoin and Ether), and put it away and don’t touch it until it’s either shot to the moon or crashed to the floor. Either way you’re in for an exciting ride. And if you have absolutely no interest in strapping any amount of your hard-earned money into an unfinished roller coaster: first of all congratulations on being a reasonable person, and secondly don’t worry, I’ll be back with tips for less-insane financial markets next time.

This cannot be construed as a solicitation or recommendation to purchase a security(ies) as RHS Financial and its opinions are subject to change given varying market conditions and the relative time horizons and risk parameters of its clients. The strategies and performance is based upon what we believe to be reliable and correct sources but cannot be guaranteed.

RHS Financial, LLC is not responsible for errors or omissions in the material on third party websites, and does not necessarily approve of or endorse the information provided. Users who gain access to third party websites may be subject to the copyright and other restrictions on use imposed by those providers and assume responsibility and risk from use of those websites.

Disclosures: This post is solely for informational purposes. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by RHS Financial, LLC unless a client service agreement is in place. Please contact us at your earliest convenience with any questions regarding the content of this post. For actual results that are compared to an index, all material facts relevant to the comparison are disclosed herein and reflect the deduction of advisory fees, brokerage and other commissions and any other expenses paid by RHS Financial, LLC’s clients. An index is a hypothetical portfolio of securities representing a particular market or a segment of it used as indicator of the change in the securities market. Indexes are unmanaged, do not incur fees and expenses and cannot be invested in directly.