Last Tuesday, 18.9% of Americans made their voices heard and elected Donald Trump as 45th president of the United States.[1] What immediately preceded and followed the surprise turnout was perhaps one of the strangest handful of days in market history.

The Nonpartisan Market?

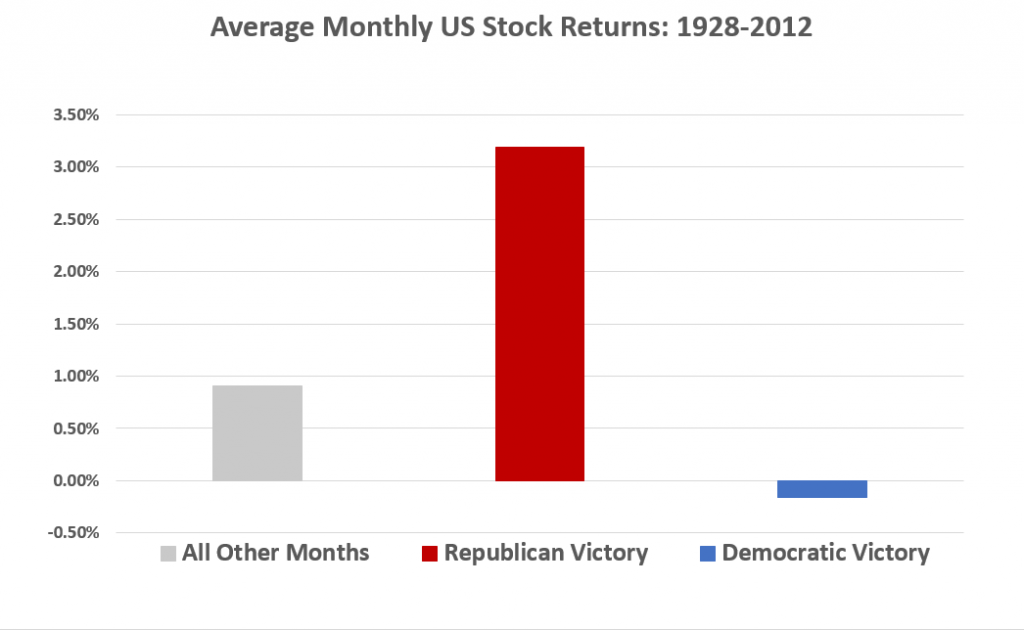

I have had to eat my words in the wake of this election. When asked this year what impact the election is likely to have on the market, my standard response has been “not much.” Historically, the US stock market has proved rather robust in the face of shifting political environments. On the age-old question of which party is better for the markets, Republicans can point to the fact that Republican presidential victories have been associated with much stronger returns in the month of the election:

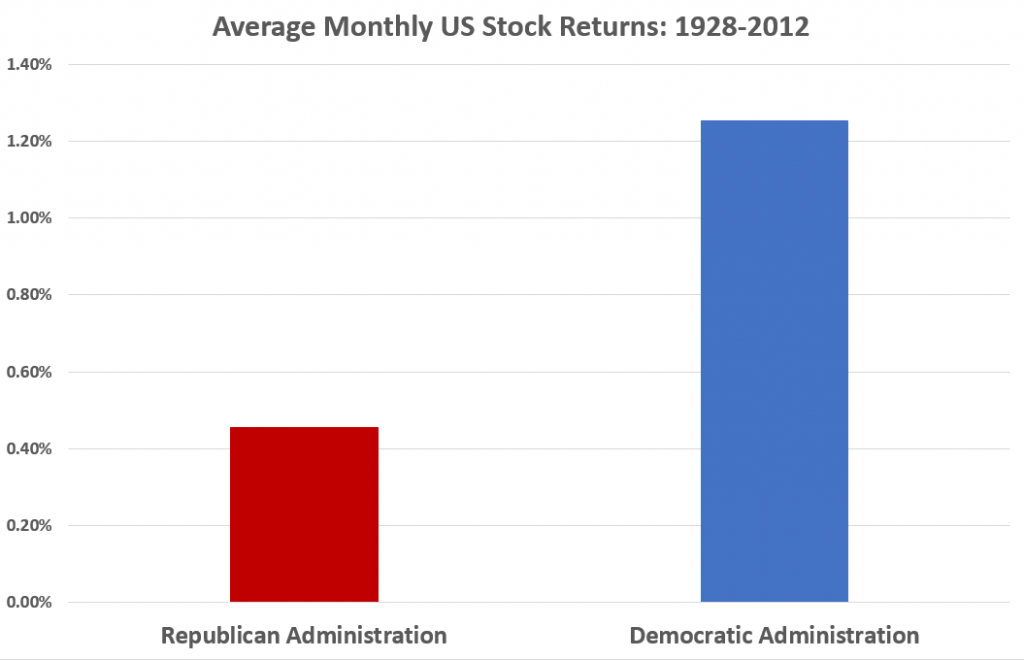

And Democrats can counter that in between the election months, Democratic presidents have presided over stronger stock bull markets:

In truth, it seems unlikely that there’s a real connection in either of these cases. The market is mostly concerned with changes in big-picture themes like productivity growth, inflation, interest rates, and demographic transitions, none of which the president has a great deal of control over. And despite our increasingly ideologically divisive political rhetoric, in a democratic republic like ours all politicians must avoid alienating a majority of their constituents or becoming associated with economic disaster, and so tend to vote in a more pragmatic and centrist manner than they may have campaigned on.

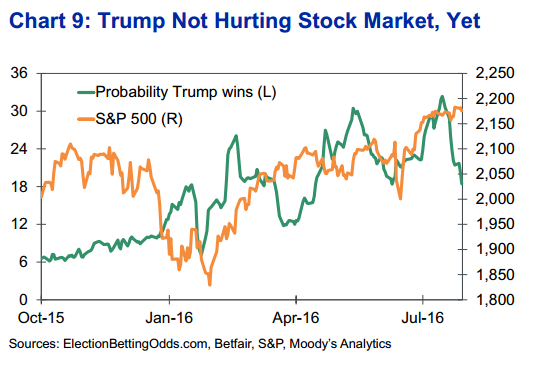

Which brings us to the 2016 election. Despite the especially vociferous nature of the campaign and the back-and-forth swinging in the polls, the relative odds of either candidate seemed to have little to no effect on the market up to the eve of the election. Indeed, in a white paper published earlier this year by Moody’s Analytics, the authors found:

More formal econometric analysis confirms the absence of a relationship between the S&P 500 and Trump’s electoral odds. Regression analysis shows that day-to-day changes in Trump’s odds of winning had a statistically insignificant effect on log differences in the S&P 500.

Trumped Up Market Moves

Then, after shrugging off the election for over a year, the market suddenly started to pay attention on October 28 when the FBI informed Congress that it was reopening its investigation of Clinton’s emails. It wasn’t happy about the news.

Stocks continued to trade down for the rest of the week until, over the weekend, the FBI announced it found no criminal activity in Clinton’s emails. The market surged at the open on Monday morning, closing up more than 2% from its close on the previous Friday. It seemed that the market, an undecided voter throughout the whole election cycle, was now confidently throwing its support behind Hillary Clinton. The market continued to trade up slightly on Tuesday as voters made their way to the polls, a Clinton victory seemingly assured.

And then, all hell broke loose.

With prediction markets calling for a less than 10% chance of a Trump victory Tuesday morning, the odds tipped in his favor just before midnight EST and markets around the world went haywire.

The overnight S&P 500 futures quickly went into freefall before reaching their Limit Down and further trading was halted below 5% losses. Markets open in Asia started crashing, in some places by even greater amounts than in the US. Futures on gold and US treasury bonds surged as investors sought safety. Moments to go before Trump made his victory speech, the world seemed to be bracing for a financial crisis.

And then, something strange happened: President Elect Donald Trump took the podium and made his acceptance speech and sounded much more… even-tempered than he had for the last year and a half. As Trump told the country that they owe Hillary Clinton a “debt of gratitude” and promised to treat all nations fairly futures on the S&P 500 began recovering.

When I woke up early on Wednesday morning after about 30 minutes of sleep and checked the US markets as they began to open, I thought at first that my screen simply hadn’t refreshed yet. “No, these are yesterday’s prices.” I thought to myself with frustration. Then, two minutes into normal trading the day after Donald Trump was elected president, I realized what was happening: the market wasn’t crashing. It was flat. Nothing had changed.

After a few more hours the market thought about it some more and decided it liked the idea of a President Trump (at least in the US) and started climbing. The S&P 500 finished the week up 3.8%.

That’s the average, though, just as it was among our country’s citizens, the election results were somewhat less than universally welcome. Below I’m going to show the activity of several widely traded ETFs over the course of the week. First up were last week’s major winners: defense stocks (ITA), biotech (IBB), and financials (IYG).

Trump’s pledges to expand military spending, streamline FDA drug approval regulations, and repeal the Dodd-Frank act were greeted with glee in each respective industry. Less sanguine were the utilities (XLU) and consumer staples (XLP) sectors, which seem to be dreading a rise in interest rates and inflation (more on that in a second).

Zeroing in on a few famous names, for the last few years the darlings of the US stock market have been the tech giants known as FANG: Facebook, Amazon, Netflix, and Google. Last week saw a reversal of their fortunes as each one slumped on the news of Clinton’s defeat.

Having personally spoken to a few friends at these companies, there is palpable anxiety that Trump’s anti-immigration stance may threaten the visa status of their many foreign-born employees. Looking abroad, Trump’s victory was mostly received positively in developed foreign markets (VEA), but a rising dollar (UUP) meant that US investors generally didn’t realize any gains. Emerging markets (VWO), up about 4% on Tuesday when a Clinton victory still seemed certain, collapsed in the three days following the election.

No country paid more dearly than Mexico (EWW), down over 12% for the week on the prospect of considerable trade restrictions in the near future. On the other hand, Russia (RSX) welcomed the BFF relationship between Putin and Trump.

Potentially most worrisome to US investors, the fixed income markets were down hard last week, with the largest long-term treasury ETF (TLT) suffering it’s worst weekly loss ever since its inception in 2002. On the other hand, Treasury Inflation Protected Securities (TIP) were down a lot less.

The difference between the two suggests that Trump will bring higher inflation to the US. This is a little puzzling; Trump has been openly critical of Federal Reserve chairwoman Janet Yellen, but because he thinks she has been too dovish. That is, he thinks she has kept interest rates too low for too long, the result of which has been to spur what little inflation we have seen. Given the Fed’s independence, it is unlikely Trump will be able to change its direction, and even if he does, his desires are not consistent with a looser monetary policy in the US. The simultaneous increase in both bond yields and inflation expectations last week brought then strike me as weirdly contradictory and rather mysterious.

What to make of all this? Hard to say. My prediction of “not much change” has clearly proved false, but everything I’ve written here could be easily reversed by the time this post is even published. Trump remains a wild card and investors will be watching him closely for some time to come. As contrarians, we have been marginal sellers of US equity and buyers of emerging markets stocks and US treasuries since the election. This implicitly is a bet on the fundamental stability of the US Constitution and its institutions by recognizing that in the long run, politics works itself out to a wash for investors and the most important thing to focus on is an investment’s fundamental valuation. This is as it should be. In any case, readers may want to consider investing in newly-discounted vacations to Mexico.

[1] Trump Received an estimated 60,371,193 votes in a country with a population of 318.9 million = 18.9%

Disclosures: This post is solely for informational purposes. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by RHS Financial, LLC unless a client service agreement is in place. Please contact us at your earliest convenience with any questions regarding the content of this post. For actual results that are compared to an index, all material facts relevant to the comparison are disclosed herein and reflect the deduction of advisory fees, brokerage and other commissions and any other expenses paid by RHS Financial, LLC’s clients. An index is a hypothetical portfolio of securities representing a particular market or a segment of it used as indicator of the change in the securities market. Indexes are unmanaged, do not incur fees and expenses and cannot be invested in directly.