In my last post I wrote about how the financial industry, led in particular by asset manager BlackRock, may begin putting pressure on the private sector to reduce carbon emissions and otherwise adopt more environmentally friendly practices, for entirely self-interested, profit-motivated reasons. Since then, I’ve been thinking a lot about the future of energy production and fossil fuels, and am starting to wonder if the many trillions of dollars of oil, gas, and coal assets in the world might be overvalued.

It’s hard to notice unless you’re paying attention, but we seem to be in the midst of a sea change in opinion surrounding energy and fossil fuels. BlackRock is hardly the only financial institution going green: State Street pegs the total global assets devoted to ESG (Environmental, Social, and Corporate Governance) Investing at over $21 trillion. That’s a substantial fraction of the entire world’s wealth, and is up from a virtually insignificant sum just ten years ago. ESG investing encompasses a variety of goals and strategies, but an emphasis on pushing the world towards the adoption of clean energy is a common theme. Institutional investors around the world are rapidly choosing to either deprive the fossil fuel industry of their capital, or agitate them for greener policies through their shareholder votes.

Energy companies of course are taking notice, and if you look on the websites of ExxonMobil or BP, for example, you’ll find plenty of material on how they are working to increase energy efficiency, invest in renewable energies, and reduce carbon emissions. The CEO of Royal Dutch Shell recently took a decidedly more dramatic stance and stated that the public’s trust in the industry was disappearing and called for the adoption of a carbon tax. Meanwhile, Shell will be investing $1 billion a year in renewables.

Governments around the world are increasingly moving to cut carbon emissions. 143 member states have now signed the United Nations’ Paris Agreement, which seeks to reduce carbon emissions enough to prevent average global temperatures from rising 2 °C above their pre-industrial levels. On the heels of this, China – the world’s largest greenhouse gas emitter – has recently announced plans to substantially cut its use of coal. Finally, the American public, long a source of environmental skepticism, is growing increasingly convinced of and concerned about the effects of climate change, according to Gallup polls, and a majority wish to emphasize environmental protection over economic growth.

Here Comes the Sun

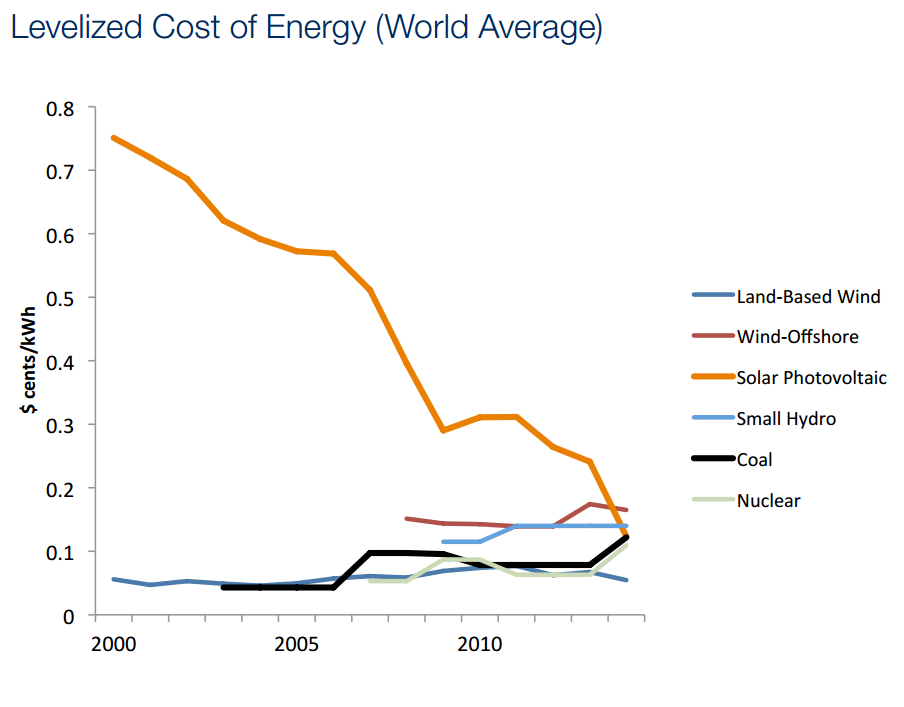

We might be tempted to dismiss all of this as cheap talk if it weren’t for this graph:

This is the levelized cost of energy of different sources over recent years, which attempts to standardize the various capital, fuel, and other costs that are associated with delivering a given amount of electricity, while also backing out the effect of taxes and subsidies. Even just a few years ago, solar energy was a prohibitively expensive means of generating electricity without heavy government subsidies. But efficiency has been increasing exponentially in the technology and now it is cheaper to generate power from the sun than from fossil fuels on a large and growing fraction of the earth’s surface. In 2015 renewable energy accounted for the majority of new energy capacity added around the world for the first time, and the last couple years have seen several high-profile milestones in solar’s competitiveness: in September 2016 Abu Dhabi (not exactly known for its strong stance against fossil fuels) announced plans to build a solar power plant that would generate electricity at a record low of 2.42 cents per kilowatt-hour, about half what it would cost to run a gas-powered plant.

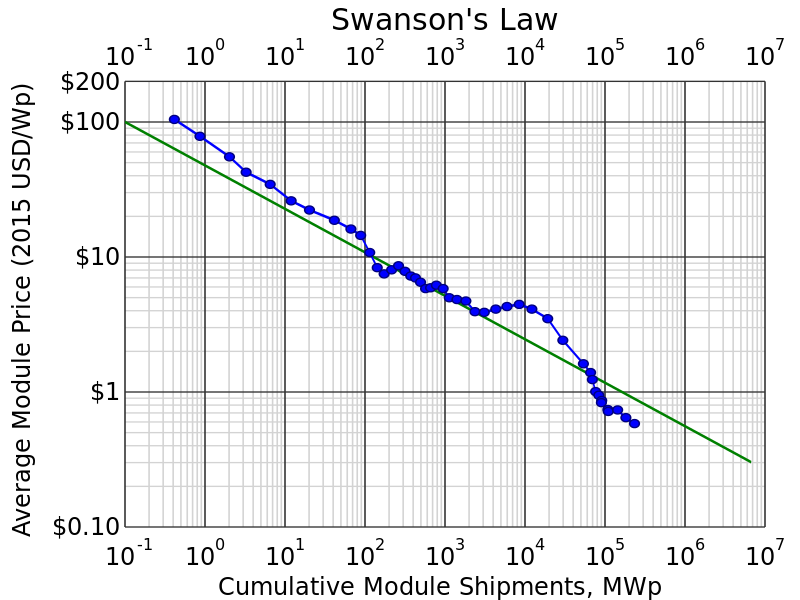

Solar photovoltaic cells are essentially a semiconductor technology and have followed a Moore’s law-like path (sometimes dubbed “Swanson’s Law”) of increasing cost-efficiency for decades.

Source: Wikipedia

Solar currently only accounts for about 1% of global energy production, but now that it’s become cheaper than traditional energy sources in a growing number of markets, there’s good reason to believe it should start rapidly gaining ground against fossil fuels. Soon, almost all new electric power plants (which are mostly built in developing countries) will be solar; after all, why pay more for dirtier technology? Meanwhile, coal and gas-fired power plants are on average much older than their renewable peers, especially in the developed world, and closer to the end of their useful lives. It may only be a few more years before we start to see more fossil fuel powered plants closing than opening, a process likely to be sped along by regulatory pressures.

All this seems to point to a rather startling conclusion: now that solar energy is cost competitive with fossil fuels, if its cost keep falling from here at a rate of about 10% per year, as it has for the last 40 years or so, then the prices of fossil fuels could start falling by a roughly similar amount. This is straightforward economics: prices are set by the intersection of marginal buyers and marginal sellers. Marginal consumers of fuel are mostly new power plants (mostly in developing countries) as well as new vehicle users (again, mostly developing country consumers, as well as shippers). As these consumers rapidly opt for solar power generation and electric vehicles, this should cap demand and potentially put a ceiling on how far fossil fuel prices can rise. Meanwhile, as solar energy producers competitively bid down the price at which they deliver electricity, existing fossil fuel-based plants will be forced to offer lower rates even in markets where they do not yet directly compete, because given a large enough disparity, somebody eventually will open a new solar plant and compete away the profits, or households will just cut out the middleman and install rooftop solar. A similar dynamic plays out in the transportation market: a falling cost of solar means a falling cost of electricity means a falling cost of operating an electric vehicle (by the way electric vehicle batteries have been following a similar declining cost curve) relative to a gas-powered one. The price of gasoline will thus have to fall to keep the cost of maintaining an existing gas vehicle competitive with the alternative of scrapping it and buying an electric one.

Is the Market Overvaluing Fossil Fuels?

Maybe. To be fair, the price of fuel has generally fallen over the last decade despite rising demand:

WTI Crude Oil Spot Price data by YCharts

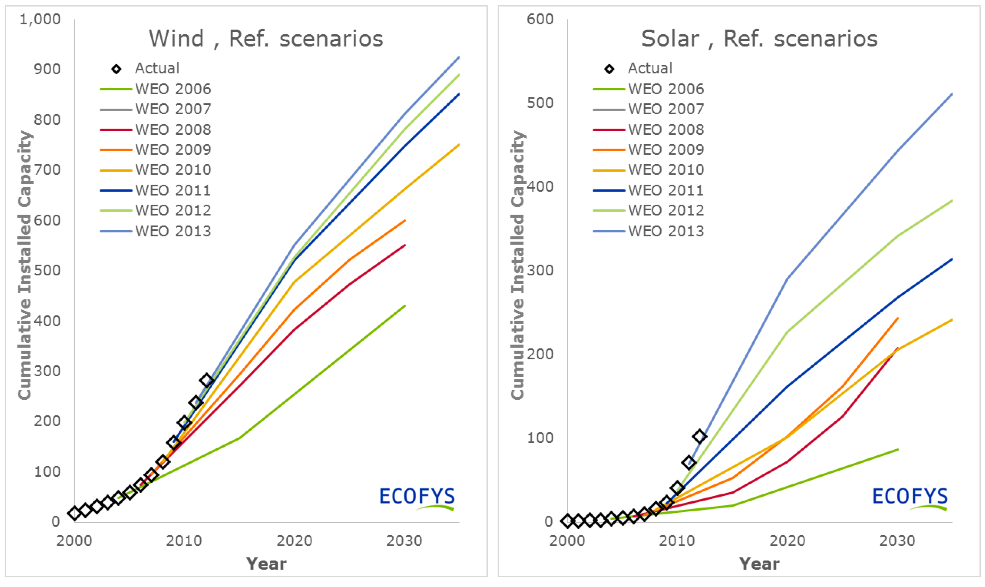

But this is mostly attributed to supply side innovation, namely fracking. The energy outlooks published by governments, energy companies, and the financial industry still tend to take continuously increasing demand for oil and gas for granted. Vox has recently put out a couple articles describing how these “official forecasts” have consistently underestimated solar and wind adoption, including this delightful graph:

These are annual projections from the International Energy Agency’s influential World Energy Outlook. Every year they have increased their forecast for how much market penetration renewable energy will achieve and yet have still underestimated what has actually come to pass. Projections like these or the US Energy Information Administration’s Annual Energy Outlook tend to err too far to conservatism, typically assuming no change in public policy beyond whatever currently exists at the time, and only modest cost-efficiency improvements in photovoltaic cell and battery technologies. And thus the EIA anticipates a measly 3-4% growth in solar capacity (it has been over 30% worldwide in recent years) to become about 8% of the US’s total capacity by 2040. Electric vehicles are projected to account for 6% of global market share by 2035. These assumptions trickle down to the forecasts published by oil majors like BP and ExxonMobil, as well as to the financial analysts who follow the energy industry. And thus most of the participants in the market seem to be assuming that global demand for oil and gas will pretty much keep increasing forever. (Shell again stands out for being unusually bearish on its own industry, predicting oil demand will peak around 2020.)

A recent report by the independent Carbon Tracker Initiative claims these industry projections are far too conservative. They see a much different future for energy by making what seem to me like two pretty reasonable assumptions:

- Nations will actually try to achieve the carbon limits agreed to at the Paris Agreement and use policy to reduce emissions and encourage renewables.

- Cost efficiency improvements in photovoltaic cell and battery technologies will continue at about the same rate they have been for many years to come.

Under this scenario demand for oil would peak around 2020, then plateau for about ten years before falling steadily into eventual obsolescence. Electric vehicles would make up a third of the market by 2035 and half by 2040.

Suffice it to say this would be a pretty big deal. If trends do indeed play out as they have been, then oil and and other fossil fuels are likely already significantly overvalued in the market. Could investors really be overlooking such a tremendous development? I think it’s possible; we know from behavioral economics that investors (and people in general) are prone to status quo bias, and likely to act as if the current state of affairs is natural and everlasting. But one must always be cautious when deciding to declare the collective wisdom of the market mistaken. So please don’t go shorting oil because of this post. The commodity is still prone to large upswings on geopolitical news and will be for some time. And of course, I could just be wrong about all of this (it wouldn’t be the first time!). Count me as a tentative fossil fuel bear, but what I’m more confident about is how much consumers (not to mention the environment) will benefit.

Disclosures: This post is solely for informational purposes. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by RHS Financial, LLC unless a client service agreement is in place. Please contact us at your earliest convenience with any questions regarding the content of this post. For actual results that are compared to an index, all material facts relevant to the comparison are disclosed herein and reflect the deduction of advisory fees, brokerage and other commissions and any other expenses paid by RHS Financial, LLC’s clients. An index is a hypothetical portfolio of securities representing a particular market or a segment of it used as indicator of the change in the securities market. Indexes are unmanaged, do not incur fees and expenses and cannot be invested in directly.