Imagine an alien race with no concept of money was observing the earth from afar, trying to understand us humans. What might they say about our civilization? I imagine their reports might sound something like this:

The humans are unparalleled in their propensity to cooperate in order to achieve their common good. Most people do not concern themselves with finding their own food and shelter. Instead, they spend much of the day working on specialized tasks that help others. When they are done with their tasks they may go to a special building that contains large amounts of food and simply take the foodstuffs they want. Other people spent their day creating each of the food items there, and most never meet the people who take the food, but nobody seems concerned with this strange arrangement. Similarly the humans may go to special buildings containing clothing, or tools, or other useful items and simply take the items they wish there as well. Eventually the humans return to a building in which they live. Typically this building was made by other groups of humans who the current inhabitant never met.

For centuries the humans have used this arrangement of specialization and sharing to make their surroundings more safe, comfortable, and generally pleasant. Increasingly, the older humans choose to stop working, but are still allowed to take the food and other items they need, and other humans still tend to them. The sick and enfeebled are taken care of by other helper humans. The young live lives of leisure until they mature and are taught skills by unrelated adults. In all, the humans seem to be almost perfectly selfless creatures, concerned primarily with the advancement of some grand, species-wide project with no apparent leader.

Naturally, that’s not how the situation usually looks to us. We know we have a secret technology that underlies and explains all our seeming altruism. That technology, of course, is finance.

The Soul of Finance

Throughout this series, I have been telling the story of finance as I see it: it’s past, present, and future, the things we have learned and the problems we’re still grappling with. To finish, I want to answer the question, why bother? What good is finance, and why should we care beyond self-interest in our own pocketbooks?

If you look up the definition of finance in a dictionary, it will probably say something about the bringing together of borrowers and lenders, the pooling and management of risk, or something along those lines. This definition isn’t wrong exactly, but it doesn’t quite get at the heart of the matter. Personally, I prefer to wax a bit more poetic: Finance is the practice of coordinating human action.

If you’re reading this you are probably a professional living in the developed world. How is it that you are able to spend your days at work on activities that likely have nothing to do with the production and distribution of the everyday luxuries and necessities you enjoy in your leisure, confident that others will do the work required to put food on your plate and a roof over your head? You know of course that the answer is “money” but there’s much more to it than the notes in your pocket or the bits in your bank account, and why do you have such faith in the power of money to provide for you in the first place? Why does money seem to work so well here and now while at other times and places it becomes so worthless that it is weighed rather than counted? We are quick to acknowledge that the modern world is a marvel of scientific and technological achievement, but perhaps even more fundamentally it is a marvel of cooperation. From the pyramids at Giza to the Empire State Building to the iPhone, the milestones of civilization have all been the works, not of some lone genius, but of countless ordinary people discovering ways to come to agreement on how to work together towards a common goal. Even the common #2 pencil lying on your desk could not exist but for a global network of coordinated human efforts.

In his recent book, Money Changes Everything, economic historian William Goetzmann writes a sweeping world history of finance, detailing how behind the watershed moments in human culture from the advent of writing and time-keeping to the European Renaissance there were always financial innovations that facilitated our advance: the first coins and currencies, loans and other financial contracts, merchant banks and securities markets. Goetzmann describes finance as the “master technology” of humanity and a sort of time machine: at the root of all financial activity is the shifting of resources and obligations through time. Whether you are taking out a mortgage to buy a house, purchasing insurance, or trading futures contracts on oil, you are in effect making a promise to one or more parties that you will direct your efforts or resources in some prescribed manner over some set of time, with the understanding that your counterparty makes a similar promise to provide a complimentary value over time as well. This web of assurances more concretely ties our future to our present and frees us to focus our energies on concerns greater than meeting our immediate needs. Though he probably didn’t realize it, the first Mesopotamian trader that accepted slabs of clay or a lump of shiny metal for his goods, not because he wanted them but because he knew he would be able to offer them in the future to somebody who would, laid the first brick in the edifice of modernity, a monument built upon our promises to one another.

The problem with promises, of course, is that sometimes they are broken. Because of this, and the innate tension between the abstract and calculating nature of finance and the intimate nature of our livelihoods and ambitions, financiers and speculators have gotten a bad rap for as long as they have existed. From Jesus Christ casting the money-changers out of the temple to the Occupy Wall Street movement, critics have long found reason to fault the financial industry for the problems of the day. Today, we recognize that natural disasters like floods and earthquakes are the consequence of an unthinking, chaotic world, but economic disasters still hold a moral character to them, one that has charged political movements, wars, and revolutions throughout history.

Above: The Great Mirror of Folly, a Dutch depiction of the world’s first stock bubble in 1720. Below: New York Times cartoon depiction following the 2008 financial crisis. Some things never change.

I am under no pretenses that today’s financial industry is perfect and that every investment banker has a heart of gold. Nor do I wish to make a basic defense of capitalism against the few remaining Marxists out there. Most people recognize that finance is a mixed bag, but that services like banking and insurance are an essential part of modern life. But there is still a pervasive skepticism about the role of money and financial markets in our culture, one that is shared across the political spectrum by people from all walks of life, including even by many who work in the financial industry! I would boil this common modern sense of skepticism down to three sets of interrelated ideas and attitudes, as follows:

- Trading is a zero-sum game.

- Financial markets contribute nothing to the “real” economy.

- Economic growth and rising wealth don’t make us any happier or more fulfilled as human beings.

Or, in the words of Paul McCartney, “money can’t buy me love.” With all due respect to Mr. McCartney, I wish to show that he is being too pessimistic.

Arbitrage Improves Capital Market Efficiency

Today no view seems more widely accepted among educated investors than the notion that active investing is a zero-sum game, or worse, a negative-sum game. The basic idea goes like this: when we refer to “the market” in investing, we are referring to the sum total of all assets held by investors. When we say the market went up, that simply means that in aggregate the assets that investors hold went up. For any particular investor to have investments that went up more than the market, or “outperformed”, that means there must necessarily be another investor(s) whose assets did not go up as much, or underperformed. Active investing, the attempt to “beat the market”, is thus a zero-sum game in that, no matter their efforts, investors in aggregate will earn the market return before costs, and in aggregate earn less than the market return by the amount of the total transactions costs and management fees they pay. For many, the implication of this logic is that professional investors are no different than gamblers; they add no value to society, as any profits they make for their clients or themselves are offset by the losses of others. Passive investors take this to mean that you should just buy index funds at the lowest possible cost, but even active investors will commonly acknowledge the zero-sumness of trading, cynically believing they can play the winning hand at a table with a limited number of chips.

This is all completely wrong and the fact that the financial industry keeps repeating this dim view of itself is a pet peeve of mine that is slowly driving me mad.

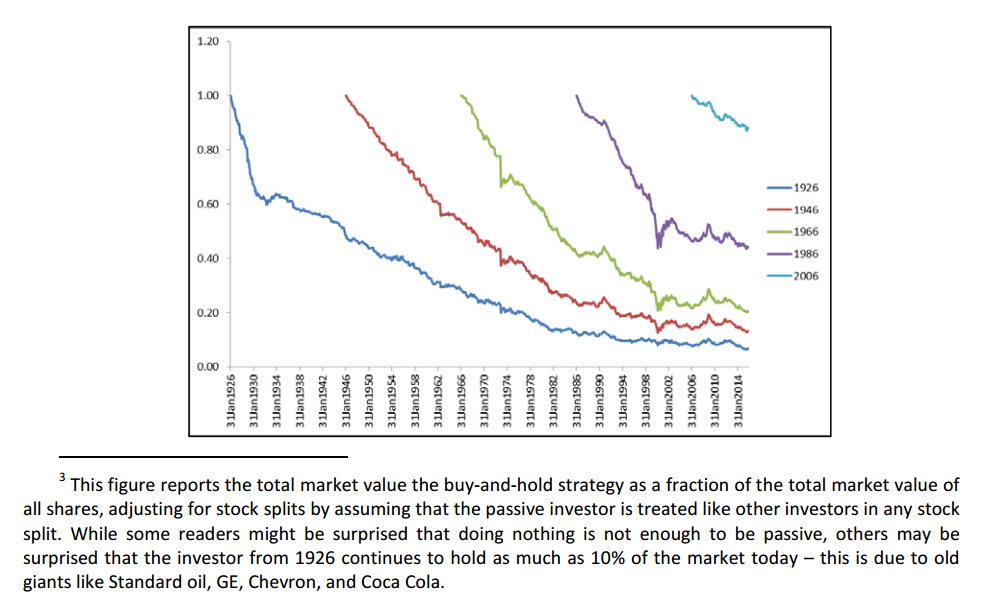

First of all, note that saying “all investors in aggregate must earn the market return” is simply a tautology along the same lines as “not everyone can be taller than average.” The activity of all investors must add up to the market return because the activity of investors is the market. The sneaky assumption that is smuggled into the zero-sum argument is that the market return is predetermined; active investment can’t change it. Now, if we zoom in and look at trading activity at the level of minutes or microsecond ticks, this is true. There are only so many securities in the world, and if I buy shares of XYZ that can only mean that somebody now owns less of them. But over time the market itself will change composition as new companies go public, old companies are de-listed, and other corporate events alter the opportunity set available to investors. Indeed, this is the reason the market exists in the first place! What’s more, in trying to find the right investments, active investors bid market prices up or down in a way that influences how capital is allocated in the economy. In a recent paper Lasse Pedersen looks at this sort of “turnover” in the market and finds that it’s quite substantial. One way to consider it is to look at the market at any given time, if you had bought every stock that was listed and held on, never trading again, how would your share in the market change over time? Pedersen finds that an investor who bought every stock in the US in 1926 would only be holding about 10% of today’s market.

Said differently, a passive investor must actually trade quite frequently in order to earn “market returns.” This opens the door for a variety of ways in which active investing and the search for arbitrage can and does perform essential functions for the economy. These functions include:

- Providing liquidity. Active investors, passive investors, corporations, and other capital-raising institutions must interact with the market, buying, selling, issuing, and redeeming securities. Everyone benefits the more these transactions are quick and inexpensive. The trading activity of active investors and arbitrageurs provides the liquidity needed to make the market a well-oiled machine, reducing the cost of capital for companies seeking financing and transactions cost for investors trying to grow their portfolio. As trading volume has increased over the decades the cost of trading has declined. This process has greatly accelerated in recent years with the rise of algorithmic trading, especially high-frequency trading. High frequency traders, despite being the bogeymen of the popular financial press, are truly the unsung heroes of recent financial history, as transactions costs for retail and institutional investors have fallen by more than 50% since their arrival. This increased liquidity benefits those trying to raise capital as well, as studies show that companies seeking to issue equity face much lower costs the more liquid their shares are.

- Valuation and capital allocation. In seeking to beat the market, the buy and sell orders of investors can push prices up or down for companies, industries, or entire economies. These prices have real-world effects on the economic activity of firms. In particular, firms are much more likely to raise capital and expand their operations when their equity prices are higher, while low-priced enterprises may tread water or contract. Investing in something can be thought of as the way people tell the rest of the world, “Hey, let’s put more effort into this thing.” And the effect of this can be powerful; one of the hallmarks of a bubble is the build-up of excess infrastructure – buildings, railroad lines, fiber-wire cables – that goes wastefully underutilized for years or decades. Sectors that are starved of capital, on the other hand, will eventually see their assets gobbled up and put to other uses. The degree to which we grow wealthier is a matter of how effectively we channel society’s resources into useful economic activity, and this is the task of investors.

- Corporate control: Investors often forget that shares of stock are not just chips to be bet at the giant poker table of capitalism: they represent ownership of businesses and the right to participate in their management, and how companies are managed matters. One of the key ways investors can add value is through positively influencing management, in the extreme case by acquiring controlling stakes in the company. A recent meta-analysis on the importance of shareholder activism – the effort by investors to influence management through concentrated ownership – finds that companies that become targets of activist shareholders tend to subsequently improve operational efficiency and enjoy greater stock returns as a result.

Efficient Markets Encourage Economic Growth

The unprecedented increase in living standards mankind has experienced over the last two hundred years has been associated with the adoption of modern financial markets, and the relation is not a coincidence. The public, on the other hand, has long doubted there’s much of any connection between Wall Street and “main street,” reflected by it’s low levels of trust in the financial industry, lack of popular ownership of stocks, and the common refrain that the stock market is rigged. Even economists have at times expressed doubt as to the role of finance in economic development, often seeing it more as an effect than a cause of growth. Clearly, when we compare rich countries and poor countries, the former have larger and more liquid financial markets, banking systems, and so forth, but that doesn’t tell us which one leads to the other. While basic economic theory suggests that financial markets should help allocate capital, pool risk, and reduce transactions costs, leading to economic growth, for many years there was little evidence to support this notion. The problem is a common one in economics. Unlike in other sciences, we cannot just randomly assign a well-developed financial sector to a sample of countries and not to others and then watch what happens.

Nonetheless, economists have done their best to tease out the effects of finance. In one of the first major empirical investigations on the topic, King and Levine gathered estimates on levels of financial development across a sample of 80 countries in the year 1960, using measures like stock market capitalization and value of bank loans outstanding, and found that they predicted levels of economic development out 30 years later in 1989. This is promising, but still does not prove a causal relation. Because financial markets are forward looking, it could be that financial intermediaries merely anticipate which countries will grow faster, and position themselves accordingly. One way to try to address that concern is to look at “natural experiments” of changes in national policies regulating financial markets. In a later paper, Levine did just that by examining the effects from financial liberalization reforms that were adopted by a large number of countries in the 80s and 90s. He concludes,

[L]iberalizing restrictions on international portfolio flows tends to enhance stock market liquidity. In turn, improvements in stock market liquidity accelerate economic growth primarily by boosting productivity growth.

Multiple economists have since taken up the empirical task of measuring the effect of the financial sector on economic development and have generally reached the same conclusion. A 2013 meta-analysis on the topic looking at 1,334 estimates from 67 studies found that the evidence supported the link between finance and growth. Lest we think there was any more room for debate the Nobel Laureate Merton Miller concluded that “[the idea] that financial markets contribute to economic growth is a proposition too obvious for serious discussion.” So there.

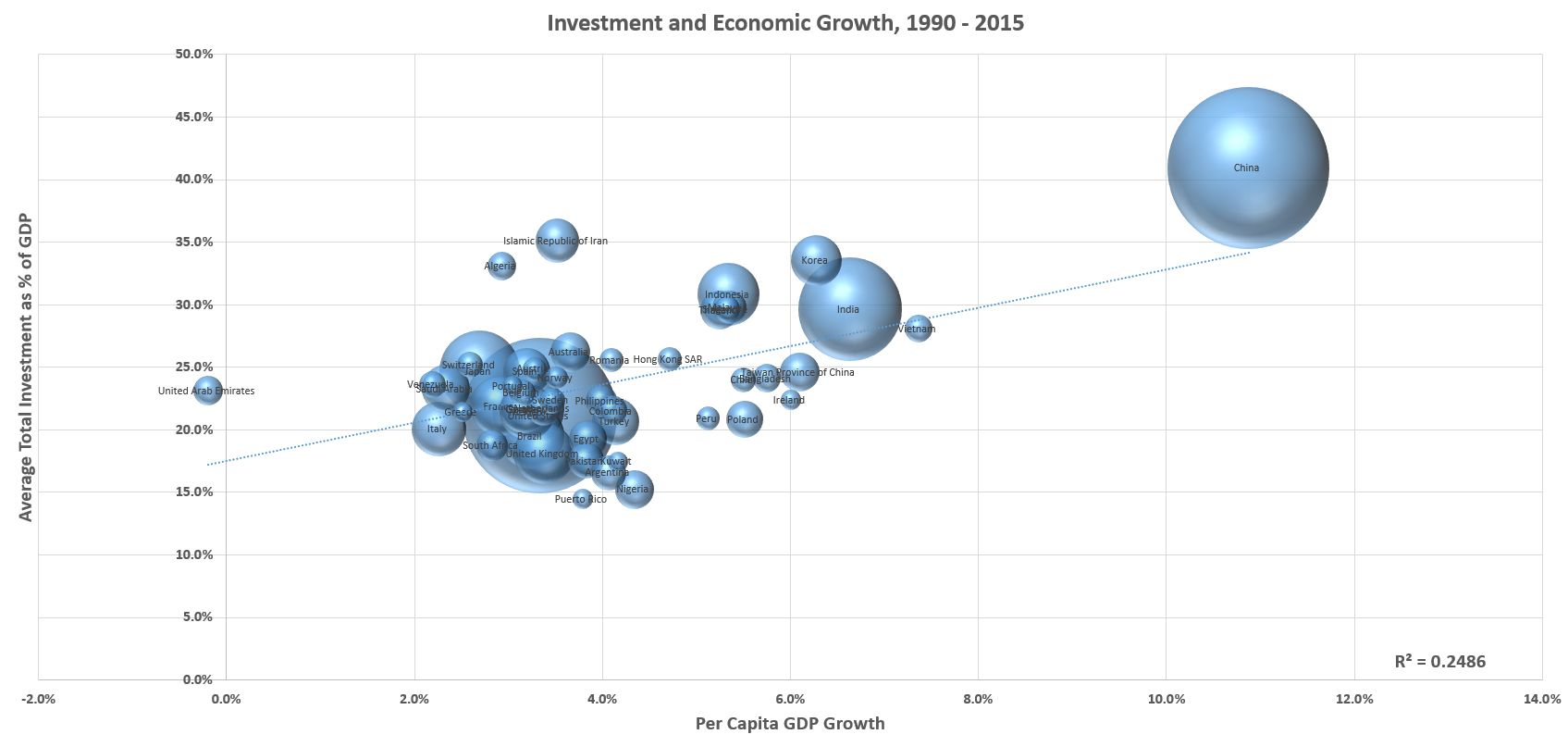

It’s important to bring home that we’re not just talking about the actions of hedge fund managers or bank CEOs here, but the decisions of billions of people around the world. The financial markets can’t work without people who are willing to delay gratification and save for the future. Indeed, the rate at which an economy grows is highly dependent on how much of the national income is directed towards investment. Below I plot the relation between per capita GDP growth from 1990-2015 and the average investment share of GDP over that time for the 50 largest economies in the world. (bubble size indicates size of the economy)

Economic Growth Fosters Human Flourishing

Every morning I wake up and thank capital that I can take a hot shower and use a flush toilet. For those of us fortunate enough to live in societies where industrialization first caught on, it is difficult to overstate just how much more abundant our lives are compared to those of our ancestors of just a few generations ago, or of those living in societies that are still catching up. We first world citizens virtually all have more than enough to eat; we live in solid structures with efficient heating and cooling; we have indoor plumbing that supplies us with unlimited clean water and we almost never have to worry about dealing with human waste; we have anesthetics, antiseptics, and other medicines that have massively reduced the suffering associated with injuries or infections; we work fewer hours, spend more time on education, and take more vacations, travelling at dazzling speeds around the world; we have instant access to more music, art, entertainment, and information than we could possibly consume in a lifetime, and can speak with anyone on the planet as though they are standing next to us; our children almost never die in their infancy anymore, and women almost never die in childbirth; we have eradicated polio, smallpox, and a host of other plagues that once bedeviled our species, with plenty more in our targets. We live longer, healthier, safer lives in which we exercise greater autonomy and determination over our own destiny.

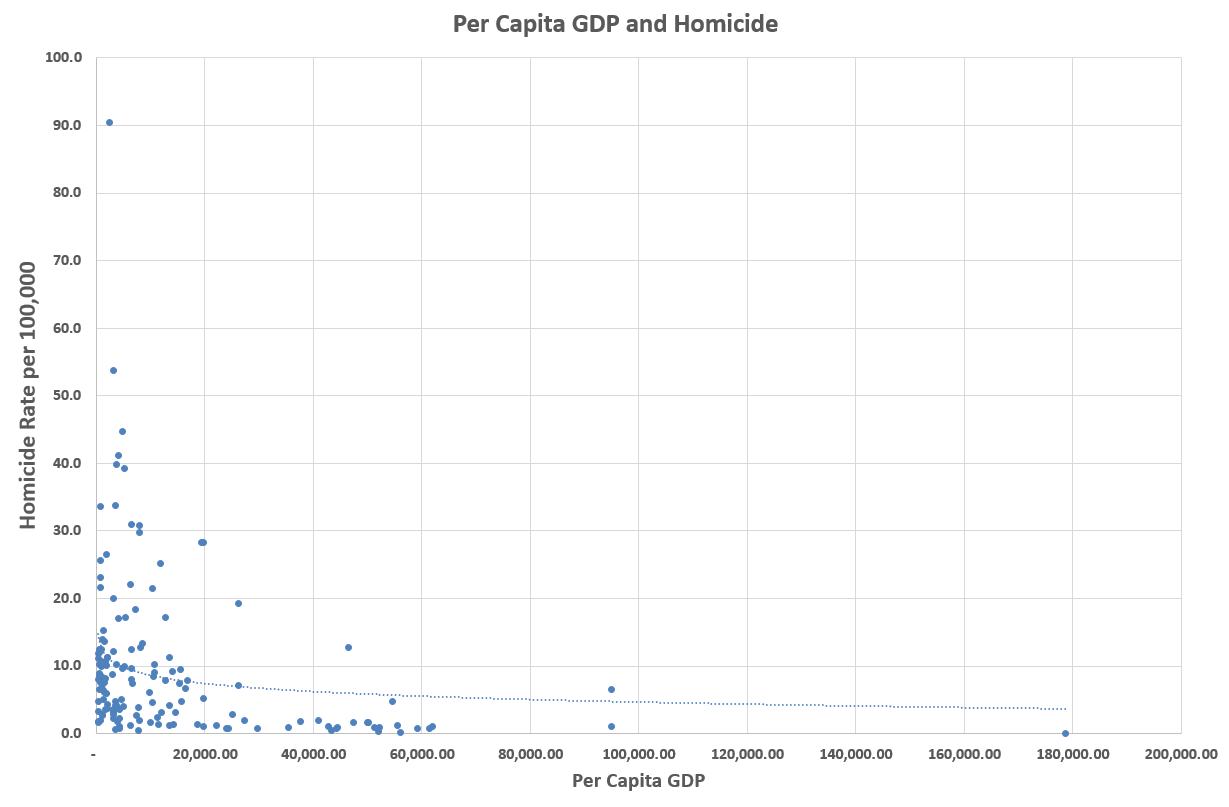

The wealth we have been accumulating since the industrial revolution has not only made our lives merely more comfortable, it has truly changed our nature and made us more enlightened. The rise of industrialization has been met with a dramatic decline in the level of violence in society, for example. Witness the centuries-long downward trend in homicide:

Today, as countries rise out of poverty, their homicide rates asymptote towards zero.

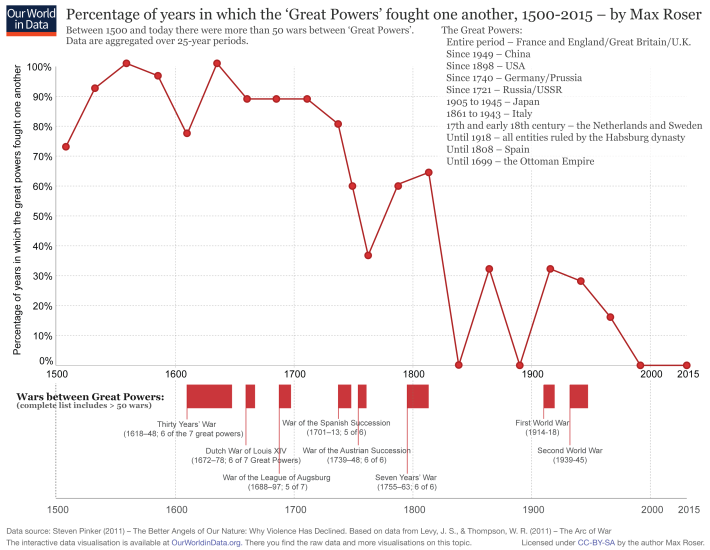

In the modern era, nations grow rich not through conquest, but cooperation, and war is now vanishingly uncommon among great powers.

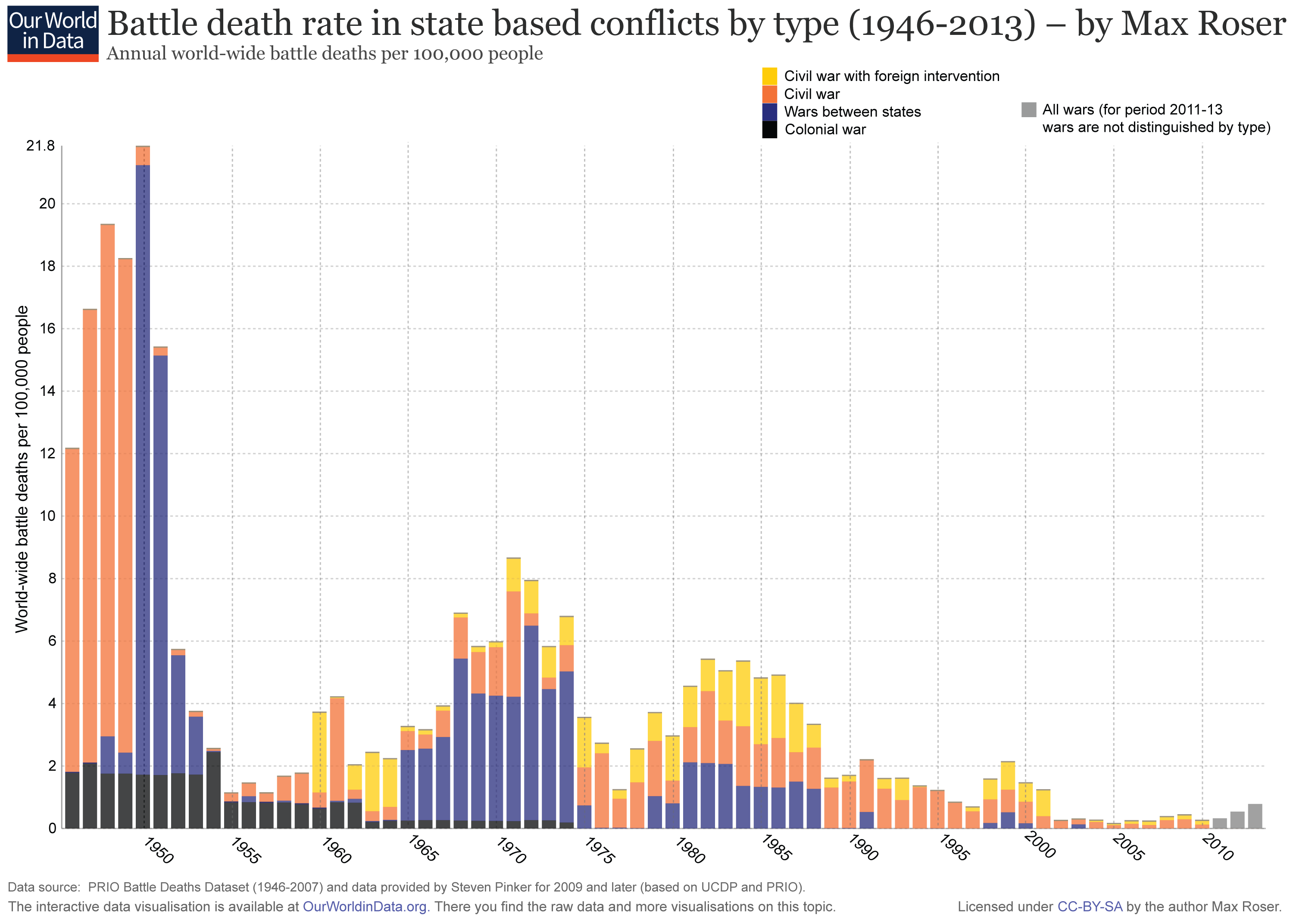

Since the end of World War II and the establishment of the modern world financial order especially, the amount of death and destruction waged by wars of all types has declined to unprecedented levels. We are in fact on the verge of achieving world peace.

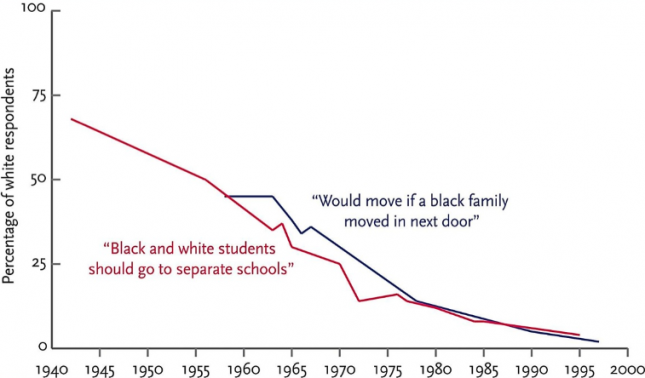

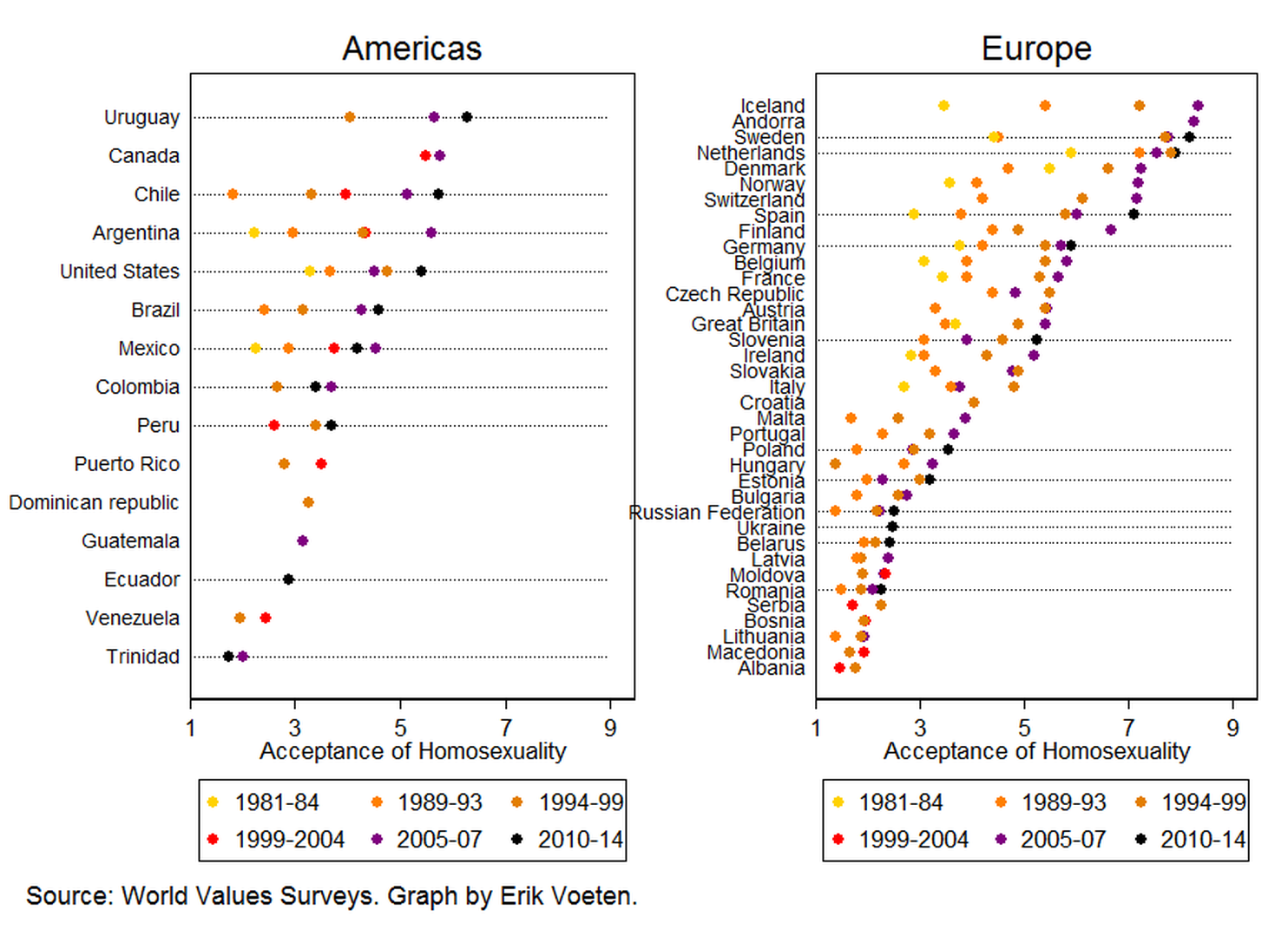

As we have gotten richer we have become more tolerant of people who are not like us:

Attitudes towards segregation in the United States. Source: Our World in Data

Acceptance of homosexuality over time. Source: Washington Post

And society’s acceptance of minorities in general improves with economic development.

Source: OECD

The richer we get, the more we find that crime, hunger, and infectious diseases go down while life expectancy, education, leisure, and even average height go up.

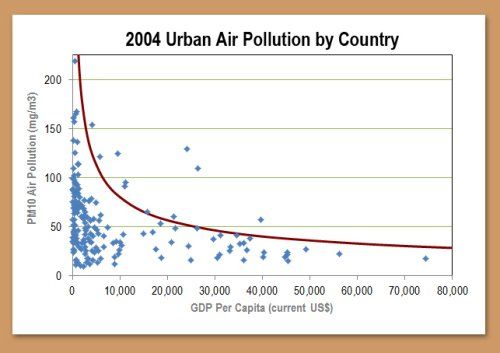

But is it all good news? Doesn’t all this economic growth come at a cost? Many people worry that our economies are unsustainable, and that further growth comes at the cost of environmental destruction that will eventually lead to catastrophe. But even here it seems rising wealth makes us better off. Richer societies can afford cleaner technologies and generally have improved air quality.

Even the existential problems posed by global climate change seem to be on the cusp of solution as carbon emissions around the world have not increased for three years now. From here it seems likely that emissions will soon recede as solar power is now cheaper than coal in much of the world, thanks to the exponential decreases in the cost of solar that show no signs of slowing.

Source: United Solar Initiative

Efforts to recapture the carbon already emitted will likely benefit from economic growth as in recent decades higher per-capita GDP has been associated with greater levels of reforestation.

Economic development seems to improve every objective measurement we care to take of our world. But what of the subjective evaluation of our lives? Does more money really make us any happier?

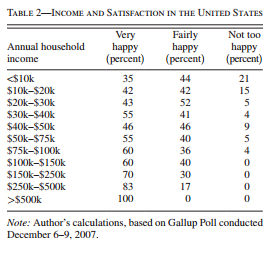

Yes. Now, increasingly it is fashionable to claim this is true… up to a certain point. The idea goes like this: sure, living in abject poverty, worrying how one will be able to afford food and basic necessities, is miserable. But once one reaches an income level above the point where basic needs are met, money can’t really offer a person any more fulfillment. This is often called the Easterlin Paradox, and is applied at both the level of the nation and the individual: Rich countries are happier than poor countries, but once they get above of the level of middle income there’s supposedly no further relation. Similarly, more money can make a person happier, but only up to a certain satiation point. Many people have claimed we even know what that point is, and it’s $75,000 per year; getting a raise after you’ve reached this point won’t make you any happier. Now, most people don’t make $75,000 a year, especially in the developing world, so there is still plenty of room for improvement just to get there. But should we simply quit striving for more as individuals and societies once we reach such a perch of modest affluence?

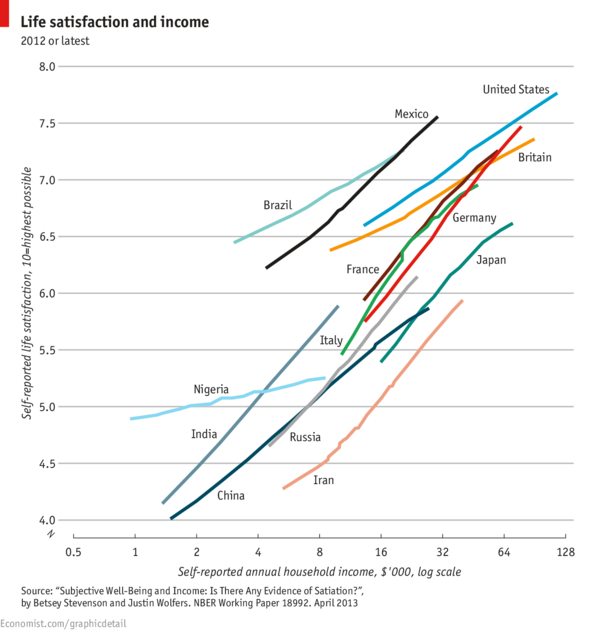

Nope! Turns out the early research on this that supported the satiation hypothesis made the simple mistake of not using logarithms. In a 2013 NBER paper, Stevenson and Wolfers look at a wide panel of international survey data and find that around the world and across all income levels, happiness increases with income in a log-linear fashion.

Source: The Economist

Far from the popular image of the lonely and miserly Scrooge, all our evidence suggests that people just keep getting happier even up to extremely high levels of income. From the paper:

Indeed, when asked, the wealthy admit to being more optimistic, healthier, and more satisfied with their family life than the less well-off. The rich are more likely to get and stay married, and they are more likely to have satisfying marriages and stronger relationships with their children. The evidence seems to clearly show that those who have great financial wealth also generally have a great wealth of love in their lives.

Triumph of the Optimists

Now, there is a pessimistic take on this: the log-linear relation between money and happiness means that we need ever greater amounts of prosperity to sustain similar increases in well-being. As happy as going from $37,500 to $75,000 a year might make you, you need to double again to $150,000 to experience the same increase in happiness. Most people cannot so readily double their income and might think that therefore the satiation hypothesis is true for all intents and purposes.

I think such a view would be overly myopic. As a reminder, here’s a chart of per-capita GDP growth over the last thousand years:

Two short centuries of 2% annual growth raised us from crushing poverty to our current station of relative splendor. But it did not happen automatically. Every upward tick along the way was a miracle of innovation brought to being by entrepreneurs and financed by investors who were striving for more. It is important that we not let our present affluence lull us into complacency. Despite everything I have written above, our world is still filled with an intolerable amount of suffering. To quote from the wonderful Scott Alexander:

– About 1% of people are in prison at any given time

– About 2% of people are on probation, which can actually be really limiting and unpleasant

– About 1% of people are in nursing homes or hospices

– About 2% of people have dementia

– About 20% of people have chronic pain, though this varies widely with the exact survey question, but we are not talking minor aches here. About two-thirds of people with chronic pain describe it as “constant”, and half of people describe it as “unbearable and excruciating”.

– About 7% of people have depression in any given year

– About 2% of people are cognitively disabled aka mentally retarded

– About 1% of people are schizophrenic

– About 20% of people are on food stamps

– About 1% of people are wheelchair-bound

– About 7% of people are alcoholic

– About 0.5% of people are chronic heroin users

– About 5% of people are unemployed as per the official definition which includes only those looking for jobs

– About 3% of people are former workers now receiving disability payments

– About 1% of people experience domestic violence each year

– About 10% of people were sexually abused as children, many of whom are still working through the trauma.

– Difficult to get statistics, but possibly about 20% of people were physically abused as children, likewise.

– About 9% of people (male and female) have been raped during their lifetime, likewise.

And that’s just in the US, one of the world’s wealthiest nations.

I like to compare life in the early 21st century developed world to the position of visible light on the electromagnetic spectrum. For those of us here, it’s easy to feel like this is all there is. Life is for all of us sometimes frustrating, sometimes heartbreaking, but mostly comfortable, pleasant, and generally okay. And it’s easy to forget that this is all just a thin slice of the full range of possible human experience. Below us, stretching through most of our history, is a vast expanse of ignorance, poverty, war, famine, and the furthest reaches of human misery. And above us… well, it is hard yet to fully even imagine. In the last post in this series, I wrote about how we may be on the verge of the dawn of a new age: artificial intelligence can bring with it the end of human drudgery, control over the physical world at the molecular level bringing near-limitless material wealth, the opportunity to explore new worlds both real and virtual, and the abolition of pain, sickness, and the indefinite postponement of death itself. How soon we get there, the progress of our civilization, and the alleviation of its ailments, will depend as it always has, on our willingness to invest in a greater future.

The only thing I don’t like about my profession is how cynical so many people are about it. When it comes to money, it’s easy for some to see a dog-eat-dog world of greed. That’s not the way I see it at all. One of the most widely cited and celebrated histories of the stock market is a tome called Triumph of the Optimists. It details how, despite occasional financial crises and even catastrophic implosions caused by revolution and war, stock markets around the world have on the whole grown steadily for centuries and enriched those brave enough to trust them along the way. I have always loved its title; for me it succinctly captures the essence of the story I wish to tell about finance. The world is never short of bad news, and it can be easy to despair, which many people do. But economics shows us that the space of utility-improving arrangements is very large, and if you have identified a problem with the world, then you have identified a profit opportunity, an arbitrage. Attempts to exploit it are not always or immediately fruitful; your payoffs may be unpredictable and only come after many others may have quit, but the enterprise of trying to improve the world we live in is usually rewarded. Over time these improvements have been accumulating, and if we have the wisdom to step back from the ups and downs of the days, months, and years we typically live our mental lives in, we see an exponential curve, bending itself at the knee to become a straight line, reaching higher, higher, higher… to the stars…

And towards the future that we shall create.

Disclosures: This post is solely for informational purposes. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by RHS Financial, LLC unless a client service agreement is in place. Please contact us at your earliest convenience with any questions regarding the content of this post. For actual results that are compared to an index, all material facts relevant to the comparison are disclosed herein and reflect the deduction of advisory fees, brokerage and other commissions and any other expenses paid by RHS Financial, LLC’s clients. An index is a hypothetical portfolio of securities representing a particular market or a segment of it used as indicator of the change in the securities market. Indexes are unmanaged, do not incur fees and expenses and cannot be invested in directly.