Recently, the WSJ reported on two positive credit trends in the US Economy. Individually, these trends are very positive for a growing economy, however, in combination, they could potentially be the foundation for another credit bubble way down the road.

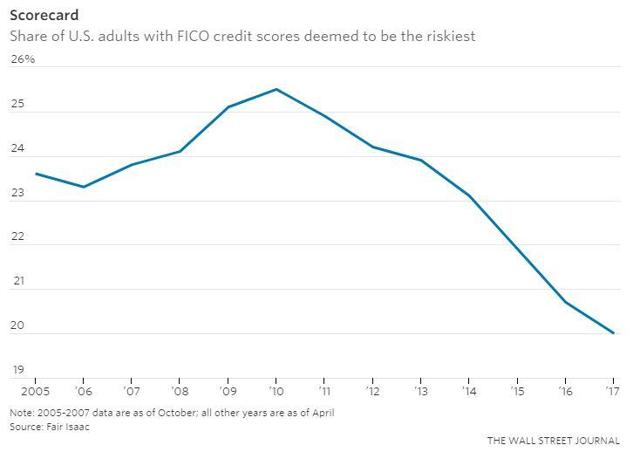

Credit scores for US consumers hit record levels last month with the average score nationwide at 700. That is a very positive statistic. Those consumers deemed the riskiest have dropped from nearly 26% of the nation in 2010 to 20% in 2017 according to credit scoring firm Fair Isaac. This group of higher credit risk Americans have gotten more credit worthy and are now just beginning to be able to get loans and credit cards previously unavailable to them. Moreover, many people who suffered foreclosures and bankruptcies will soon see those credit events “fall off” their credit reports. This will dramatically increase their capacity to borrow soon, the question is do they have the requisite capacity to pay what they borrow back? After repairing their balance sheets on paper, will they borrow again like they did before and perhaps get in trouble again? No one knows, but they will shortly have more options for sure.

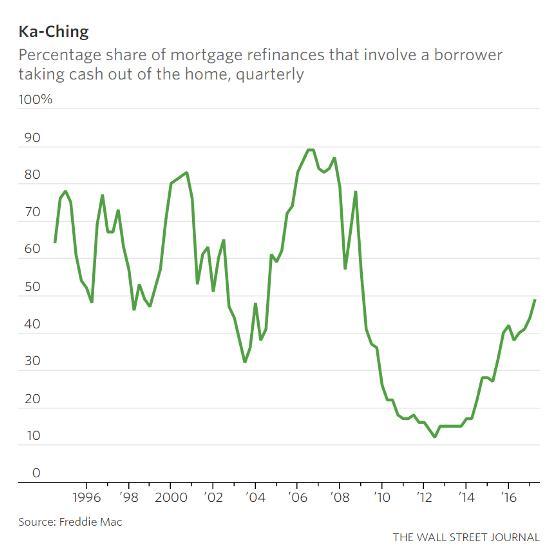

There is little doubt that more credit card and loan approvals will likely have a positive demand driven ripple effect on the economy. Since the economy began its prolonged recovery in 2010, housing prices are again near their peaks and in some areas, they have surpassed the levels we saw at their peaks in 2007. A flood of people who have been forced to rent due to their poor credit scores may re-enter the housing market further driving up prices of homes that they may not ultimately be able to afford. Combine that with the fact that according to the WSJ, nearly half of borrowers who refinanced their homes in the first quarter chose to cash out in exchange for equity built in their home. The Cash-out option when refinancing is what I call the second credit-threat. Refinance rates are currently at historic lows and the cash-out option is an easy way to borrow money cheaply.

This begs the question, what are they using that money for? With 2.65 Trillion dollars still sitting on the sidelines in money market funds, what on earth are people cashing out equity in their homes for? Is it to set up a rainy-day fund, pay off other debt or go on vacation? What exactly is it?

I see this double threat as a potential problem that could eventually build into a bubble again. While Freddie Mac is quick to point out that the amount of money Americans are taking out in cash is significantly less that what they were doing back in 2006, the amount is increasing as the graph above points out and if interest rates remain at historic lows, I see a trend building here. If you combine this trend with many new potential homebuyers of the riskiest ilk starting to home shop again, we could potentially see another bubble that no one wants to burst.

Disclosures: This post is solely for informational purposes. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by RHS Financial, LLC unless a client service agreement is in place. Please contact us at your earliest convenience with any questions regarding the content of this post. For actual results that are compared to an index, all material facts relevant to the comparison are disclosed herein and reflect the deduction of advisory fees, brokerage and other commissions and any other expenses paid by RHS Financial, LLC’s clients. An index is a hypothetical portfolio of securities representing a particular market or a segment of it used as indicator of the change in the securities market. Indexes are unmanaged, do not incur fees and expenses and cannot be invested in directly.